Solana Price Forecast: SOL eyes 12% gains even as altcoin gears up for unlock this week

Solana price today: $163.93

- Solana unlocks $12.49 million worth of SOL tokens every day this week.

- The technical picture suggests bullish potential for SOL.

- SOL gears up for over 10% gain, eyes $184 target.

Solana (SOL) price gained for the fourth consecutive day early on Monday before finding resistance and retracing from around the $170 level. The Ethereum-alternative token trades at $163.93 at the time of writing, losing over 2% of its value on the day as SOL holders speculate the impact of the upcoming Solana token unlock this week.

What to expect from Solana token unlock this week

Solana is scheduled to unlock and enter the circulating supply of 524,030 SOL tokens, worth $88.46 million, this week, according to data from tokenomist.ai.

Between October 1 and 7, $81 million worth of SOL entered circulation after a scheduled unlock. SOL price erased nearly 6% value in the same timeframe, bouncing shortly after and making a recovery in the next week.

If the pattern repeats, SOL could lose value this week and recover it in the next one. SOL typically generates demand among traders to absorb the Solana circulating on exchange platforms.

Solana Price Forecast: Solana could gain 10%

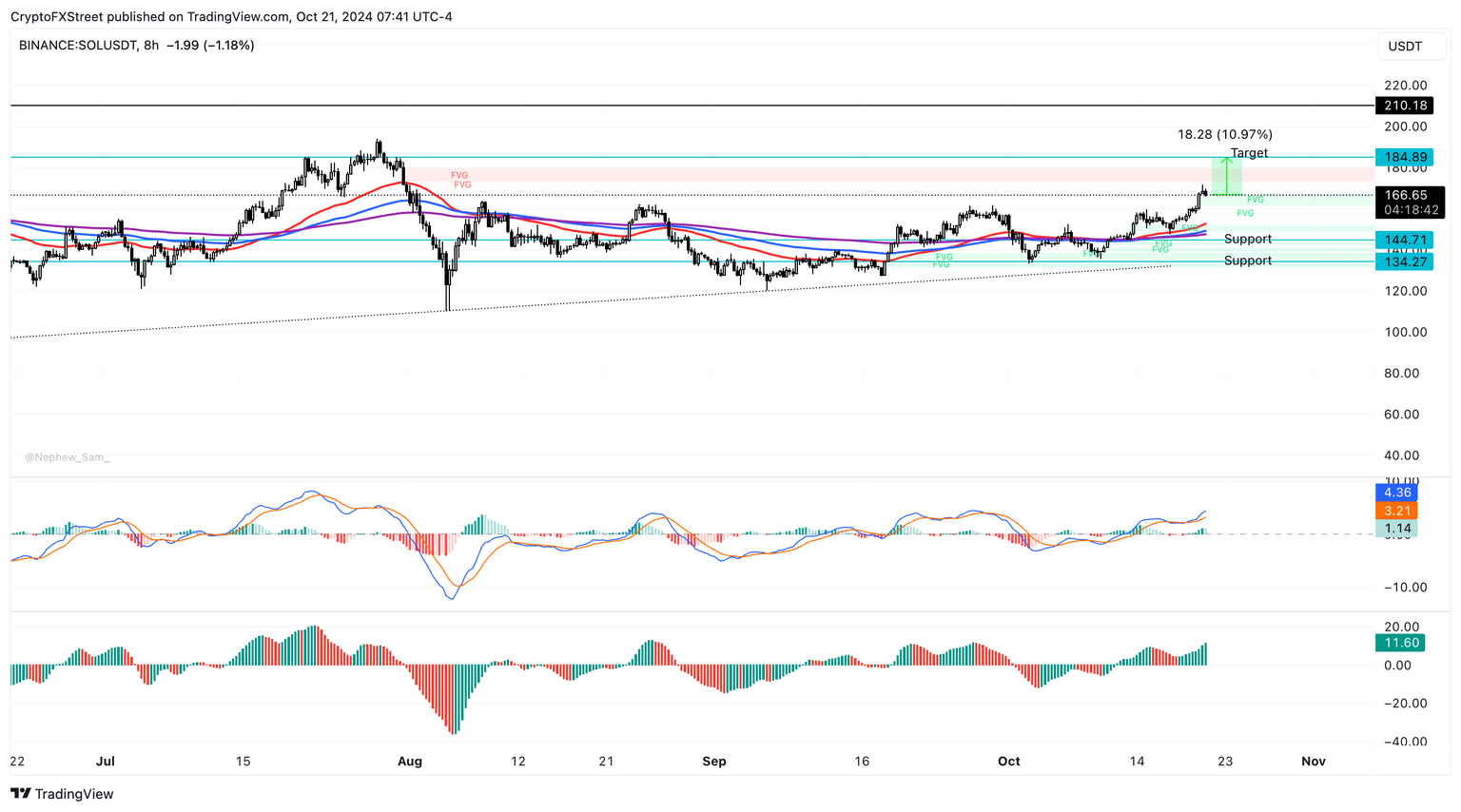

SOL’s price has been in an upward trend, plotting higher highs and higher lows in the 8-hour price chart, and could rally over 12% to hit its target at $184.89. This level coincides with the July 30 high and has not been tested in over two months.

The green bars in the Awesome Oscillator (AO) and in the Moving Average Convergence Divergence (MACD) indicators support the bullish thesis. The MACD indicates that there is an underlying positive momentum in the SOL price trend.

SOL/USDT 8-hour price chart

On the other side, Solana could find support in the Fair Value Gap (FVG) between $159.85 and $163.22, as seen on the 8-hour price chart. Below this level, the 50- and 200-day Exponential Moving Averages (EMAs) at $142.23 and $147.50 are key support levels for SOL.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.