Solana price faces the last line of defence before a 13% plunge

- Solana price slips for a second day in a row and nears historical support.

- SOL price could be set for another decline as no real support elements are present.

- With a very eventful week ahead, SOL price could get in the crosshairs and trigger a plunge by Thursday.

Solana (SOL) price dips another 1% at the start of this trading week after traders threw in the towel on Sunday as the event calendar for this week made them run for the hills. Currently, a supportive pivot is refraining SOL price from making new lows, as just one catalyst would be enough to drive price action into the ground. Expect this very eventful week to see some more downside pressure, only to see some positive returns by Friday as traders let the dust settle before engaging again in price action.

SOL price set to bow to pressure

Solana price is at risk of finding itself in the crosshairs of central banks this week as several are on the docket, with the biggest, the Fed and the BoE, set to hike several basis points to tame inflation. The issue for cryptocurrencies remains the same as elevated inflation still eats a large part of the disposable income of households with less money to allocate to cryptocurrencies, and central banks are tightening monetary policy, making credit more expensive and thus reducing the amount available to invest in cryptocurrencies. It leads to liquidity drying up, and could see cryptocurrencies not yet at their low for the year.

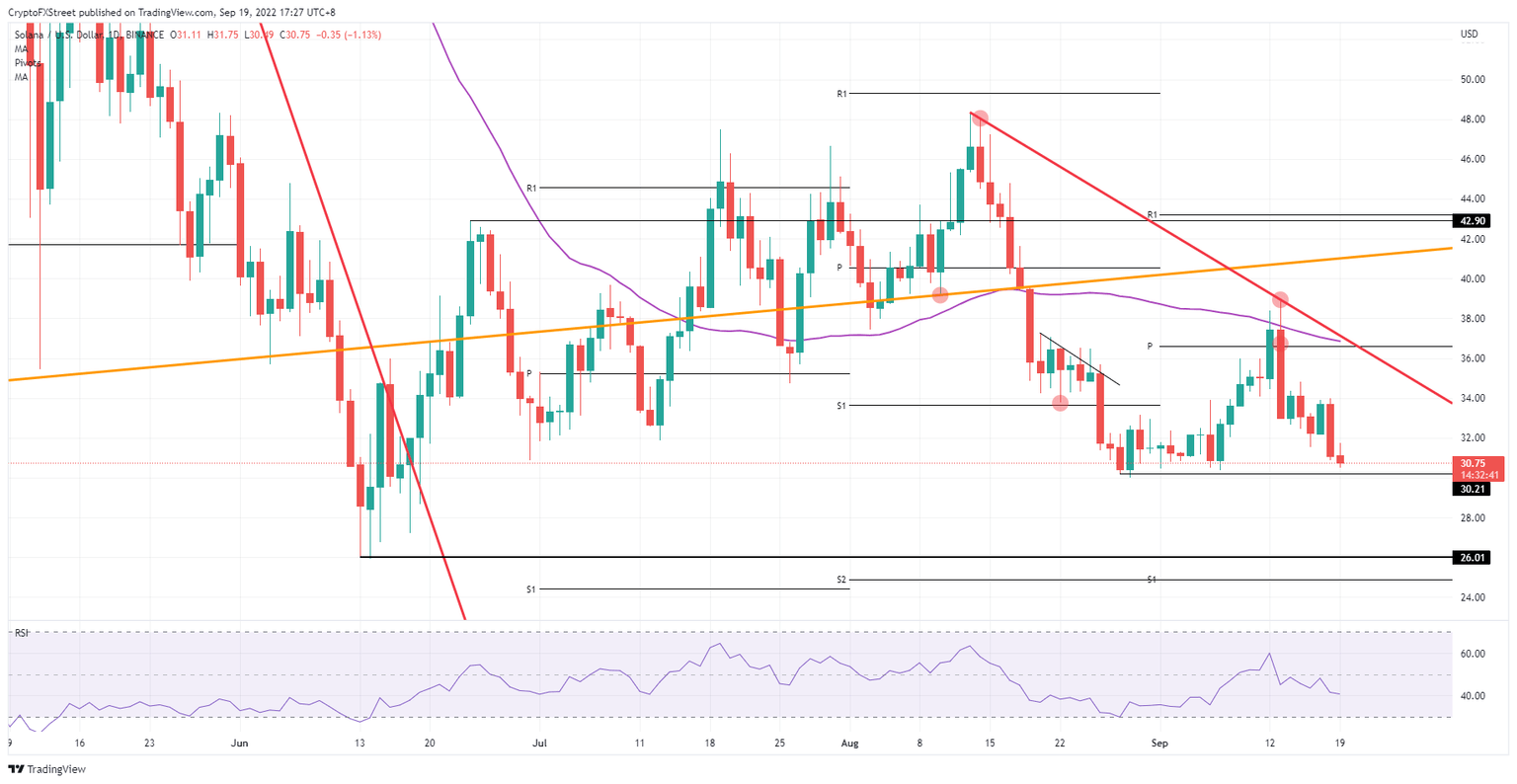

SOL price has got underpinned by the low of August near $30.21 and has been holding quite well these past few weeks. Once broken below, the Relative Strength Index still has plenty of room to trade lower. That would mean that another 13% of downside potential is at hand and could see SOL price trading at $26 by Wednesday or Thursday when the Fed and the BoE will have made their likely bullish policy statements.

SOL/USD Daily chart

As already mentioned, price action remains underpinned for now. Although in a bearish triangle formation, SOL price could still be set for a bounce back up towards $36, where the monthly pivot, the 55-day Simple Moving Average, and the red descending trend line all fall into place and form a unified cap over price action. SOL price would still rally roughly 20% despite being in a bear trend formation.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.