Solana price today: $176

- Solana price corrects from Tuesday’s high above $183 after rallying alongside Bitcoin.

- The number of unique active wallets has doubled in the past five days, according to on-chain data.

- SOL could gain nearly 9%, breaking above the $190 level, according to technical indicators.

Solana (SOL) loses 2% on Wednesday, putting an end to a four-day rally fuelled by Bitcoin’s (BTC) sharp rise to almost a fresh all-time high. Despite the correction, the outlook for SOL remains positive, on-chain data and technical indicators show, adding to the chances that the recent uptrend could continue toward $190.

These catalysts could push Solana higher

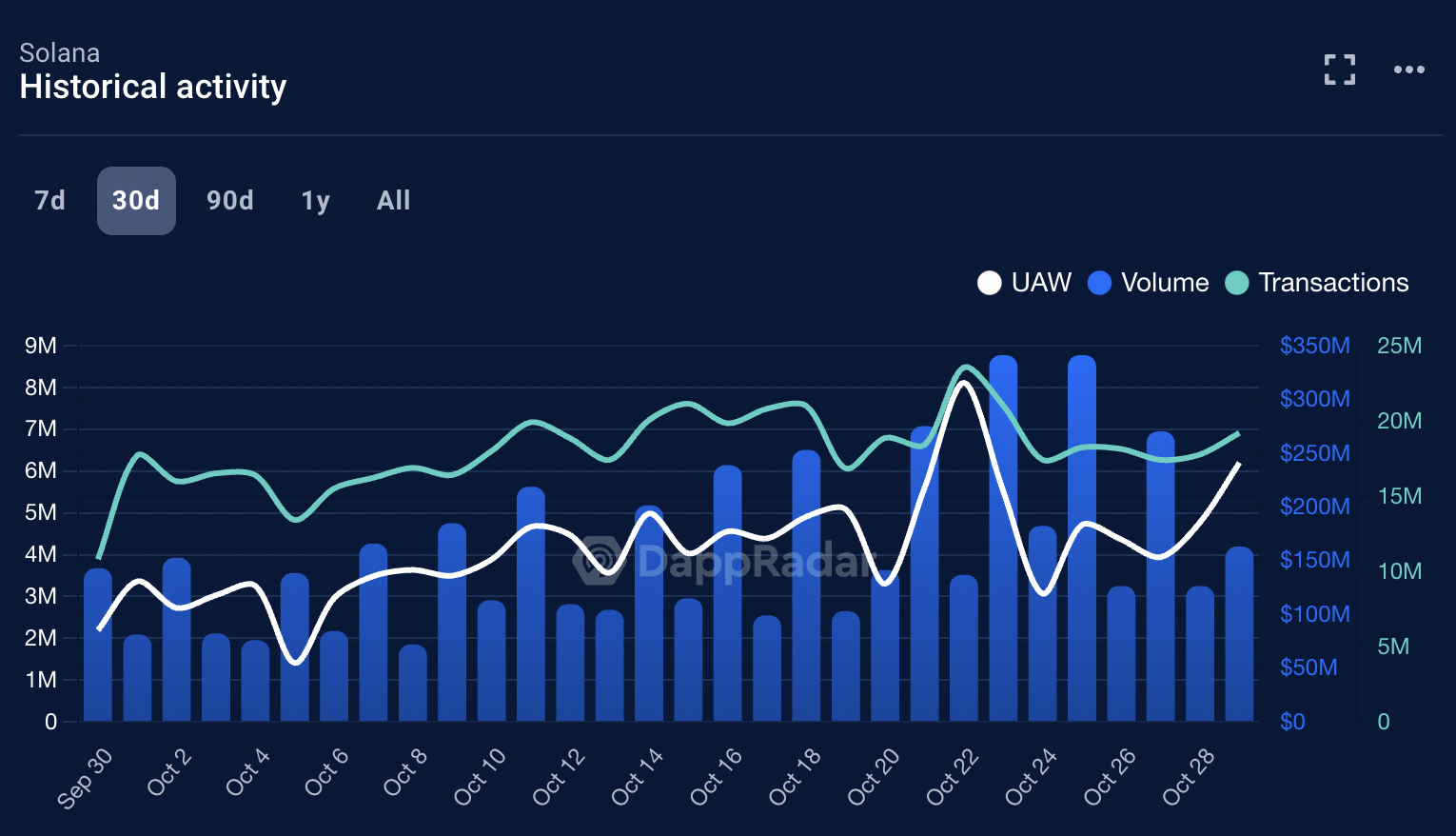

On-chain metrics such as the volume of SOL traded, the number of transactions and the number of unique active wallets (UAW) have increased in the past five days, according to data from DappRadar.

Volume climbed from $126.46 million on October 26 to $163.09 on October 29. It peaked on October 25 at $341.1 million.

As for transactions, increased from 17.4 million on October 24 to 19.2 million, while UAW more than doubled from 3.06 million to 6.19 million in the same period. Typically, an increase in active wallets within a short period of time is a sign of rising interest and demand from traders.

UAW, Volume and Transactions in the Solana network. Source: DappRadar

Solana Price Forecast: SOL could add 9% gain

Solana price is in a clear uptrend in October. SOL climbed to a three-month high of $183.38 on Tuesday but corrected thereafter.

If the uptrend persists, SOL could target the lower boundary of the Fair Value Gap (FVG) between $193.69, a 9% increase from the current levels, and $192.24.

The Moving Average Convergence Divergence (MACD), a momentum indicator, shows green histogram bars above the neutral line. This implies that there may be positive underlying momentum in SOL price trend.

Traders need to watch this indicator closely, if the histogram bars turn red and appear under the neutral line, it could indicate a reversal in the asset’s price trend.

SOL/USDT daily chart

If the recent correction becomes a more pronounced pullback, Solana could find support at the 10-day Exponential Moving Average (EMA) at $156.03.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

ETH could see new all-time high in 2025 as blobs top burn leaderboard

Ethereum (ETH) is down 1% on Tuesday following a weeklong consolidation of the general crypto market. The top altcoin could be set for a bullish 2025 if blobs continue their recent trend of burning high amounts of ETH.

PEPE Price Prediction: Last-minute $121M whale demand sparks 1,500% 2024 rally

PEPE price surged 25% within the last 24 hours, decoupling from the broader crypto market’s year-end volatility. With whales spotted entering last-minute buying frenzy, can PEPE breach the $0.000025 resistance?

These three narratives could fuel crypto in 2025, experts say

Crypto narratives like Real-World Asset tokenization, Artificial Intelligence and Bitcoin as a treasury asset could gain relevance in 2025. Experts say meme coins could emerge as a key vertical next year and strike a cautious note about Solana and XRP ETFs.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.