- Solana price consolidated above $236 on Thursday, down 10.3% from last week’s peak of $264.

- Solana node validators have unstaked 10.8 million SOL ($2.6 billion) since prices crossed the $200 mark on November 8.

- The influx of unstaked coins into the market could potentially impede Solana's next $250 breakout attempt.

Solana price declined to $236 on Thursday, reflecting a 10.3% correction from the all-time high of $264 recorded last week.

On-chain data trends reveal rising sell-pressure among node validators booking profits could potentially impede the next breakout phase.

Solana price tumbles 10% after failed $265 breakout

Propelled by key bullish catalysts like Securities and Exchange Commission (SEC) chair Gary Gensler’s exit confirmation, rising memecoin demand and Canary Capital’s SOL ETF application, Solana price has emerged as one of the biggest gainers in November 2024.

However, recent market trends observed over the past week show Solana has entered a steep consolidation phase after a new all-time high milestone sparked a profit-taking wave.

Solana price action | SOLUSD

The chart above depicts how Solana's price rose 70.5% between Trump’s re-election on November 5, to reach a new all-time high of $264.4 on November 22.

However, since failing to stage a decisive breakout above the $265 territory, Solana has succumbed to a sharp 10% rebound, trading as low as $236 on Binance at the time of writing on Thursday.

Investors unstaked $2.6 billion as Solana raced to all-time highs

When an asset price takes a sharp downturn after hitting a milestone price, it signals rising sell-side pressure from holders looking to take profits at the market top.

On-chain data trends show that Solana’s key insiders began selling when SOL price crossed the $200 mark shortly after Trump’s reelection.

