Solana price eyes $70 as founder Anatoly Yakovenko bins narrative that SOL is an Ethereum killer

- Solana founder Anatoly Yakovenko has binned the narrative that SOL is an Ethereum killer.

- He says that while the theory became loud during the past cycle, it should not be used in the coming one.

- According to the Solana executives, it is okay for the two technologies to have overlapping features and compete.

- Solana price continues to eye the $70.00 psychological mark, trading for $63.58 with prospects for more gains.

Solana founder Anatoly Yakovenko envisions a future where SOL and Ether (ETH) co-exist, urging that the whole narrative of one ecosystem kills the other be binned.

Also Read: Solana price nears $60 after 6% rise in a day as institutions pour millions into SOL

Solana founder wants SOL vs ETH cold war binned

Solana (SOL) founder Anatoly Yakovenko has urged his followers not to bring back the narrative that played during the past cycle, putting SOL against Ethereum (ETH), saying, “It is lame.” The Solana executive envisions a future where the two ecosystems can coexist, leveraging their overlapping features to compete.

Don’t bring back last cycle “eth killer” bs. It’s lame. Pareto efficient technologies can have overlapping features and will compete, but that’s all ok. I don’t see a future where solana thrives and somehow eth dies. I am such a techno optimist that I am certain that…

— toly (@aeyakovenko) December 2, 2023

The outburst comes after Rune Christensen, MakerDAO co-founder and CEO revealed plans to remove the protocol’s NewChain from Ethereum and fork it on the Solana blockchain. While his intentions may have been harmless, the community received it as a battle of the best between Solana and Ethereum. To Yakovenko, however, this battle can only be detrimental to the ecosystem.

Discrediting the perception that “Solana thrives and somehow Ethereum dies,” Yakovenko demonstrates optimism in Danksharding being able to have adequate bandwidth to contain the entire expanse of Solana data.

Notably, Danksharding is a technology that enables blockchain technology to add cheaper blocks. It is an Ethereum rollup scaling method that expands transactional throughput by increasing storage space for roll-up transactions.

Not the first time

This is not the first time Yakovenko is attempting to quell the Solana versus Ethereum feud. In an October citing, jebus.eth, an Ethereum community member took shots at Solana, likening it to the Democrat Party of crypto. He called it a “Coalition of poors and wealthy people,” who lack an understanding of value and its source, adding that it was a group of people who prioritized cheap over value.

Sol is like the dem party of crypto

— Jebus.eth (@jebus911) October 1, 2023

Coallition of poors and wealthy ppl who don't understand where value actually comes from or how to create it, just that the things I want should be cheap

In response, Yakovenko defended, “In the grand theatre of economic transformation, Ethereum presents itself not as a harbinger of genuine revolution, but merely as a novel spectacle of bourgeois upheaval.”

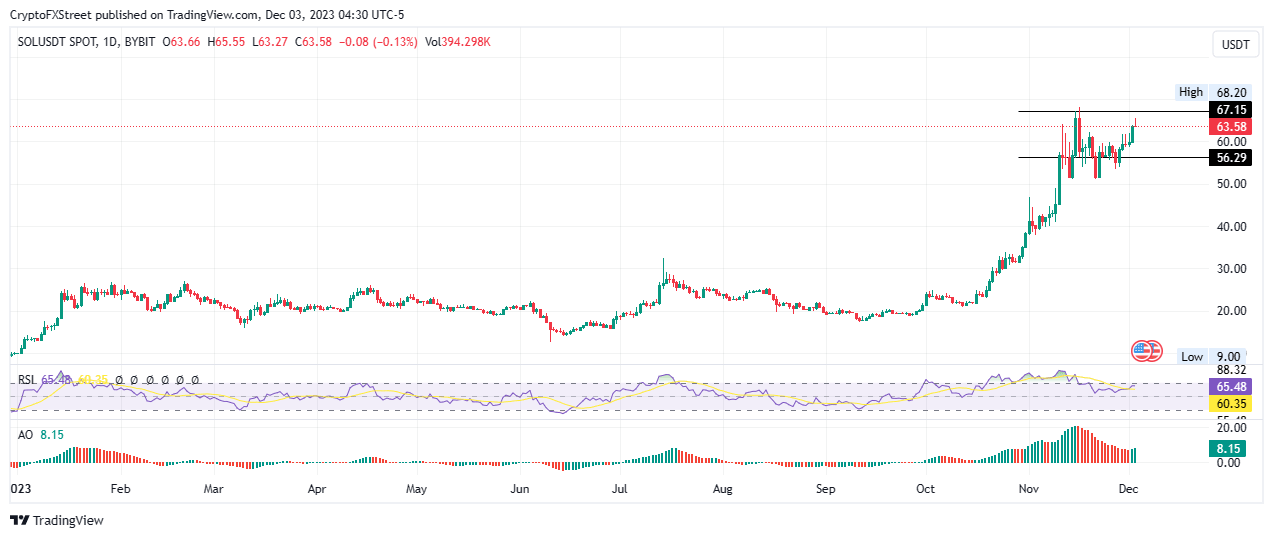

Meanwhile, Solana price remains committed to the north, boasting a 2% surge on the day, accompanied by an 11% climb in trading volume. The parity between price and trading volume points to strong interest in the asset by buyers. It also points to higher liquidity, better order execution, and a more active market for connecting a buyer and seller.

At the time of writing, the cryptocurrency is trading for $63.58, with eyes peeled on the $70.00 mark amid rising momentum and the presence of bulls in the SOL market. This is indicated by the northbound RSI and the green histogram bars of the Awesome Oscillator (AO) in the positive territory.

SOL/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.