Solana Price Forecast: DTCC lists first SOL futures ETF, will it avert $130 breakdown?

- Solana price scored a mild 2% gain to reclaim $137 in the early hours of Thursday amid a run of 24% losses since the start of the week.

- Derivatives trading platform DTCC has filed to lose Solana futures ETF, subject to US SEC approval.

- With SOL price still pressing against the lower Bollinger Band indicator, bears could push for more downswings.

Solana (SOL) price edges higher and trades near $140 at the time of writing on Thursday after tumbling from $172 to $134 this week as FTX estate’s impending token unlock looms ahead despite early gains from a new SOL Exchange Traded Fund (ETF) listing.

Solana price holds $130 support as sell-side pressure cools

Solana has been among the hardest-hit top 10 cryptocurrencies this week, with sustained selling pressure driving prices from Sunday’s close of $172 to a local bottom of $134 on Wednesday.

The dramatic drop coincided with growing concerns over the impending FTX estate unlock, which is expected to inject additional supply into the market, amplifying downward pressure on SOL.

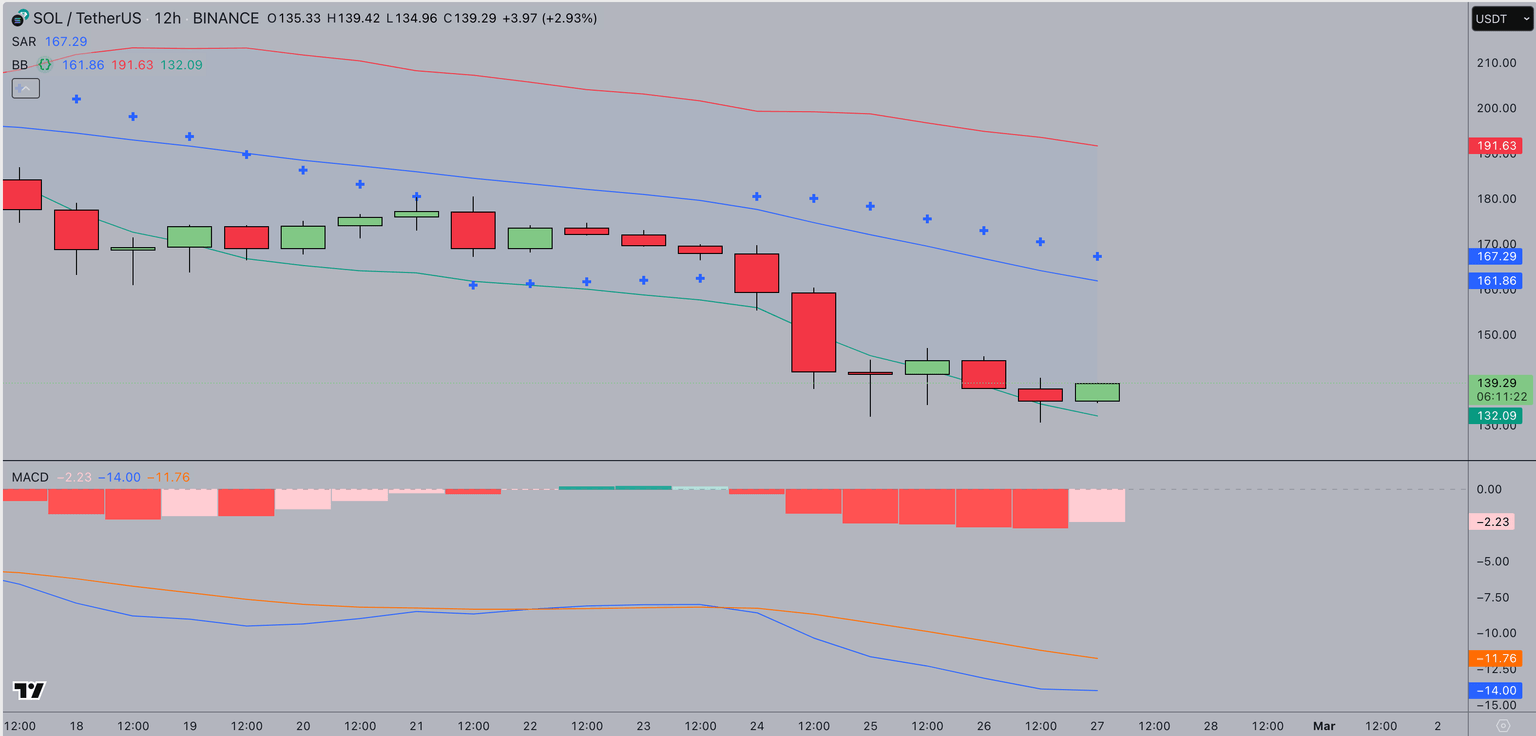

Solana price action | SOL/USDT

Further compounding bearish sentiment, US President Donald Trump’s new tariffs on foreign imports have reignited macroeconomic fears, prompting a broader risk-off approach across financial markets, including the cryptocurrency sector. The combination of these headwinds saw Solana endure one of its steepest weekly corrections in months.

However, Thursday brought a momentary reprieve. Following news of DTCC’s listing of Solana futures ETFs, SOL recovered by nearly 2%, stabilizing around $137.

While this suggests that some buyers are stepping in at current levels, the sustainability of this recovery remains uncertain, especially as broader market conditions continue to weigh on investor sentiment.

