- Solana price stagnated around the $128 mark on Monday, despite multiple active bullish catalysts.

- Alameda research’s recent SOL unlocks ahead of FTX creditor repayments created a bearish overhang since start of March

- The falling wedge trading pattern hints SOL could retest the 50-day peak of $259 mark during the next rebound phase.

Solana (SOL) stagnated around the $128 mark on Monday despite multiple bullish catalysts. The recent SOL unlocks by Alameda Research, ahead of FTX creditor repayments, have created a persistent bearish overhang since early March.

Solana (SOL) stagnates below $130 despite fresh bullish catalysts

Since the beginning of March 2025, Solana has underperformed relative to rival layer-1 altcoins.

Key developments, including ETF filing advancements and Donald Trump’s inclusion of SOL in a crypto strategic reserve, have acted as bullish catalysts. However, while assets like XRP, Cardano, and Litecoin have rallied on similar news, Solana has struggled to gain upward momentum.

This trend continued on Monday as Solana remained trapped below the $130 resistance level, despite two major positive market events.

CME launches Solana Futures, yet price action remains subdued

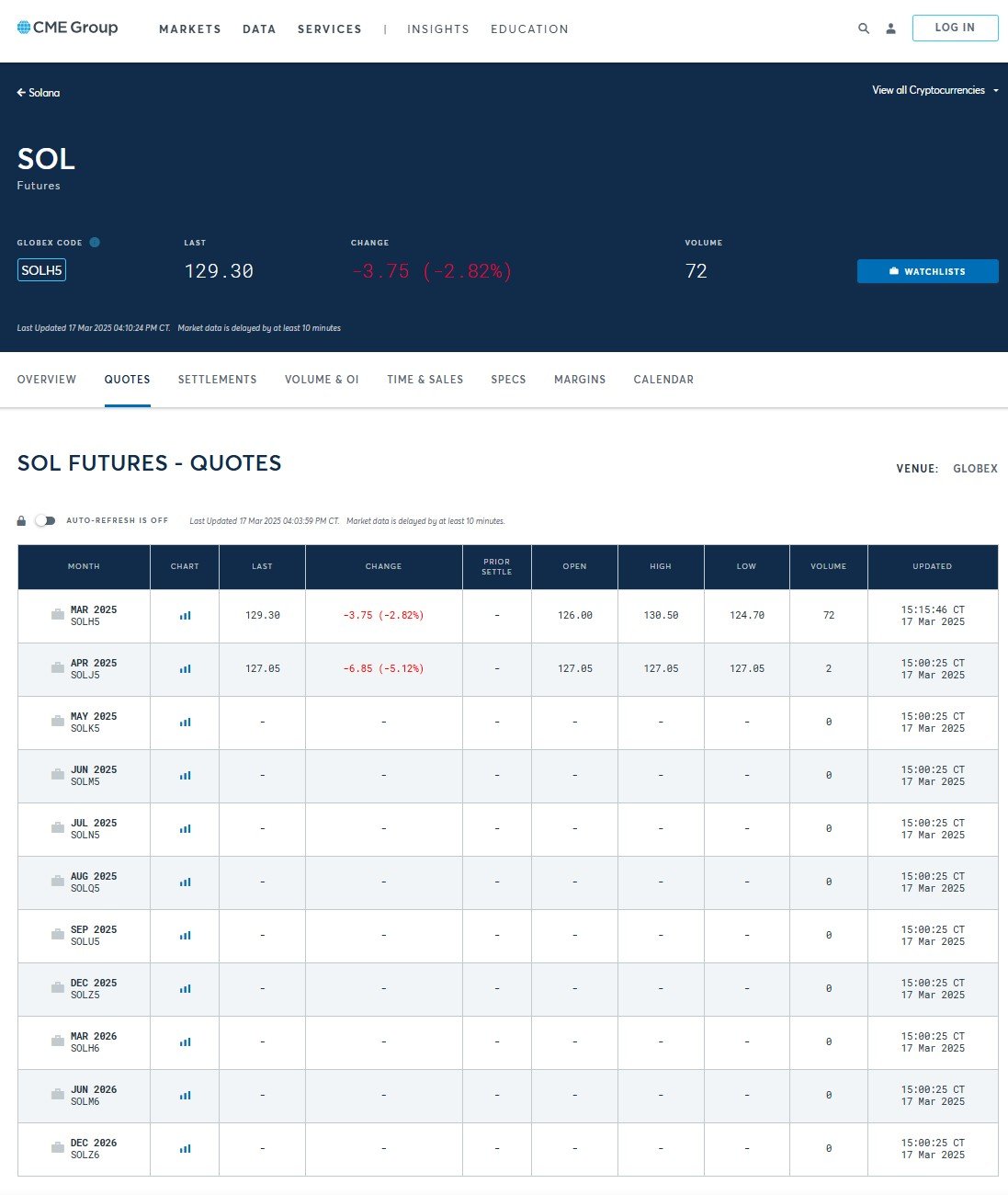

Following its announcement in February, the Chicago Mercantile Exchange (CME) officially launched Solana futures trading on Monday.

Trading volumes reached $5 million on the first day, reflecting growing institutional interest.

Solana futures, first day trading volumes hit $5 million | Source: CME Group

While this development boosted investor sentiment, it failed to generate immediate buying pressure, as SOL remained below the $130 resistance level.

