Solana price holds small gains as traders brace for Powell’s make-or-break moment

- Solana price holds on to slim gains after 4% advance Tuesday.

- SOL does not see a follow-through after the US CPI numbers as the Fed is set to hike.

- Expect to see the Powell speech key to making or breaking this fragile rally.

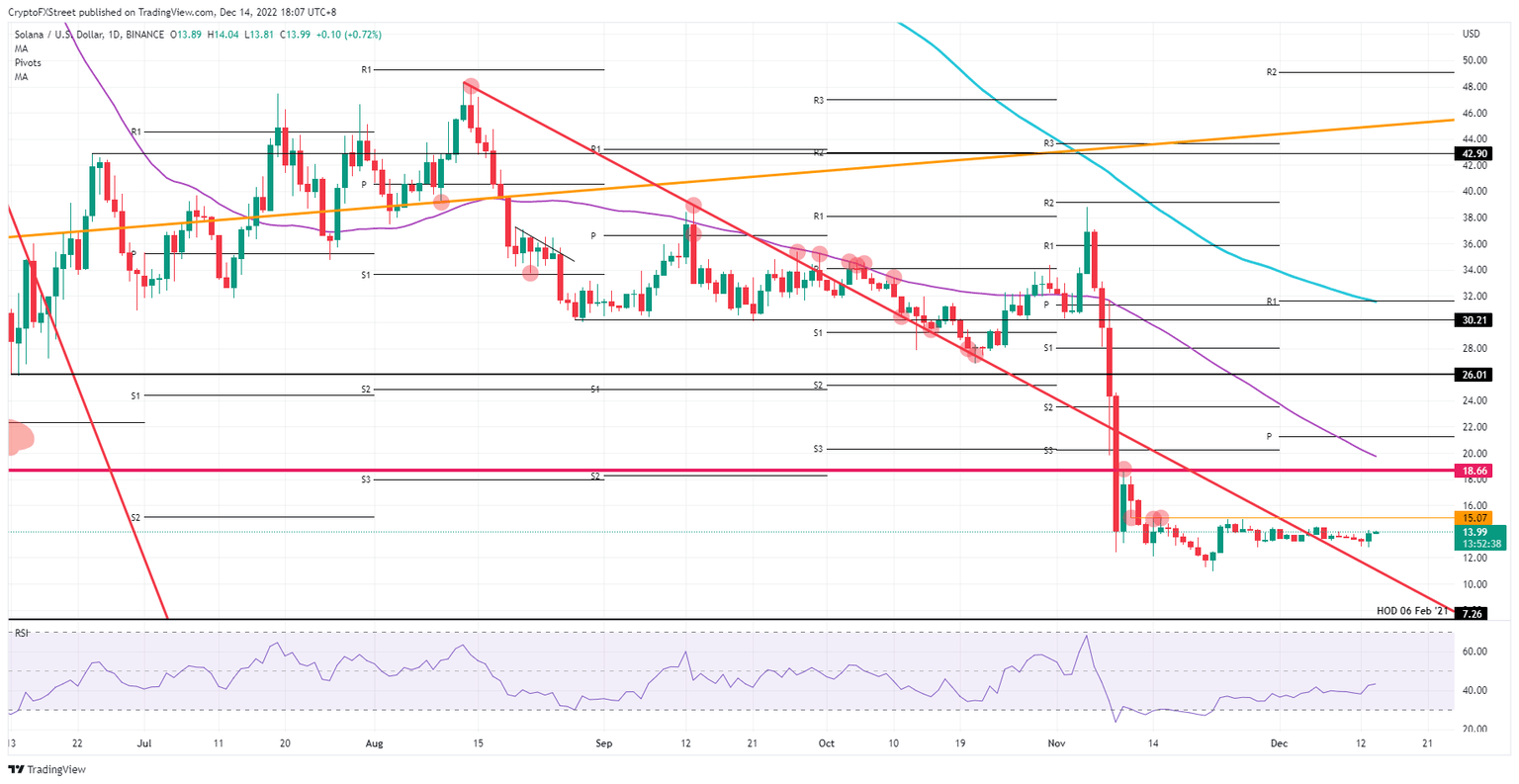

Solana (SOL) price will depend on every word Federal Reserve Chair Jerome Powell utters about the current situation in the US economy. Traders will look for the dot-plot curve, any word on quantitative tightening and how big the coming rate hikes will be. If Powell delivers a dovish message, expect a key Solana level to be broken to the upside, with possibly $18.66 being hit by the end of this week.

SOL can finally forget about FTX

Solana price can finally eliminate the negative stress hanging over the price action since the FTX implosion. With SBF being indicted and detained, the crypto caravan can finally move on to the next big thing. And that is the Fed FOMC rate decision this evening, with Powell having his say on inflation and the US economy.

SOL should see some tailwinds from Powell as he will confirm that inflation is abating, but more rate hikes are still needed. Should the dot-plot curve confirm 50 basis point hikes toward March/April and then a plateau, that would be on point with what markets are predicting and trigger a small Goldilocks balloon. SOL would finally break above $15.07 and rally to $18.66 by the end of this week.

SOL/USD daily chart

Risk comes from the quantitative tightening scheme the Fed has, from all the assets it has carried since the pandemic and the financial crisis before that. Should the Fed speed up that offloading, that would mean a flood of assets entering the market, triggering a sell-off as that volume needs to be absorbed. SOL would give up its gains from this week and drop further lower toward $12 for a possible bounce off the red descending trend line.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.