Solana price finds strength after crypto ratings agency flips XRP for SOL on its top five global crypto index

- Solana price remains steady with an ascending parallel channel.

- Honk Kong Virtual Asset Consortium chooses SOL over XRP following the former’s stellar performance in December.

- The prevailing bullish outlook would be invalidated if the Layer 1 smart contract token’s price breaks and closes below $89.02.

Solana (SOL) price was a top performer across December, rising almost 120% within the month. The surge bolstered the position of the cryptocurrency, putting SOL on the pedestal against its contender, Ethereum (ETH). The impressive surge drew Solana founder Anatoly Yakovenko out to quell debates on SOL versus Ether.

Also Read: Solana Price Prediction: Make or break moment as SOL runs back to the trendline with falling TVL

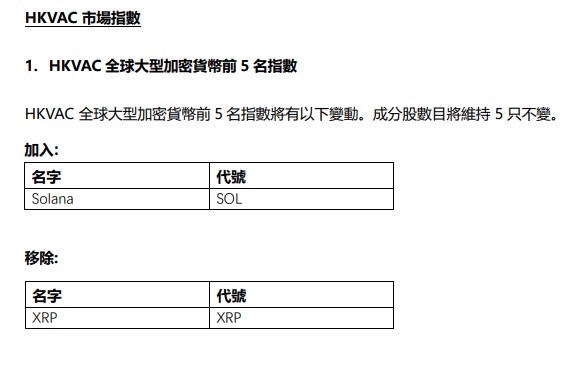

SOL dethrones XRP on HKVAC list

In a recent press release, the Hong Kong Virtual Asset Consortium (HKVAC), which serves to rate digital asset trading platforms and crypto market indexes, revealed having replaced XRP with SOL on its top five list of cryptocurrencies global index.

HKVAC replaces XRP with SOL

The number of constituent assets will be maintained at five, according to the HKVAC. The move comes after Solana managed to take the fifth position on the list of cryptocurrencies by market capitalization, sidestepping XRP, which moved to the sixth position.

Meanwhile, Hong Kong’s efforts to bolster the crypto industry within the region have not gone unnoticed. The country’s financial regulator declared preparations to receive spot crypto exchange-traded funds (ETFs) in December. This came as the US Securities & Exchange Commission (SEC) was reviewing the spot BTC ETFs that were approved last week.

Recent reports have also indicated that Hong Kong’s industry leaders are also calling for spot BTC ETFs of their own, urging regulators to approve them.

Hong Kong needs to speed up approval of spot cryptocurrency exchange-traded funds after US launch, industry insiders sayhttps://t.co/RkaPcZtxhf

— Modern Crypto News (@ModernCryptoNew) January 14, 2024

Co-founder and chief executive of digital asset custodian Cobo, Mao Shixing, alias “Discus Fish”, said, “[Hong Kong needs to launch spot virtual asset ETFs as soon as possible to] ensure that the city remains competitive in the global cryptocurrency market.”

Solana price outlook as SOL ascends on HKVAC list

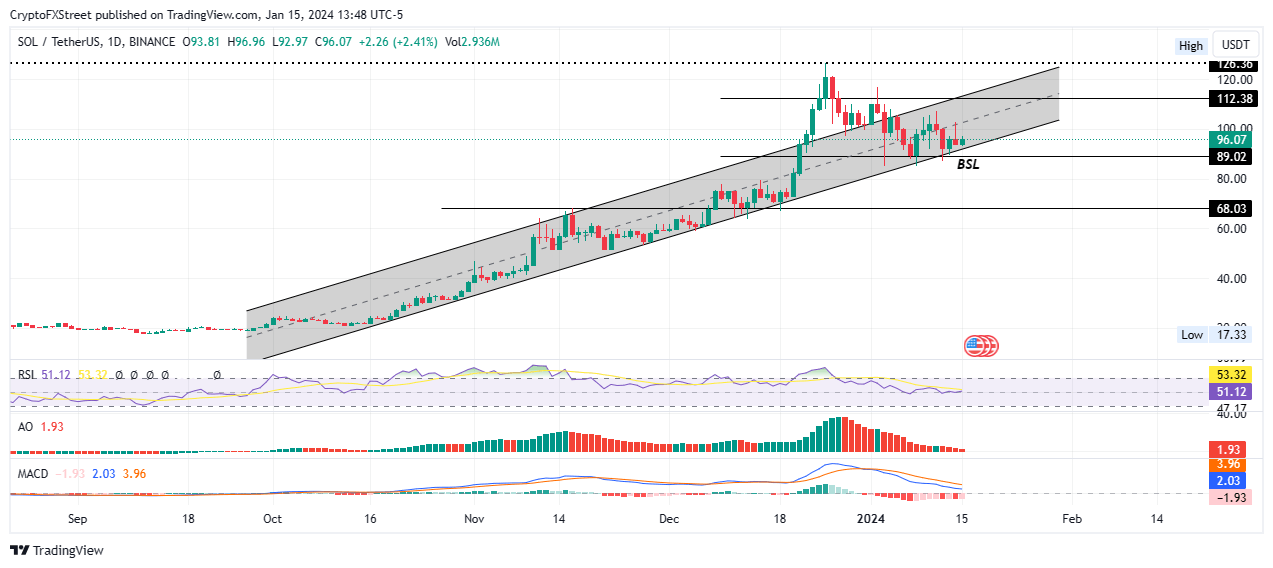

Despite recent corrections, Solana price remains bullish and has consolidated within an ascending parallel channel. This bullish technical formation could deliver more gains as long as SOL remains within its confines.

From a technical standpoint, the Relative Strength Index (RSI) is rising to show increasing buying strength. If the trajectory of the RSI is maintained, it could soon cross above the signal line (yellow band) with the crossover interpreted as a buy signal. Traders heeding this call could catalyze the upside potential for Solana price, sending it past the midline of the channel above the $100.00 psychological level.

In a highly bullish case, Solana price could extend to tag the $112.38 resistance level or even extrapolate the rally to the range high at $126.36. Such a move would denote a 30% climb above current levels.

SOL/USDT 1-day chart

Conversely, seeing as the histogram bars of the Awesome Oscillator (AO) are southbound, bears are fastening their grip on SOL. This is accentuated by the nose-diving Moving Average Convergence Divergence (MACD) indicator, which continues to move below the signal line (orange band), after crossing below it during late December.

If profit takers have their way, Solana price could lose the immediate support at $89.02 to collect the buy-side liquidity residing underneath. In a dire case, the fall could extend to the $68.03 support floor, 30% below current levels.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.