- Solana price is still posting bullish candles despite the slowdown in the broader market, trading at $23.92.

- SOL has the support of its 30-, 50- and 100-day Exponential Moving Averages, which should prevent a sharp decline in price.

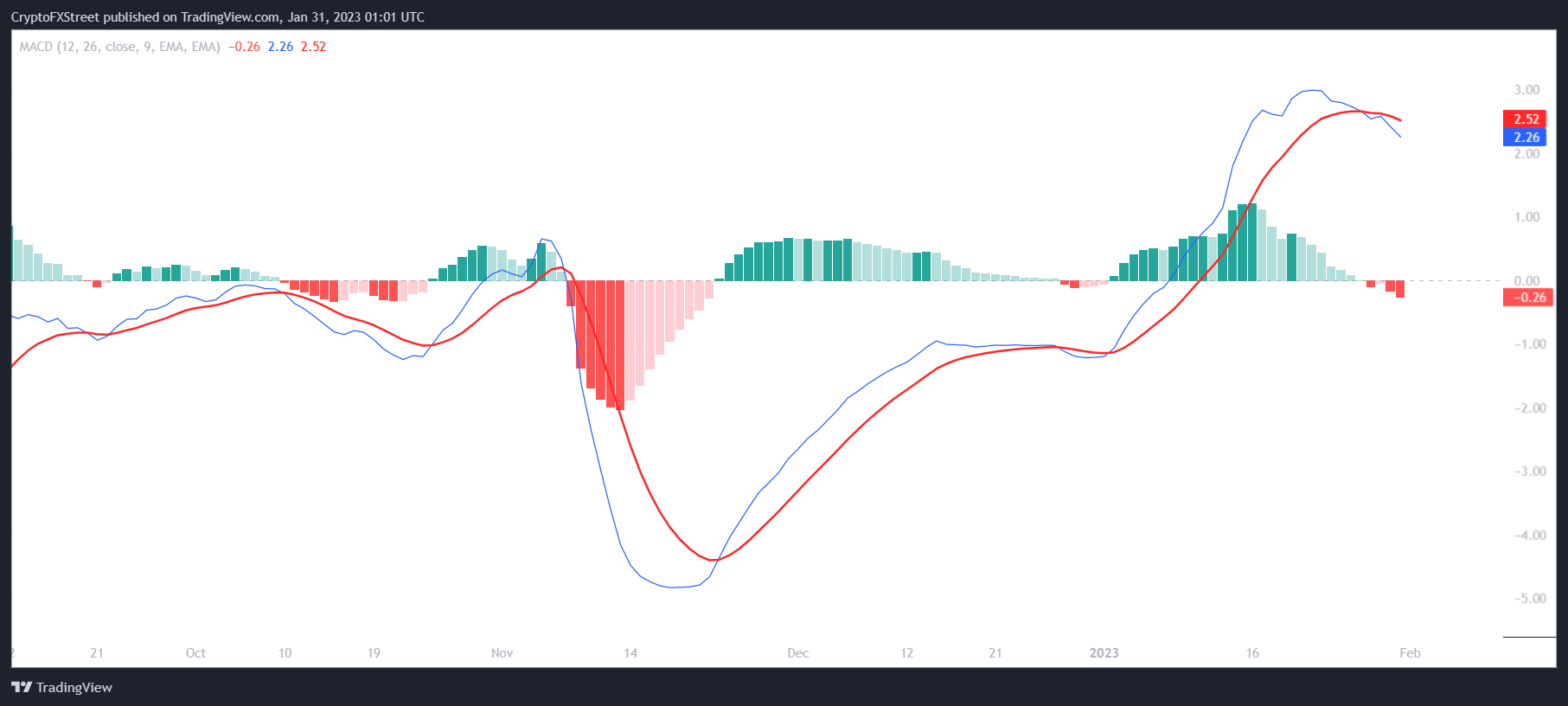

- The altcoin’s indicators are pointing towards intensifying bearishness, with the MACD registering a bearish crossover this week.

Solana price is maintaining its presence above the $22 mark that it reclaimed about a week ago, enabling the altcoin to preserve its uptrend. The next major hurdle for the altcoin stands at $28.28, which will determine whether the uptrend can continue or if SOL will lose the opportunity to regain November 2022 crash's losses.

Solana price remains in an incline

Solana price, trading at $23.91, is defying the downward trend seen in many cryptocurrencies by maintaining its upward momentum despite the noticeable slowdown. SOL could reaffirm its macro uptrend that began at the beginning of the month by reclaiming $28.28.

Acting as the critical resistance, this price level is crucial for the Ethereum killer to reclaim in order to recoup the losses SOL noted following the FTX collapse-induced crash. Flipping $28.28 into a support floor will push the price toward the next hurdle at $32.06, breaching which will enable Solana price to tag November 2022 highs of $36.90.

Even though the altcoin does have the support of the 30-, 50- and 100-day Exponential Moving Averages (EMA), there is a chance of a possible decline in price. The Moving Average Convergence Divergence (MACD) indicator highlights an active bearish crossover that took place a week ago.

Solana Moving Average Convergence Divergence (MACD)

If the bearishness intensifies and traders move to sell, the price could decline quickly. As it is, Solana price is treading right above the immediate support level at $22.77. A single red candle could invalidate this support floor, which could leave the price vulnerable to a decline to $19.30.

SOL/USD 1-day chart

Falling through it will give SOL another opportunity to bounce off the critical support at $17.89. However, a daily candlestick close below $17.89 will invalidate the bullish thesis, bringing the price action bearish towards $15.90.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Is BTC sell-off over?

Bitcoin price declined over 6% this week until Friday as the escalation of the conflict between Iran and Israel added fuel to this sell-off. The decline was also supported by falling institutional demand for ETFs, which recorded outflows of more than $280 million this week.

Three reasons why Solana could see a double-digit decline

Solana price appears to have found some support on Friday, recovering slightly from the sharp sell-off registered earlier this week. However, on-chain metrics and technical indicators show increasing chances of a further decline in prices, suggesting that the rebound could be short-lived.

Tron network revenue exceeds Bitcoin, Ethereum and Solana in Q3

The Tron network (TRX) generated the highest revenue in the third quarter since its inception, outperforming leading cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bitcoin finds support around $60,000

Bitcoin is hovering around its key support level; a sustained close below this threshold could signal further declines. On the other hand, Ethereum and Ripple have closed below their critical support levels, indicating further downsides.

Bitcoin: Is BTC sell-off over?

Bitcoin price declined over 6% this week until Friday as the escalation of the conflict between Iran and Israel added fuel to this sell-off. The decline was also supported by falling institutional demand for ETFs. BTC bulls seem to be holding strong at a critical support level.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.