Solana price is done for as another hedge fund defaults on FTX exposure

- Solana price tanks over 5% as an unnamed hedge fund cannot repay crypto loans on the back of FTX collapse.

- SOL dips back toward a crucial line in the sand that could hold but at slim odds.

- Expect another drop lower, flirting with $10 as traders step away again.

Solana (SOL) price is tanking again after what could have been a very silent breakout after it trashed the red descending trend line on Tuesday. The drop comes as an unnamed hedge fund defaults on tens of millions of US Dollars worth of crypto loans, on top of several banks and financial institutions confirming that massive layoffs are set to kick in and much lower than expected bonuses will be paid out. With the holiday season just before the door, it looks like it will be a grim Christmas dinner for many.

SOL cannot get a boost if spending is not there

Solana price is lacking the only most important commodity needed to catch a break and finally pair back with the better levels of this summer at $40. Instead, SOL is still stuck and muddling through near $15 as price action slides lower again this morning in the ASIA PAC and European session. That important commodity needed so much is simply traders with cash. As the economic situation becomes more dire with massive layoffs and inflation still elevated, that cash is going everywhere except into cryptocurrencies.

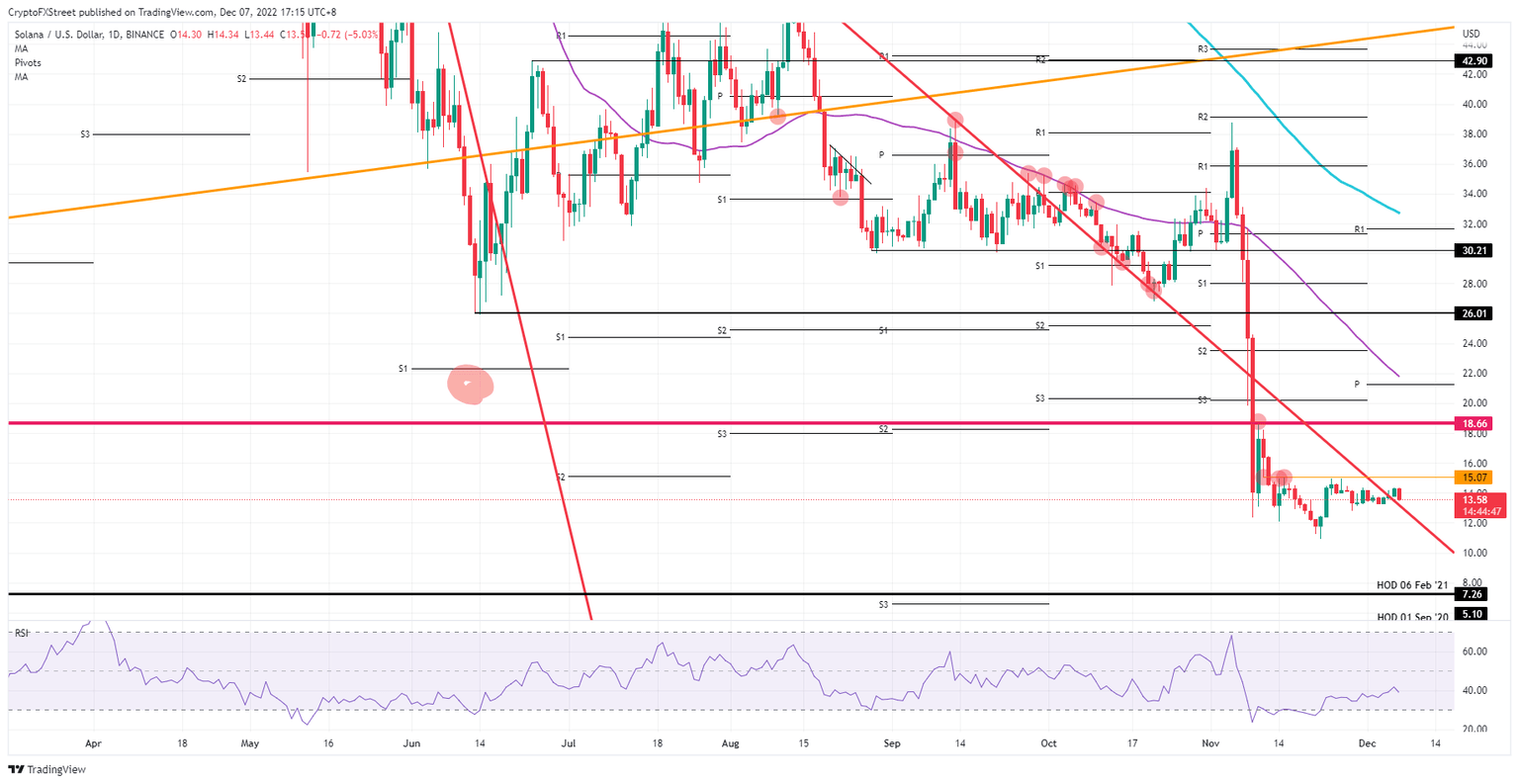

SOL thus will simply see a magnified effect of all this and will spiral further downwards once it breaks below the red descending trend line. Expect $12 to catch the fall, but as more US Dollar strength comes in as well, expect quickly to see $10. Although it looks a bit far off, and the Relative Strength Index (RSI) will be oversold by then, a drop to $7.26 is not impossible, flirting with a two-year low.

SOL/USD daily chart

Two big elements to watch here are one from a technical side and a second from a geopolitical side. The first comes with a simple bounce of the red descending trend line that could still trigger a bounce high enough to break $15.07 and try and target $18.66 to the upside; The second element, which comes from geopolitics, is that next week will be the last week where every central bank or politician can pencil in its last comments for 2022, after which markets will go in a sort of steady trend mode. That could open the door for a small rally in those two very quiet last two weeks of the year before kickstarting 2023.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.