Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana price today: $153.82

- Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer.

- Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

- Solana’s technical indicators turn bullish, increasing the chances of a nearly 11% gain.

Solana (SOL) price increases more than 2% on Friday, tracking the broad gains seen among the main cryptocurrencies, as its community discusses on social media the progress in the development of a new validator, Firedancer, that could boost the blockchain’s performance.

Solana sees Solv Protocol launch, prepares for Firedancer mainnet launch

Solana is preparing for the mainnet launch of Firedancer, a high-performance validator being built by Jump Crypto, a Web3 infrastructure company. Firedancer went live on the testnet in September and the mainnet launch is expected in early 2025.

The validator is expected to boost Solana’s transaction processing, boosting the chain’s utility and likely driving adoption in the long term.

The official launch date isn’t known yet, and Jump Crypto's Chief Science Officer Kevin Bowers discussed the significance of a second fully functional validator for the Solana blockchain at the “Breakpoint” annual conference held in Singapore at the end of September.

Developer and analyst Jarry Xiao tweeted:

Firedancer is an extremely ambitious project and an impressive technical feat.

— Jarry Xiao (@jarxiao) October 17, 2024

It also highlights this industry’s tendency to prioritize narrative over pragmatism.

Infrastructure should be built to serve its consumers, and the impact should be judged according to how well the…

Multicoin’s Kyle Samani told YouTube channel Milk Road in an interview that Firedancer is Solana’s “northstar” and could help the token lead against competitors like Ethereum.

Other notable developments on Solana include the launch of Solv Protocol’s Bitcoin staking token on the blockchain. Solv announced the launch of SolvBTC.JUP on Thursday, a pilot Liquid Staking Token (LST) for Bitcoin.

Introducing SolvBTC.JUP: The First Step into @solana’s DeFi Ecosystem!

— Solv Protocol (@SolvProtocol) October 17, 2024

We’re thrilled to announce SolvBTC.JUP, a pilot Liquid Staking Token (LST) for Bitcoin. This is our first major step into Solana DeFi, beginning with @JupiterExchange's JLP integration.

Stay tuned as we… pic.twitter.com/dVRzovq2OE

Solana Price Forecast: SOL gears up for 11% gains

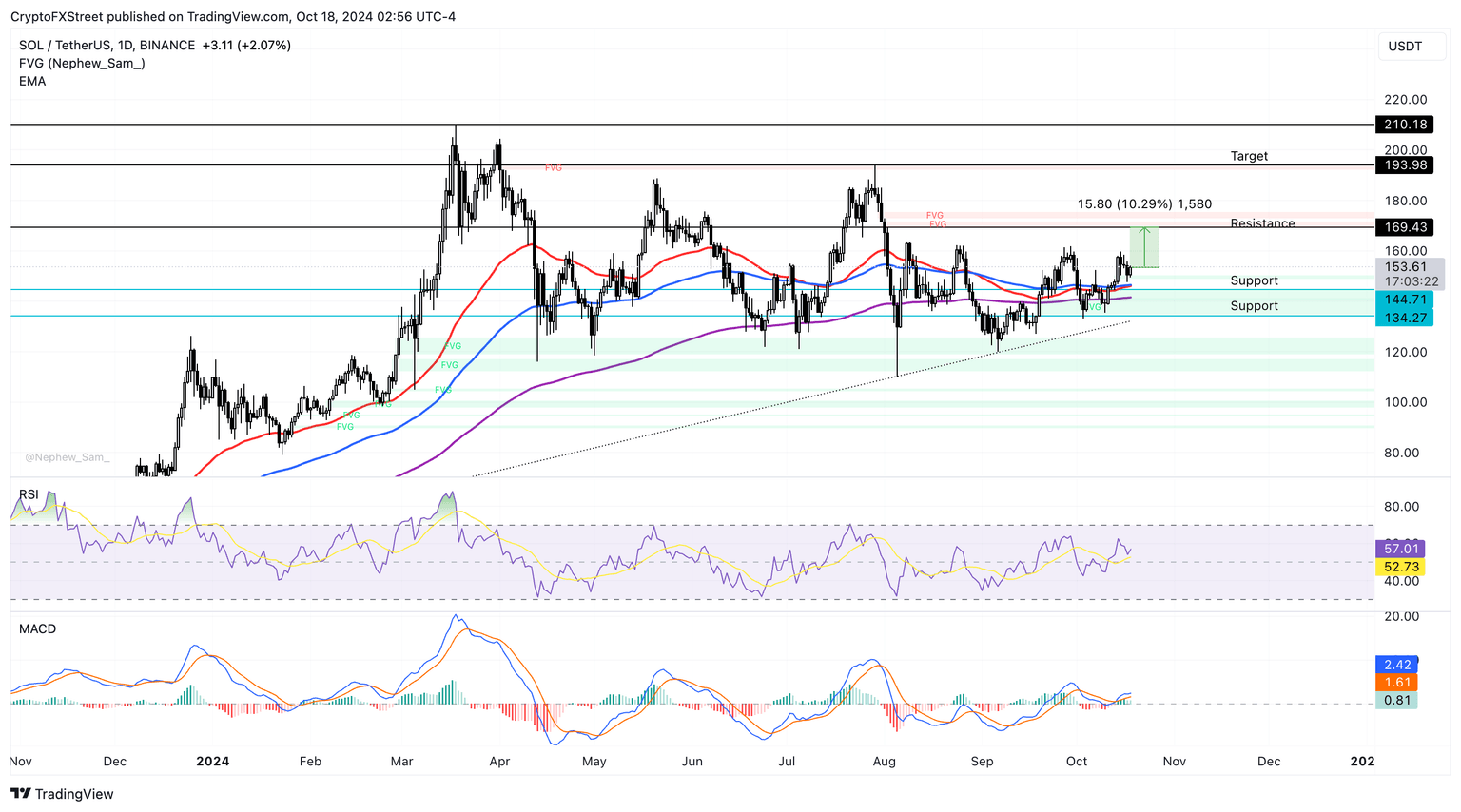

Solana has been trading rangebound for nearly six months, between an upper boundary at the July top of $193.98 and a lower boundary at the August 5 low of $110.

Momentum indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) show that the token has potential for gains.

The MACD flashes green histogram bars above the neutral level, signaling underlying positive momentum. The RSI is at around 57, above the neutral level, and pointing upwards.

In case of a rally, SOL could gain nearly 11% and target resistance at $169.43, a level that has not been tested for over two months now.

SOL/USDT daily chart

Looking down, Solana could find support at $134.27, the September 19 low and a key level for the altcoin, in the event of a correction. This is important as it coincides with the Fair Value Gap

(FVG) on the daily time frame. A daily candlestick close under the 50-day Exponential Moving Average (EMA) at $146.48 could invalidate the bullish thesis.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.