Solana price holds 20% gains for SOL traders not afraid of range trading

- Solana price action could get caught in a rough patch as bulls cannot break free from tail risks.

- SOL, meanwhile, sees bullish signs that could push price action back toward $25.

- Traders must be conscious of trading because SOL could get stuck in a range for quite some time.

Solana (SOL) price is maybe the best cryptocurrency to visualize what is going on in cryptocurrencies as an asset class. It has become very clear pre-2022 that cryptocurrencies are no longer the outlaws of the market that were defying gravity by trading higher while the whole world was trading its way down toward a recession. Since 2022 that has changed as cryptocurrencies are now acting as the canary in the coal mine: once they stop whistling, it is a sure thing that stocks will be next to tank.

Solana price gets caught between tail risks and tailwinds

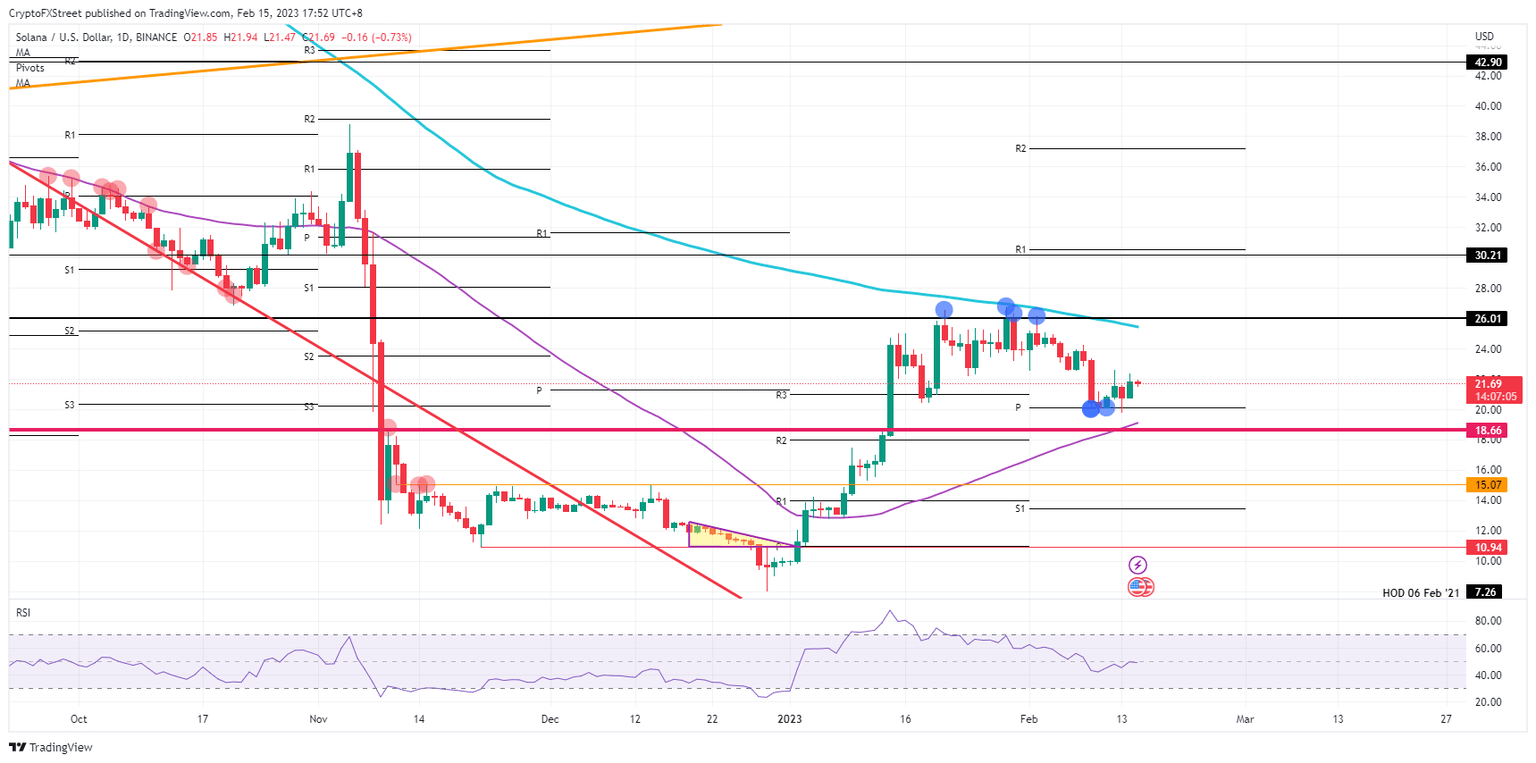

Solana price looks to be trading within the two moving forces of the 55-day and the 200-day Simple Moving Averages. This falls in line with the several elements guiding SOL. On the one hand, bulls want to see price action higher because inflation is falling while the economy is not falling into a hard recession. In the tail, risk pressure is building in Ukraine with Russia planning another big offensive and tension between China and the US has been much higher recently.

SOL is thus caught between tailwinds with decreasing inflation and tail risk from the geopolitical corner. Expect these lower US inflation numbers to see SOL price grind higher toward $25, which still is 20% of gains. Should traders want, they can enter a short SOL position to buy them back at $20 and flip back into a long position in that same area.

SOL/USD daily chart

A big risk that needs to be marked up with an alert on your charts would be when the descent in the range starts to break lower. That would mean that SOL breaks below $18.66 and could be seen selling off toward $15.07 or even $10.94. Incurred losses would vary between a 20% to 40% devaluation in SOL price.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.