Solana price eyes a return to $120 as confidence in SOL fades

- Solana price faces continued selling pressure against critical support zones.

- Fundamentally, Solana’s network concerns have grown, and confidence has waned.

- Increasingly likely that a test of $120 is coming up.

Solana price continues to face some strong technically and fundamentally bearish scenarios. In addition, concerns about Solana’s network stability and scalability remain. Those concerns continue to weigh in on the bearish price action ahead.

Solana price may drop to $120, a support zone it must hold, or a significant flash-crash could be coming

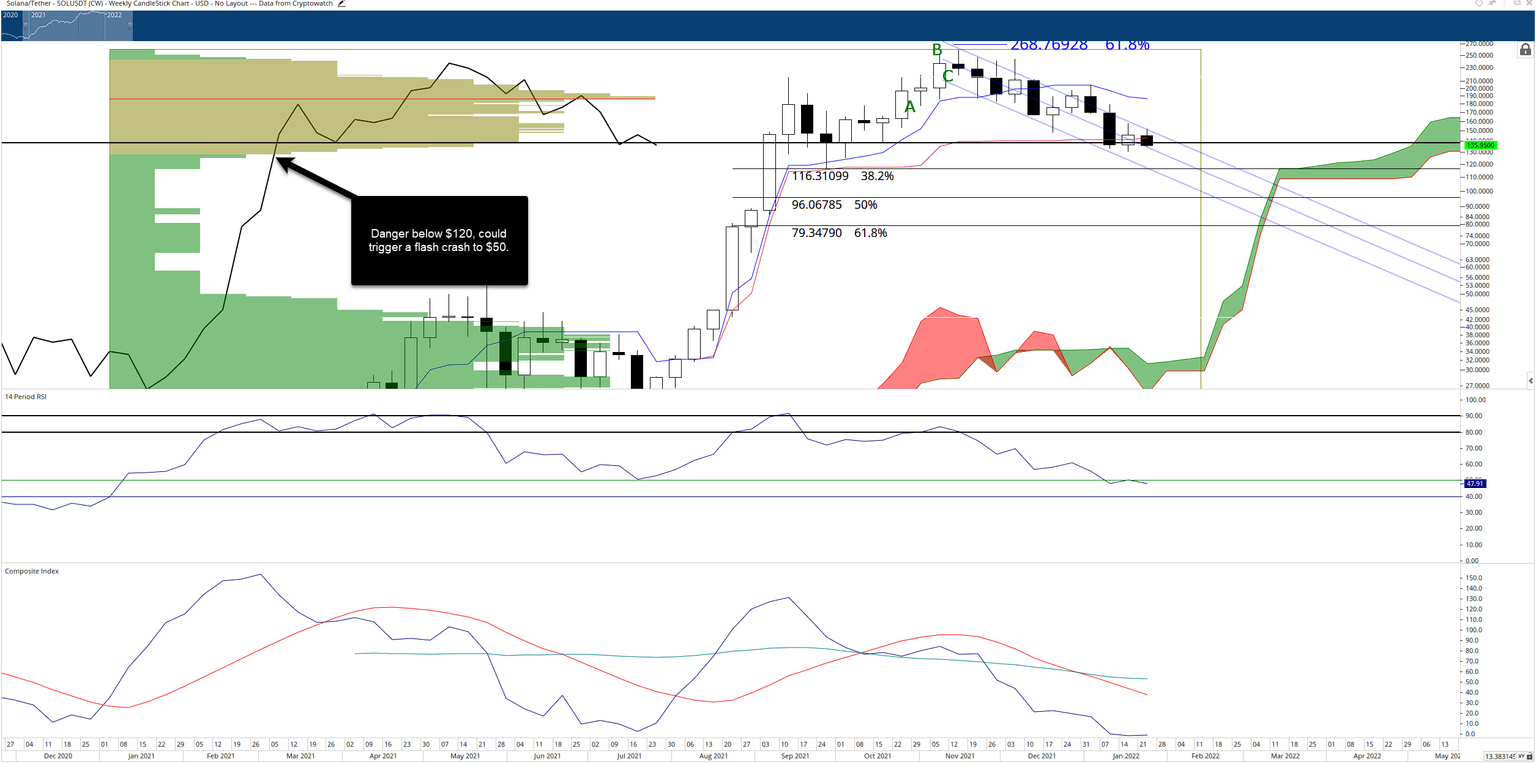

Solana price has one final support zone ahead that can keep SOL above water. The bottom of the bull flag/linear regression channel and the 38.2% Fibonacci retracement level share the support zone near $120.

The oscillators indicate some support should be expected between $120 and the present value area ($135). Mostly because of the Composite Index sitting at new all-time lows. The Relative Strength Index oscillator remains in bull market territory but is trading just below the first oversold level at 50 but above the second oversold level at 40.

It can not be overstated how vital it is to maintain the $120 value area for Solana. The volume profile between $120 and $50 is extremely thin to non-existent in some areas. Fragile areas in the volume profile act as a vacuum – when price action moves away from a high volume node and into a thing volume node, price gets ‘sucked’ through to the next high volume node.

SOL/USDT Weekly Ichimoku Kinko Hyo Chart

For Solana price, that means a drop below $120 could easily trigger a flash-crash towards the $50 value area – the next high volume node. Therefore, to invalidate and alleviate any current bearish outlook, SOL bulls will need to push for a weekly close above the Kijun-Sen at $144 or higher.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.