Solana price likely to crash by another 15% as crypto markets nosedive

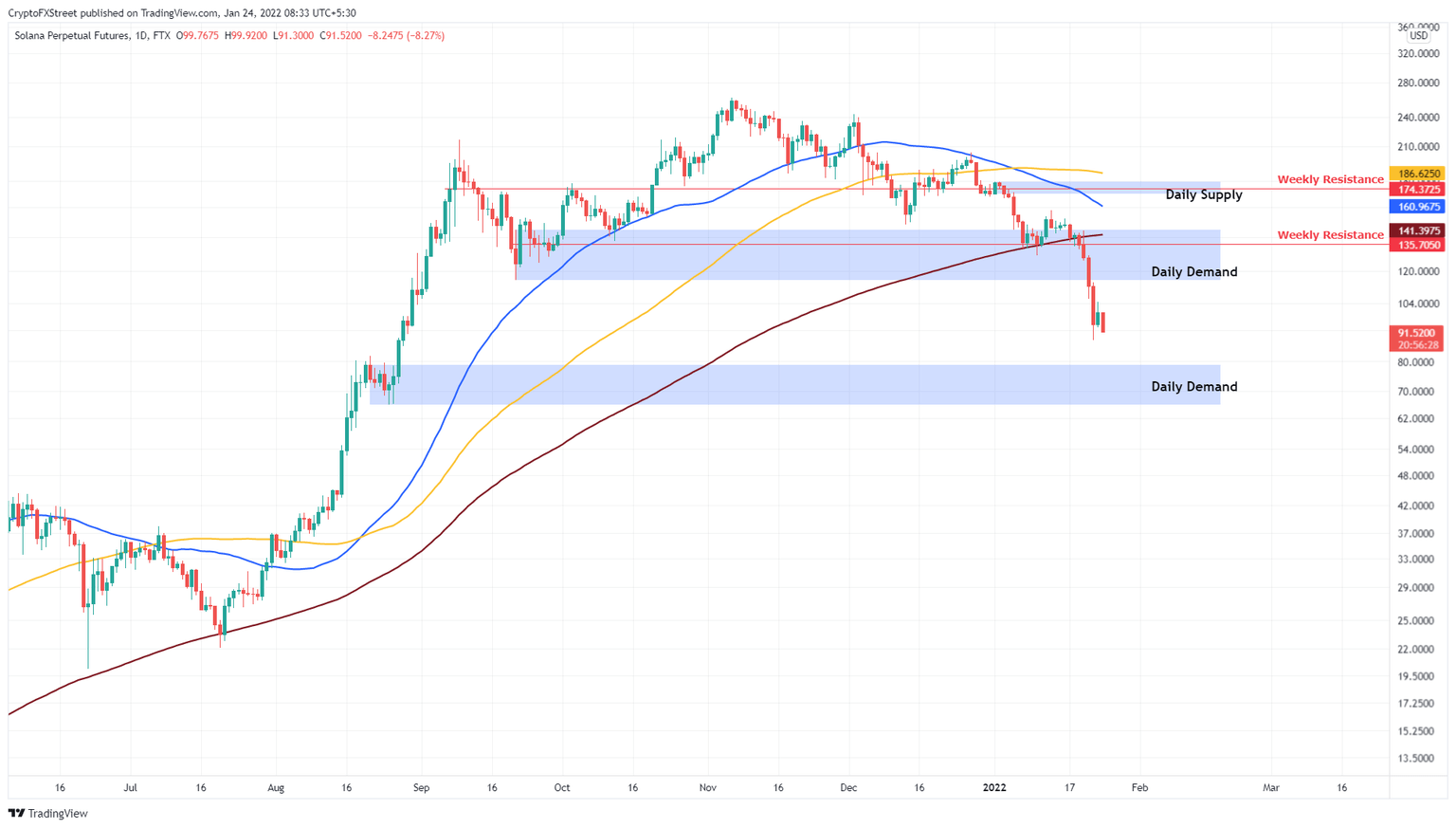

- Solana price has sliced through the $115.51 to $144.70 demand zone, signaling a bearish outlook.

- The 38% crash will likely continue toward the next demand zone, extending from $65.91 to $78.76.

- A daily candlestick close above $144.70 will invalidate the bearish thesis.

Solana price has seen a massive downward trend over the past week and things are likely to remain bearish. This bearish outlook is seen across all of the crypto markets as Bitcoin crashes. SOL is also likely to continue its descent until it finds a stable support level.

Solana price slide shows no restraint

Solana price has dropped roughly 38% over the past four days, breaching through the daily demand zone, extending from $115.51 to $144.70. This descent has also flipped the weekly support level at $135.71 into a resistance barrier.

As Solana price hovers around $91.82, there is a good chance this downward trend will continue. SOL is likely to drop a minimum of 15% before it tags the daily demand zone, extending from $65.91 to $78.76.

The 15% crash could extend to 26% when SOL retests the lower limit of the said demand zone. Here, Solana price is likely to see a pause in the bearish trend, as bears and bulls hash it out.

SOL/USDT 1-day chart

Regardless of the bearish outlook for Solana price, a bounce off the daily demand zone, ranging from $65.91 to $78.76 seems plausible. The resulting uptrend, while temporarily bullish, needs to pierce the previously broken $115.51 to $144.70 demand zone to end the bearish regime.

Only a daily candlestick close above $144.70 will invalidate the bearish outlook. This development could see Solana price make a run at the 50-day Simple Moving Average at $160.97.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.