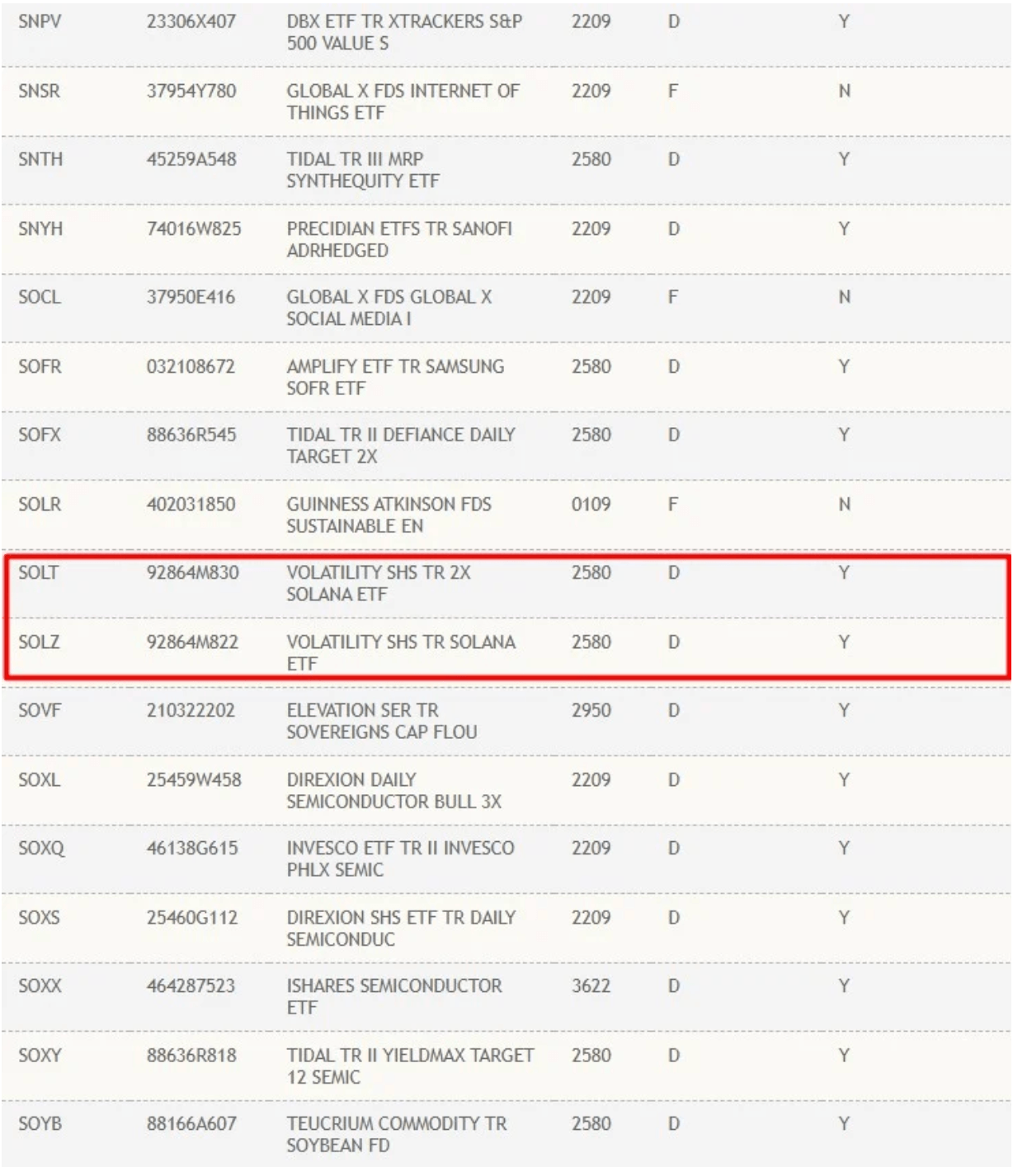

DTCC lists first Solana futures ETF

The recent listing of Solana futures ETFs by the Depository Trust & Clearing Corporation (DTCC) injected fresh optimism into the market, potentially influencing Solana’s mild rebound on Thursday.

The newly listed products — Volatility Shares 2x Solana ETF (SOLT) and Volatility Shares Solana ETF (SOLZ) — represent the first structured investment vehicles designed to offer exposure to Solana’s futures market.

Adding to DTCC’s platform signals that these ETFs are eligible for clearing and settlement through the US financial system’s central infrastructure is an essential step for institutional adoption.

However, the listing does not equate to the US Securities and Exchange Commission (SEC) approval, leaving regulatory uncertainty as a lingering risk.

DTTC files to list Solana futures ETF, Feb 2025 | SEC.gov

Volatility Shares, a firm specializing in exchange-traded funds focused on volatility-driven strategies, had initially filed with the SEC last December for three Solana-related ETFs.

Besides the two listed on DTCC, the firm also seeks approval for an inverse Solana ETF (-1x Solana ETF), which would provide inverse exposure to Solana’s futures market, benefiting when SOL prices decline.

The move sparked speculation, given that, at the time of filing, no Solana futures contracts were available on Commodity Futures Trading Commission (CFTC)-regulated exchanges.

However, Bloomberg ETF analyst Eric Balchunas noted that the listing strongly indicated that future contracts for Solana were on the horizon.

