Solana Price Forecast: A break above $26.30 would spell doom for bears

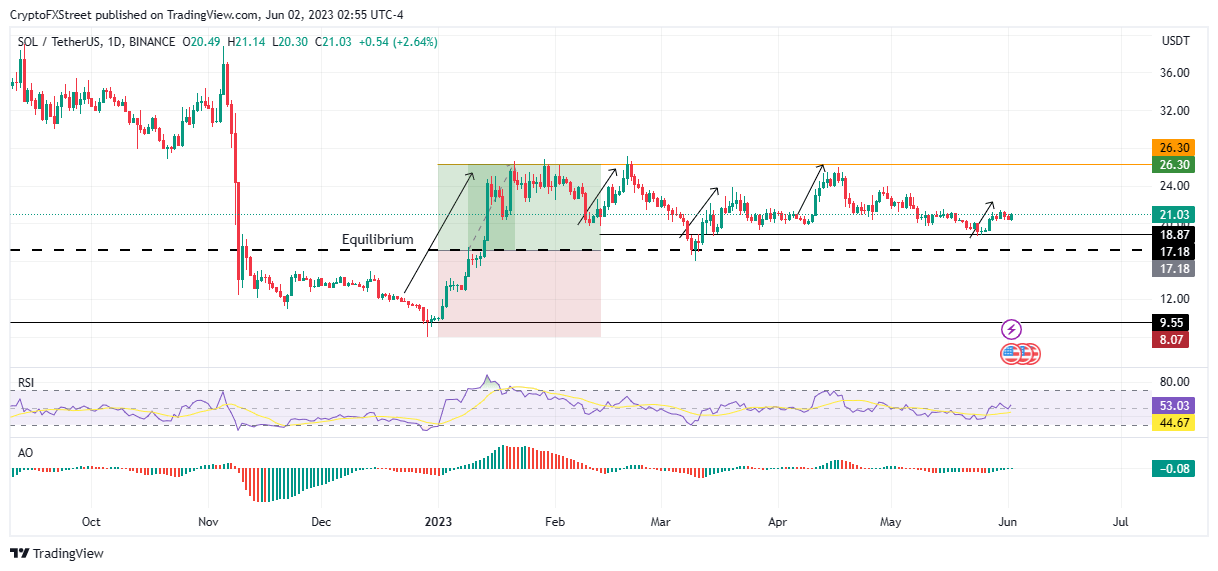

- Solana price has made multiple attempts to break above the $26.30 resistance level but none of them succeeded.

- A retest of the equilibrium level at $17.18 could pump SOL to break out due to uncollected liquidity.

- Time is a factor for traders to buy Solana at fair market value to avoid missing the next bullish attempt.

Solana (SOL) price has been trading with a bullish bias after an explosive breakout on December 30. However, because of volatility and the gloom in the broader crypto market, SOL has been unable to break above a key hurdle at $26.30, causing the price to trade sideways.

Also Read: Solana price back above $20 as SOL sees a spike in active users

Solana price could rally 50%

Solana price is bearing the brunt of an overly volatile market and a broader lack of momentum. This comes as Bitcoin (BTC) has failed to inspire a wave of bullishness across altcoins. Nevertheless, SOL shows some optimism indicated by its multiple attempts to break above the hurdle at $26.30.

The Ethereum (ETH) killer trades between a market range between $26.30 and $8.07. To gain sufficient momentum that could facilitate the uptrend, Solana price could fall to the equilibrium at $17.18 before a breakout that could see SOL tag the $26.30 resistance level, which would represent a 50% increase. Solana trades at $21.1 at the time of writing.

This equilibrium is critical, as it would provide an opportunity for traders to accumulate SOL at fair market value. The ensuing buying pressure could fuel the uptrend, delivering Solana price to the target. In a highly bullish case, the altcoin could shatter this hurdle to record a new range high above the psychological $32.00 level.

Notably, when markets go below equilibrium, they do not spend much time below this level. In fact, there is usually a very dynamic price move away from that zone, especially if the context behind that market is bullish. As such, Solana price could break out as postulated above, thereby adding credence to the bullish thesis.

To support this thesis, the Relative Strength Index (RSI) had moved above the midline and points north, indicating rising bullish momentum. The Awesome Oscillator (AO) was also inclined to support the growing bullish momentum idea as it was drawing closer to the midline. Both metrics appear to support the bounce-off equilibrium thesis, spelling doom for the bears.

SOL/USDT 1-Day Chart

On the other hand, an increase in selling pressure countered by a less-than-sufficient buying power from the bulls could see Solana price head lower, potentially breaking below the discount zone to collect the liquidity below $9.55 at around $8.07.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.