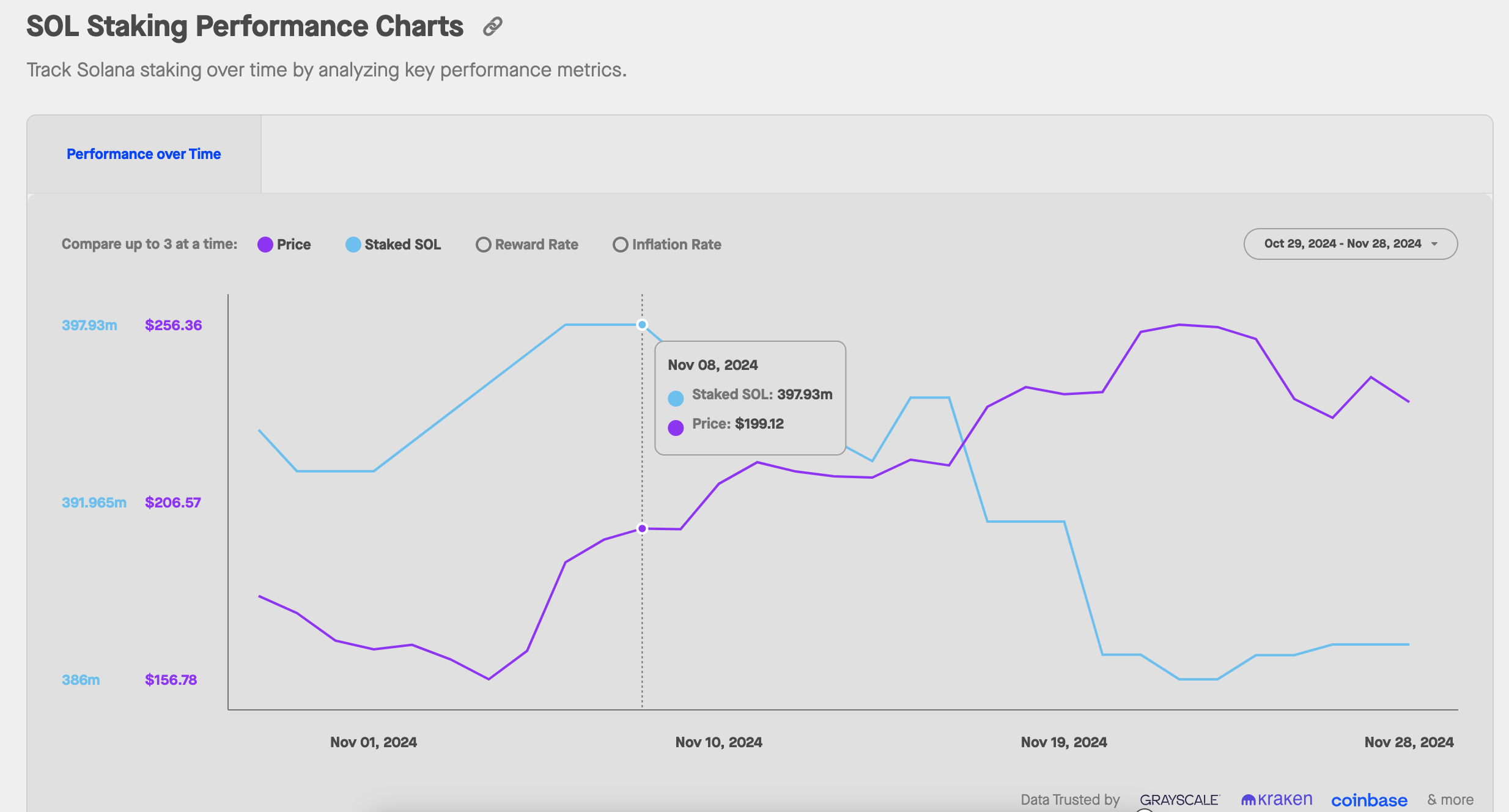

The chart below tracks daily changes in the total number of SOL coins deposited in staking contracts to validate transactions and secure the network.

Solana staking data | Source: StakingRewards.com

Looking at the chart above, Solana’s key stakeholders held 397.9 million SOL in staking contracts on November 8.

But as Solana's price breached the $200, the investors began to make rapid withdrawals from the staking network.

The latest data shows the total staked value has now declined to 387.1 million SOL on Thursday.

Solana’s network validators have effectively unstaked 10.8 million SOL, worth approximately $2.6 billion when valued at the current price of $236 per coin.

For any Proof of Stake (PoS) network, such a rapid decline in staking deposits raises major bearish concerns.

First, it signals that the majority of Solana’s key investors staged large sell-offs at all time high prices, locking in record profits.

More so, having flooded $2.6 billion worth of SOL coins within three weeks, Solana’s bloated short-term supply could nullify upward momentum, as bulls push for an instant rebound toward the $250 level in the days ahead.

Solana price forecast: Bearish sell-wall looms large at $250

From a technical standpoint, Solana's price is flashing multiple bearish potential as SOL faces a critical resistance near $250.

In the short-term price projection, the Donchian Channels (DC) middle band around $229 acts as the immediate support level.

Failure to hold this level could see SOL retesting the lower band at $194.

Solana price forecast | SOLUSDT (Binance)

Volume Delta data further validates a bearish outlook, with a negative trend of -291,730, signaling waning buyer momentum.

This negative divergence between price action and volume highlights weak bullish strength and raises the risk of a major pullback.

On the upside, the psychological resistance level at $250 remains the key level to watch, where sell walls could trigger significant downward pressure.

A close above $250 could mark the start of a bullish reversal, especially if supported by a spike in Solana trading volumes.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Tether expands reach with Juventus acquisition and new Bitcoin-native public company launch

Tether announced on Thursday that it had acquired additional shares in Juventus Football Club, bringing its total stake to over 10.12% and representing 6.18% of voting rights. Tether, Bitfinex, SoftBank & Jack Mallers also launch Twenty-One, the first Bitcoin-native public company.

Ethereum Price Forecast: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum (ETH) saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Stacks price eyes $1 amid growing interest in Bitcoin layer-2 protocols' DeFi ecosystems

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem.

Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.