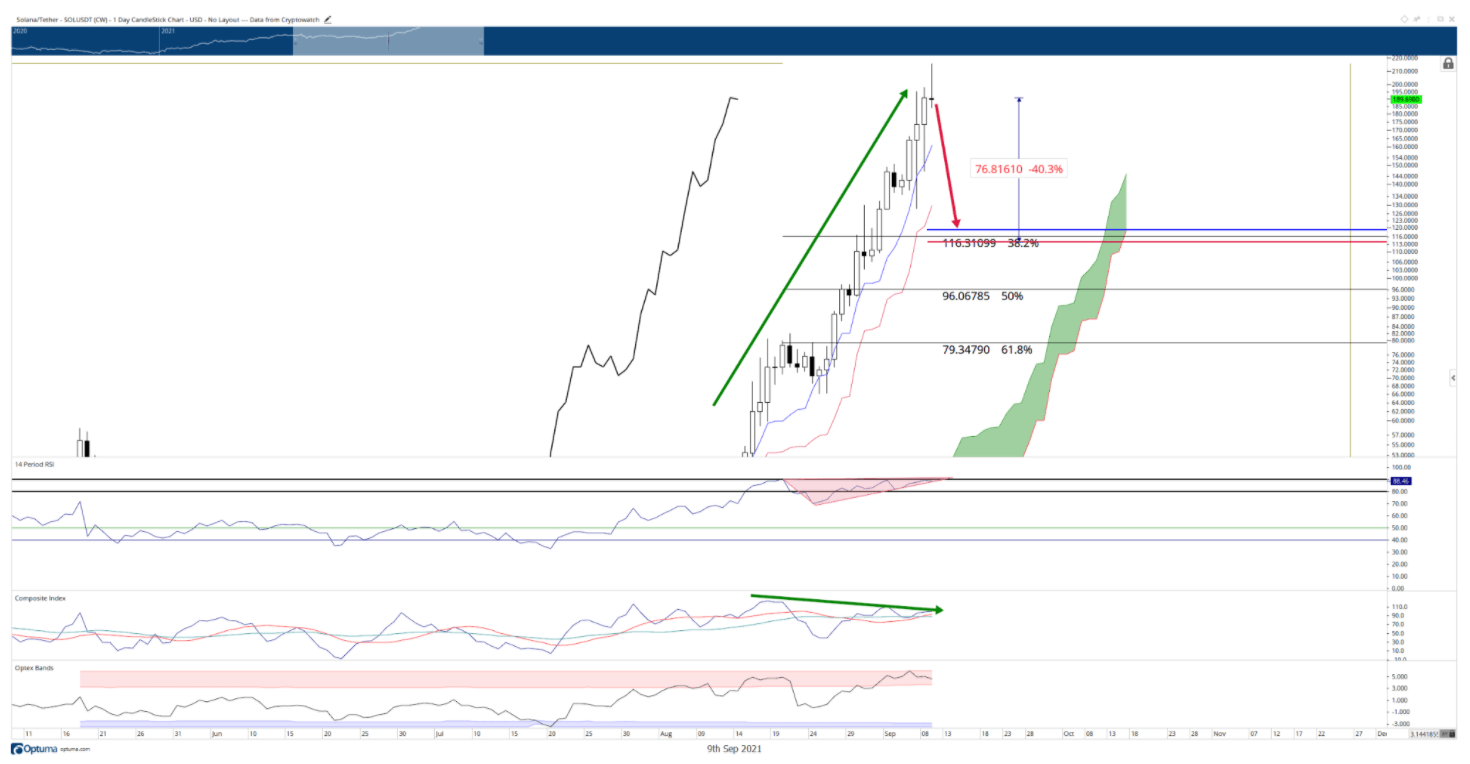

Solana price is primed to drop by 40% and test $115

- Solana is extremely overbought on the daily and weekly charts.

- Bearish Shooting Star candlestick pattern at the extreme new highs indicates a top is likely in.

- SOL has experienced no meaningful pullback in 8-weeks.

Solana price has hit another new all-time high of $216 during today’s trading session. As the New York trading session winds down, a very bearish Shooting Star candlestick pattern develops daily.

Solana price to test Fibonacci and Ichimoku confluence zone as support

Solana has made some impressive gains over the past eight weeks, easily outperforming its peers and propelling itself into the top ten in market capitalization. Still, further upside potential is limited given the extremes found across multiple timeframes. There are several highly overbought levels in Solana’s oscillators.

First, the weekly Relative Strength Index is at 91.80 - above the second overbought condition in a bull market. The Relative Strength Index on the daily chart has been trading between 80 and 90 since August 28th. A rising wedge pattern has now formed on the Relative Strength Index, pointing to an imminent sell-off.

Second, the Composite Index shows its sloping down, suggesting a cross below its slow and fast-moving averages will happen very soon. There is a clear and extended regular bearish divergence between the Solana price chart and the Composite Index.

Third, the Optex Bands are extremely overbought and have been trading in an overbought condition since September. Thus, a move below these levels will likely be the final oscillator trigger for a violent corrective action south.

The first support zone Solana will probably reach is the $115 value area. This is because the weekly Tenkan-Sen, Kijun-Sen and 38.2% Fibonacci retracement all exist within the $115 price range.

SOL/USDT Daily Chart

Solana price action is, however, in price discovery mode and has become parabolic.

When an instrument is in such conditions, any attempt to identify the ‘top’ can be foolhardy. Bulls and bears should all be aware that prices can still move higher, despite the daily and weekly timeframes pointing to a severely overbought market.

Therefore, bears will want to avoid any short opportunities if bulls push Solana to $225.

Author

FXStreet Team

FXStreet