Solana price is set to achieve a 20% rally, provided SOL does not fall below this level

- Solana price has managed to rise by almost 70% in the span of 10 days to trade at $16.40.

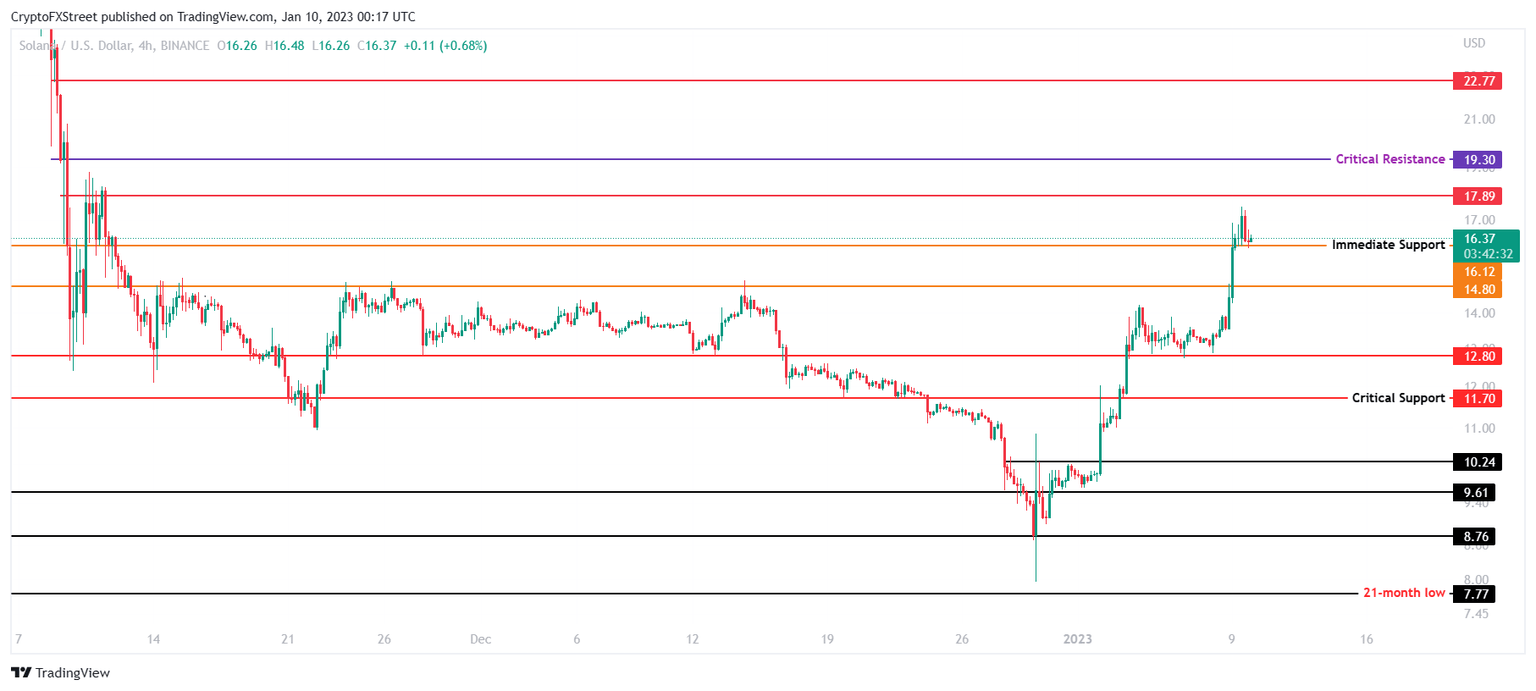

- If the bulls continue pushing the price, Solana is set to tag the critical resistance of $19.30.

- Should Solana end up being overbought, a correction could take place, which could result in a 28% drop.

Solana price has been having a rather phenomenal new year as the cryptocurrency registered a massive rally over the past few days. Following the arrest and investigation against Solana DEX Mango Markets exploiter Avraham Eisenberg, SOL has enjoyed much more bullishness.

This bullish buildup could trigger a recovery rally for the altcoin. However, it also opens the cryptocurrency to a potential decline in price, which is likely if this support level is invalidated.

Solana price - Ready to go up or down?

Solana price is currently trading at $16.44, following a 12.45% increase in value over the last 24 hours. At the moment, following the consistent green candles since January 1, SOL is pumped for a rally that could arrive if the buyers continue their buying spree.

In such a case, Solana price would end up breaching the immediate resistance at $17.89, which would increase the chances of SOL bouncing off and tagging $19.30. If this critical resistance is flipped into a support floor, the altcoin would have all the room it needs to initiate a recovery rally.

However, given the intensity of buying in the last couple of days, Solana has become prone to a correction. This could arrive if the market sees persistent profit-taking, which is highly likely since Solana is technically overbought, per the Relative Strength Index (RSI).

SOL/USD 4-hour chart

Thus, if a decline in price initiates, Solana price would first lose its immediate support at $16.12 and tag $14.80. From here on, a further decline would push SOL to $11.70, registering a 28% drop in value. Should it lose this critical support, the bullish thesis would be invalidated, and the cryptocurrency could slip to tag $10.24.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.