- Solana price jumped by more than 32% towards the end of last week, bringing the price to $23.68.

- Solana price needs to maintain the bullishness noted over the last two weeks as it still needs to rise to $36.90 to recover FTX-induced losses.

- Enthusiastic traders must watch out for a decline in price, as losing the $15.90 support level would invalidate the bullish thesis.

Solana price emerged as one of the best-performing assets among the top cryptocurrencies maintaining its uptrend that began at the end of December 2022. Following in the footsteps of Bitcoin and Ethereum, SOL is also close to gaining back all its losses caused by the November 2022 FTX crash. But traders must be wary of a change in the active trend.

Solana price is far from the top

Solana price managed to rise by almost 140% in the span of 17 days, rising from $9.63 to trade at $23.68 at the time of writing. However, investors waiting to recover their losses might have to wait a while longer as SOL is still pretty far away from its November highs.

Solana price still needs to push by another 40% in order to reach $36.90, the value it was at prior to the FTX-induced crash. In order to do so, SOL needs to first reclaim the support at $28.28, which would enable the cryptocurrency to initiate a rise to breach the critical resistance at $32.06. From here on, the altcoin can climb to $36.90 and invalidate all previous losses.

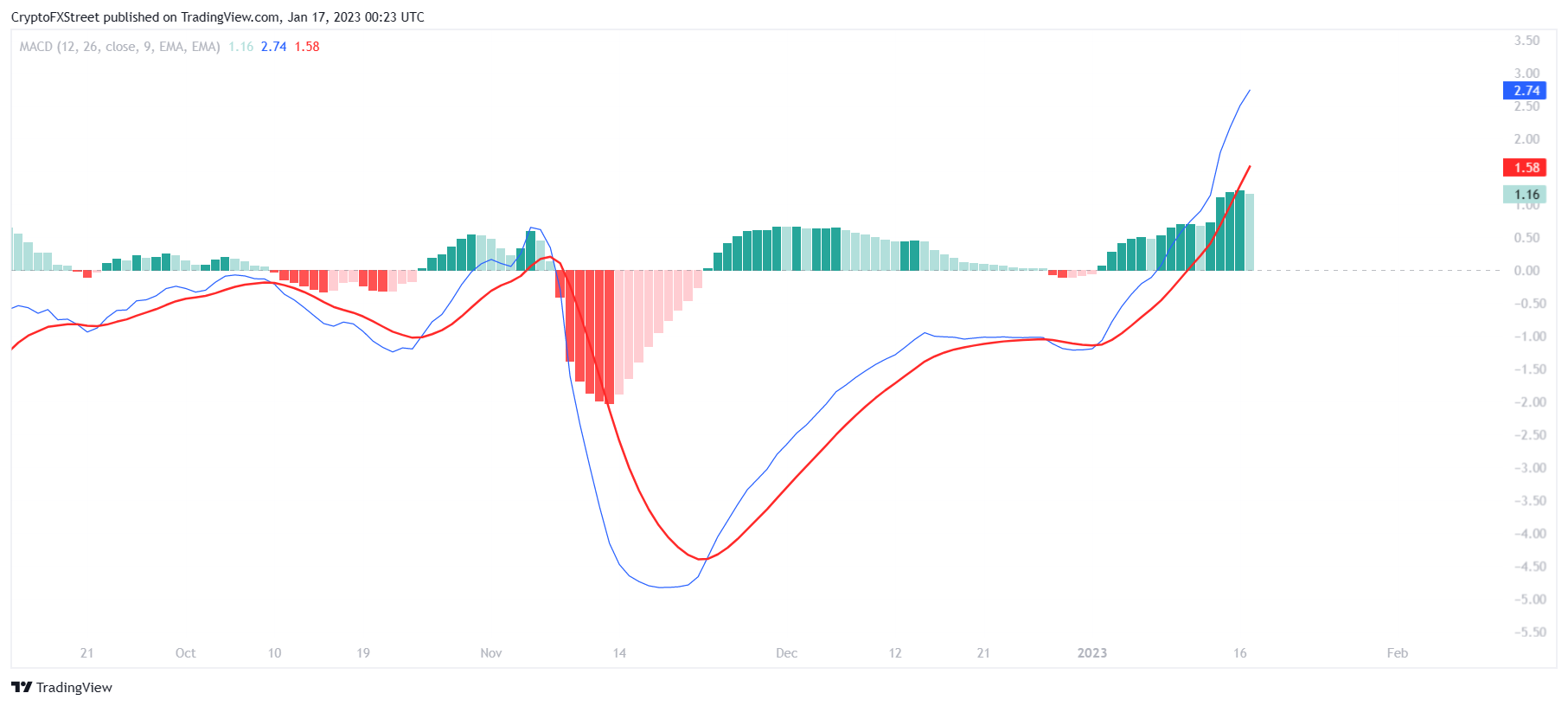

The Moving Average Convergence Divergence (MACD) also supports this bullish outlook, as the indicator is maintaining its bullish crossover at the moment. As long as the signal line (red) does not crossover the MACD line (blue), Solana price is not likely to face a sharp decline.

Solana MACD

Nevertheless, traders should refrain from getting comfortable with this possibility as the volatility of the market could pull Solana price back down. As it is, the altcoin has been teetering at the immediate support at $23.11 for the last three days.

SOL/USD 1-day chart

If this price level is lost, SOL will find support next at $19.30 and $17.89 before sinking to critical support at $15.90. A daily candlestick close below this level would invalidate the bullish thesis, resulting in the Ethereum-killer falling below $14.80.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP could face volatility as Trump’s “Liberation Day” nears

Bitcoin (BTC) price hovers around $87,000 on Wednesday after recovering 4% in the last three days. Ethereum and Ripple find support around their key level, suggesting a recovery on the cards.

BlackRock’s BUIDL fund launch on Solana platform while Fidelity files for spot Solana ETF

Solana’s price hovered around $142 at the time of writing on Wednesday. Asset management companies show a rising interest in the Solana platform as the BlackRock USD Institutional Digital Liquidity Fund fund launches on the Solana platform while Fidelity files for a spot Solana ETF with Cboe Global Markets

XRP fails to rally as Ripple agrees to drop cross-appeal against SEC

Ripple confirmed on Tuesday that it will no longer pursue its cross-appeal against the United States (US) Securities and Exchange Commission (SEC).

GameStop unveils plan to add Bitcoin as reserve asset

Video game retailer GameStop announced in its Q4 financial report on Tuesday that it would acquire Bitcoin and US Dollar-backed stablecoins as treasury reserve assets.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-638095145975685004.png)