Solana price is rekt unless this level gets broken

- SOL price has yet to retrace into a substantial Fibonacci retracement level.

- Solana price has not printed a candle stick of equal or more value to the May 12 decline.

- Invalidation of the bearish thesis is a breach above $44.50.

Solana price shows optimism but needs tangible price movement to justify a bullish call.

Solana price needs to retaliate more

Solana price is still suppressed within the $30 region as the 3rd week of June's trading session commences. Over the weekend, the price action traded mostly sideways as neither the bulls nor the bears could produce a confident rally. The 4-day chart printed an indecision doji candle with significant volume which now suggests an anomalous scenario in play. The overall trend is bearish, thus the thesis will be written from a bearish perspective until more price action validates the idea for a bullish countertrend rally.

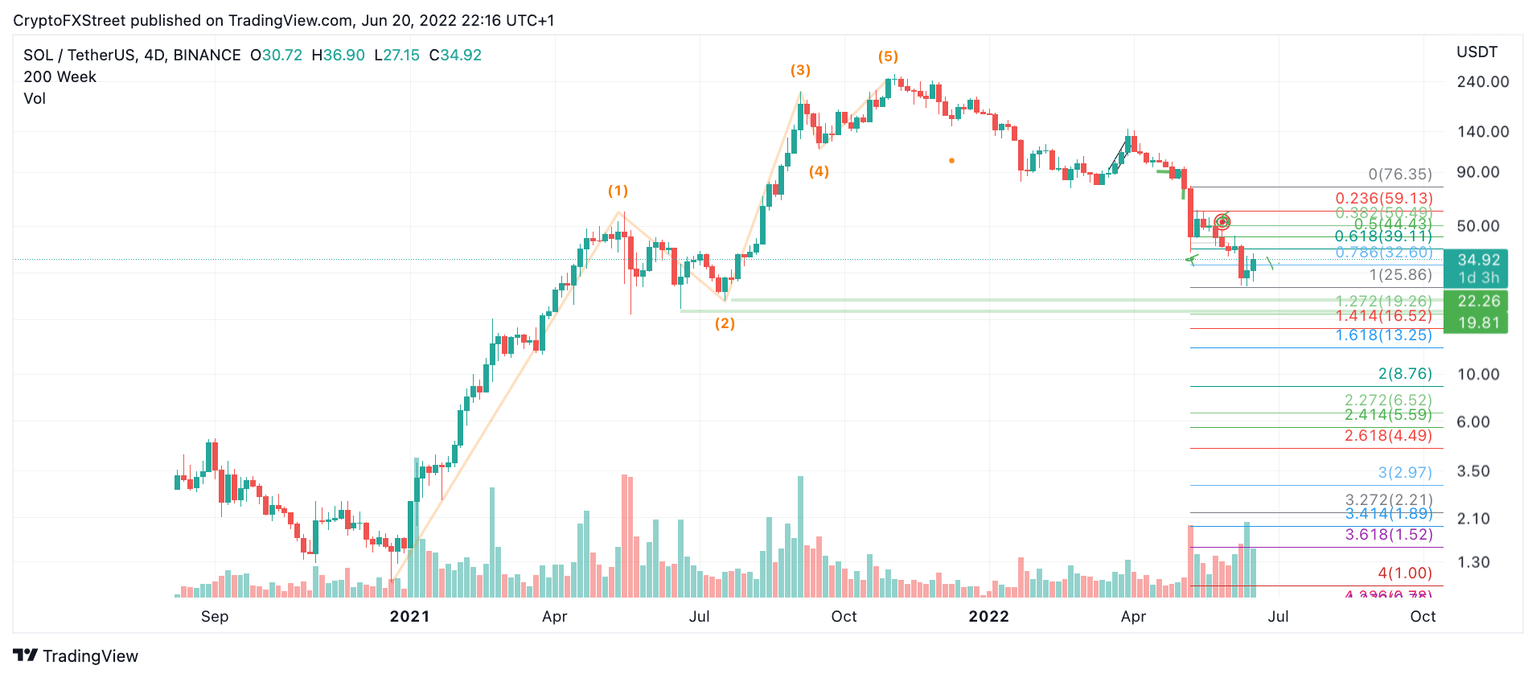

Solana price provides confluence of more decline. The Volume Profile indicator has substantially increased without much price movement. Secondly, a Fibonacci retracement tool surrounding the large decline on May 12, into the new swing low at $25, suggests a 50% retracement level at $44.50 has not been breached. The bears must breach this level first before looking for early entries as previous outlooks forecast that the centralized smart token contract token could fall well below $20. .

SOL/USDT 4-Day Chart

An invalidation of the bearish onslaught is a breach and close above $44.50 on the 2-day chart. If the bulls sustained the price action, they may be able to conquer the 88 dollar threshold, resulting in a 160% increase from the current Solana price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.