- Solana's $100 support shaky ahead of US President Donald Trump's reciprocal tariffs.

- Solana's Confidential Transfers feature morphs into Confidential Balances, encompassing privacy, fees, mint, and burn features.

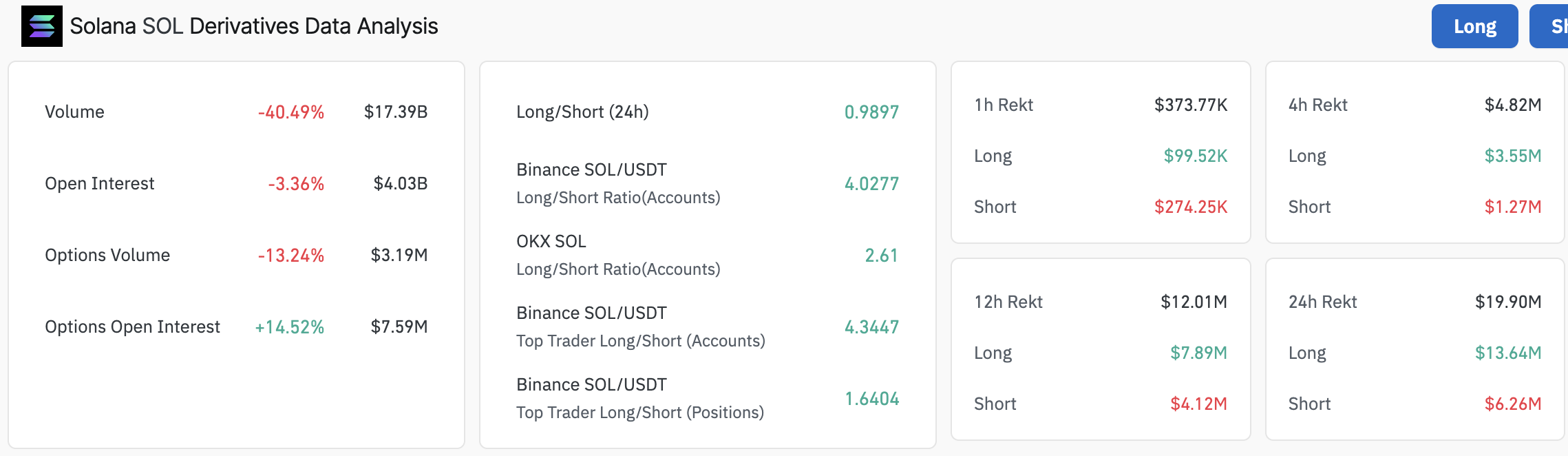

- Solana derivatives face $19.9 million in 24-hour liquidations as open interest falls 3.36% to $4.03 billion.

- A falling wedge pattern on the daily chart could trigger a 29.78% rebound in SOL if validated.

Solana (SOL) stabilizes and trades around $105 at the time of writing on Wednesday, clinging to the daily open, as macroeconomic factors bite global markets, including crypto. The smart contracts token recovered the previous day, reaching $112.50, but quickly reversed the gains in the American session alongside majors Bitcoin (BTC) and Ethereum (ETH) as United States President Donald Trump insisted that tariffs are good for the world's largest economy, escalating trade tensions, especially with China. Meanwhile, Solana's "Confidential Transfers" has transformed beyond privacy to cater to other features, including transfers, fees, mint, and burn.

How Confidential Balances elevate Solana ecosystem

According to an article published on the Helius blog, a network validator, Solana's Confidential Transfers feature has grown over ten years to include various layers of confidentiality without compromising regulatory compliance.

Confidential Transfers, launched by Solana's Token2022, made it possible for token issuers to 'obscure' token amounts. The process involved processes like deposit, application of confidential balance and transfer on the sender's side. On the other hand, the recipient would accept the tokens into their confidential balance before withdrawing (optional).

Helius’ post says, "All of these steps take advantage of homomorphic encryption and zero-knowledge proofs (ZKPs) behind the scenes so that, while sums are hidden, the system can still verify correctness."

However, Confidential Balances has transformed into an umbrella-like platform beyond confidential transfers, including a suite of extensions using cryptographic primitives to hide token transfer amounts, fees confidentiality and confidential mint and burn.

Solana developers currently have a Rust-based implementation in place and are working on JavaScript libraries, which are expected later in 2025. With this update, Confidential Balances will include native wallet integration, such as Phantom.

Solana’s early "Confidential Transfers" feature has evolved into "Confidential Balances," a suite of advanced privacy extensions covering confidential transfers, fees, minting, and burning, enabling asset issuers to conceal amount details without compromising compliance.…

— Wu Blockchain (@WuBlockchain) April 9, 2025

Solana's ecosystem could become more attractive to decentralized finance (DeFi) projects and institutional players with improved privacy features.

Despite the launch of Confidential Balances, Solana's price had minimal bullish impact as Trump’s tariff fears dominated sentiment. Leading investment banks like JP Morgan and Goldman Sachs have warned that the new tariff regime could weigh heavily on the economic growth outlook and see a stronger probability of a recession in the US.

Liquidations in the derivatives market highlight the impact of Trump's reciprocal tariffs on Solana and other altcoins. As per Coinglass data, $19.9 million in long and short positions has been liquidated in the last 24 hours. A 3.36% decline in Solana's open interest to $4.03 billion indicates a growing risk-off sentiment.

Solana liquidations and open interest data | Source: Coinglass

Can Solana defend $100 support?

Solana's $100 level is a psychological support tested several times in 2024. With the 50-day Exponential Moving Average (EMA), the 100-day EMA and the 200-day EMA breached and acting as resistance, the probability of a smooth recovery is dwindling. If SOL slides below $100, the next crucial level holds at $75, where bulls could tap liquidity for a significant rebound.

XRP/USDT daily chart

A falling wedge pattern in the same daily chart hints at a possible 29.78% breakout (equal to the distance between the pattern's widest points), which could see SOL close in on $140 if volume surges and tariff-driven volatility declines.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.