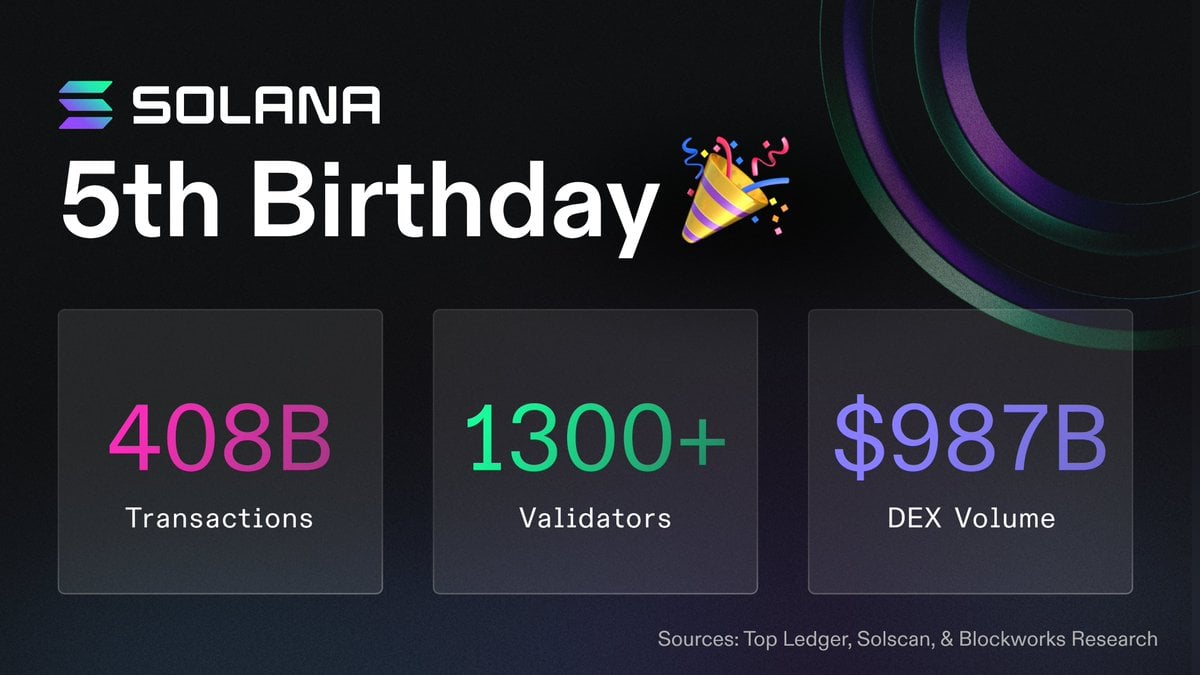

Solana’s fifth anniversary: A record-breaking milestone without market impact

In a second major positive catalyst this week, the Solana team celebrated the blockchain network’s fifth anniversary with a commemorative post on March 16, 2025.

Launched in March 2020 by founder Anatoly Yakovenko Solana, marks 5th anniversary with record-breaking stats.

Solana fifth anniversary stats, March 2025 | Source: X.com/Solana

According to the anniversary post on X, the Solana blockchain has processed over 408 billion transactions, secured by more than 1,300 validators, and facilitated a total volume exceeding $987 billion.

These figures affirm Solana’s position as one of the top 3 most valuable layer-1 blockchain, renowned for its speed and scalability.

Despite a series of planned ecosystem events to mark the occasion, Solana’s fifth anniversary failed to ignite a price rally on Monday, March 17. SOL traded sideways at around $128.

Why is SOL price stagnant despite major catalysts?

FTX estate outflows have created a persistent bearish overhang on Solana prices since the start of the month.

On March 1, 2025, the FTX estate and Alameda Research initiated the un-staking of 11.2 million SOL tokens, valued at approximately $1.5 billion.

By March 4, blockchain analytics firm Spot On Chain reported that 3.03 million SOL ($432.5 million) had been unstaked and distributed across 37 wallets, with 24,799 SOL ($3.38 million) already deposited on Binance.

This marked the largest single un-staking event since November 2023, when FTX first began liquidating assets post-bankruptcy.

Since then, a total of 7.83 million SOL has been unstaked, leaving an estimated 5.5 million SOL ($693.8 million at $126 per SOL) still locked in staking reserves, according to Arkham Intelligence.

SOL Price Forecast: Falling Wedge pattern hints at $259 breakout after prolong consolidation

With further sell-offs expected from the FTX estate’s liquidations, new buyers remain hesitant to accumulate SOL at current levels, contributing to the ongoing price stagnation.

However, on the positive side, strategic bull traders could hold SOL as prolonged consolidations often precedes major price breakout phases.

Technical indicators on the SOLUSD daily chart also offer data-driven insights supporting this optimistic long-term outlook on Solana price action.

First the SMA death cross, where the 50-day moving average has fallen below the 200-day moving average, which confirms the lingering bearish momentum caused by FTX estate month-long sell-offs.

Solana price forecast | SOLUSDT

Solana price forecast | SOLUSDT

Historically, such crosses confirm sustained downtrends, but they can also indicate oversold conditions when paired with strong reversal patterns.

In this case, the Falling Wedge pattern hints at a near-term breakout for Solana price as sell-side pressure diminishes.

Supporting this outlook, the MACD histogram is showing early signs of bullish divergence, with green bars indicating a potential momentum shift.

If the MACD signal line crosses above the baseline, it could confirm a buy signal, aligning with past cycles where similar conditions led to sharp price recoveries.

However, failure to break out above the $130-$140 resistance zone could result in extended consolidation or a retest of lower support levels near $115-$120 before an uptrend resumes.

A successful breakout from the Falling Wedge would set SOL on a trajectory toward $169-$190, aligning with the 50-day resistance zone, before potentially surging to $259, a level last seen in January 2025.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.