The timing of this development is critical, as Solana’s market remains vulnerable to downside risks. Should regulatory clarity emerge and the broader market sentiment improve, these ETFs could provide an alternative investment avenue, potentially boosting institutional participation and stabilizing SOL’s price.

For now, Solana traders will be watching whether the ETF news translates into sustained demand or if selling pressure resumes, testing key support levels below $135.

Solana price forecast: $130 breakdown risks persist as bears remain dominant

Solana price hovers at $139.71 after a 3.24% rebound, but the broader trend remains bearish.

The 12-hour chart shows SOL extending its descent beneath the mid-Bollinger Band ($161.88), reinforcing downside risks. Price action has consistently clung to the lower band ($132.18), suggesting sellers maintain control.

If bears breach this level, SOL could spiral toward the psychological $130 support, opening the door to deeper losses.

Solana price forecast

The MACD indicator confirms the bearish outlook, with both the MACD line (-13.96) and signal line (-11.76) steeply negative, indicating sustained downward momentum.

The histogram’s deep red bars show growing selling pressure, aligning with SOL’s failure to reclaim key resistance.

While the Parabolic SAR dots above price action at $167.29 signal an entrenched downtrend, a potential bullish reversal hinges on a decisive close above the mid-Bollinger Band.

For buyers, reclaiming $150 would weaken bearish dominance. A move above $161.88 could spark renewed confidence, challenging the upper Bollinger Band at $191.58. However, until SOL breaks its current downtrend structure, risks of a $130 breakdown remain elevated.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.