Solana price likely to trigger 15% rise as stability returns after SOL bears’ rampage

- Solana price shows a consolidation after a 27% crash from roughly $48 to $35.

- The ongoing range tightening will likely result in a 15% upswing to $40.39.

- A daily candlestick close below $35 will invalidate the bullish thesis.

Solana price shows that it is in a consolidation phase after the recent drop. This tightening could evolve into an explosive move to the upside. Investors can wait for a confirmation of the breakout and ride the wave.

Solana price ready for recovery

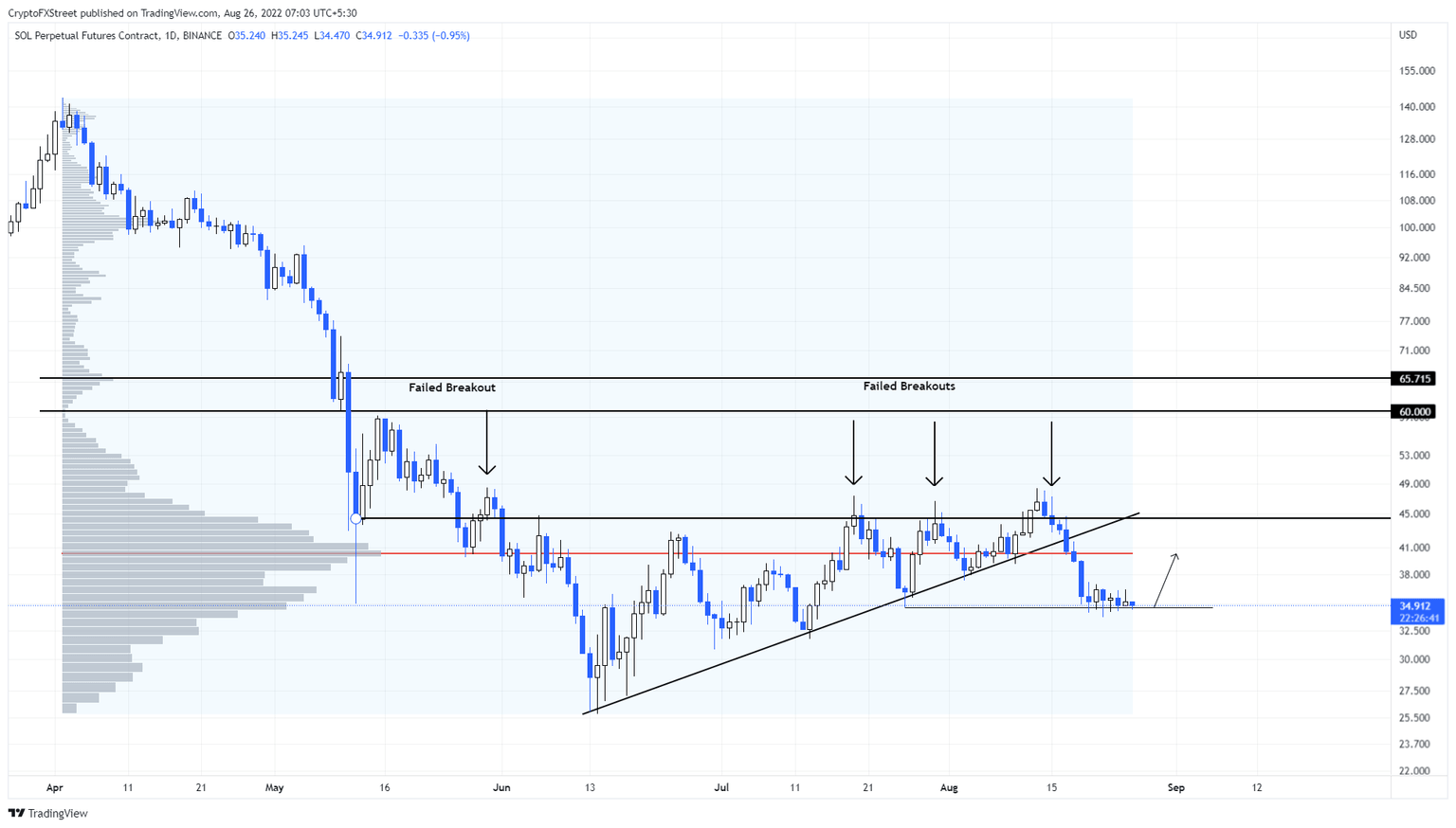

Solana price dropped 27% from its August 14 swing high at $48.37 and is stabilizing around $35. So far, SOL seems to be consolidating here for roughly the last week and shows no signs of an immediate uptrend.

However, investors can look for confirmations of a bullish move for Solana price in a lower time frame.

The volume profile shows that the point of control, aka the highest volume traded level, is present at $40.39. Hence, the breakout move will likely face resistance around this barrier, suggesting the upside for Solana price is capped at 15%.

If the buying pressure and bullish momentum are strong enough to flip this hurdle into a support floor, the uptrend for Solana price could extend to $44.45 or roughly $45. This barrier has been a major resistance level for the last three months, hence a local top could form here before a breakout.

SOL/USDT 1-day chart

While things are looking up for Solana price, a daily candlestick close below $35 will create a lower low and invalidate the bullish outlook. This development could see SOL drop to July 13 swing low at $31.75.

If the sellers step on the pedal, then SOL could revisit the subsequent swing lows until $25.84.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.