Solana price gets relief after surprise Bank of Japan intervention

- Solana price jumps over 3% as cryptocurrencies defeat all risk assets intraday.

- SOL ties up with gains and looks set to break the high of Monday.

- Jump toward $15.07 is possible if Solana bulls can bank off this.

Solana (SOL) price jumped during the ASIA PAC trading session as a surprise yield curve intervention from the Bank of Japan shook up markets. This a perfect example to keep in mind that correlations are not always being abided by, as cryptocurrencies jumped while equities sold off in market woes. If crypto bulls can follow through with this rally in Solana price, expect to see them knocking at the door around $15.07, to print a new high for December.

Solana price sees bulls gearing up for 25% gains

Solana price is seeing a breakdown in correlations working in its favor on Tuesday as markets got caught with their pants down. Plenty of traders were busy wrapping their Christmas gifts and putting in their last orders in online shopping instead of believing that the Bank of Japan (BoJ) would bring something to the table. Instead, markets rattled as the Japanese central bank tweaked its yield curve control and triggered a 5-figure drop, or 3.6% movements, in EUR/JPY and USD/JPY in a one-off event.

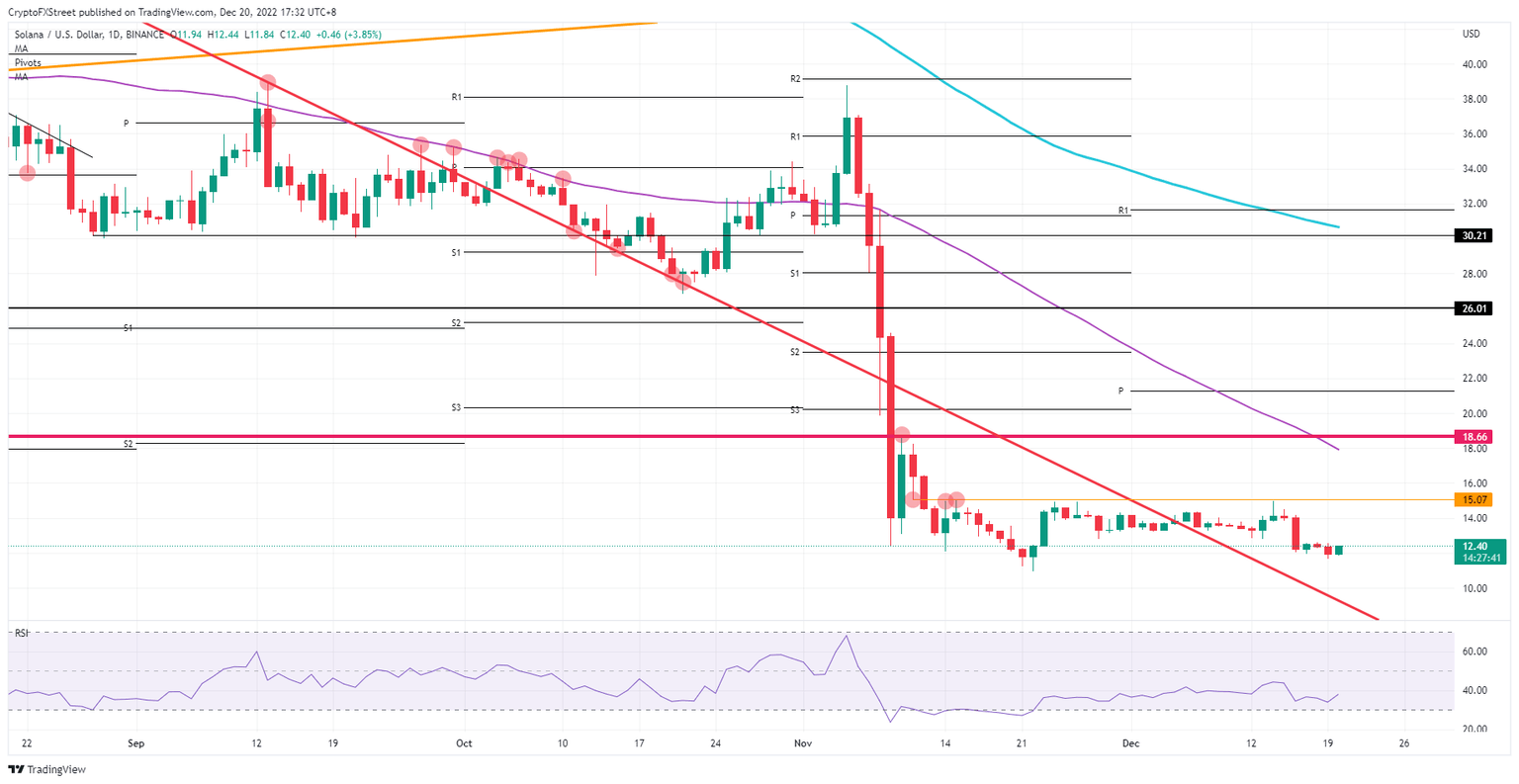

SOL would or should be dropping as a stone on the back of this event as Japanese Yen strength is often correlated with risk-off. And that market theory holds up as equities are selling off on investors worried by this surprise and unannounced intervention. Instead, Solana is trading higher at the time of writing, already at 3.85% in the green intraday. If this bullish price action can extend, Solana has room to rally up 25% and test $15.07, which would print new highs for December.

SOL/USD daily chart

The risk with these one-off events is that they can quickly unwind, as already seen when the Japanese Minister of Finance intervened in the markets with an FX intervention. Often in just a matter of hours, the move is completely paired back. So the risk is that the move from the ASIA PAC session gets nullified by the US session. That would mean giving up of gains for Solana to end the day unchanged.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.