Solana price can tag $135 if SOL bulls find support

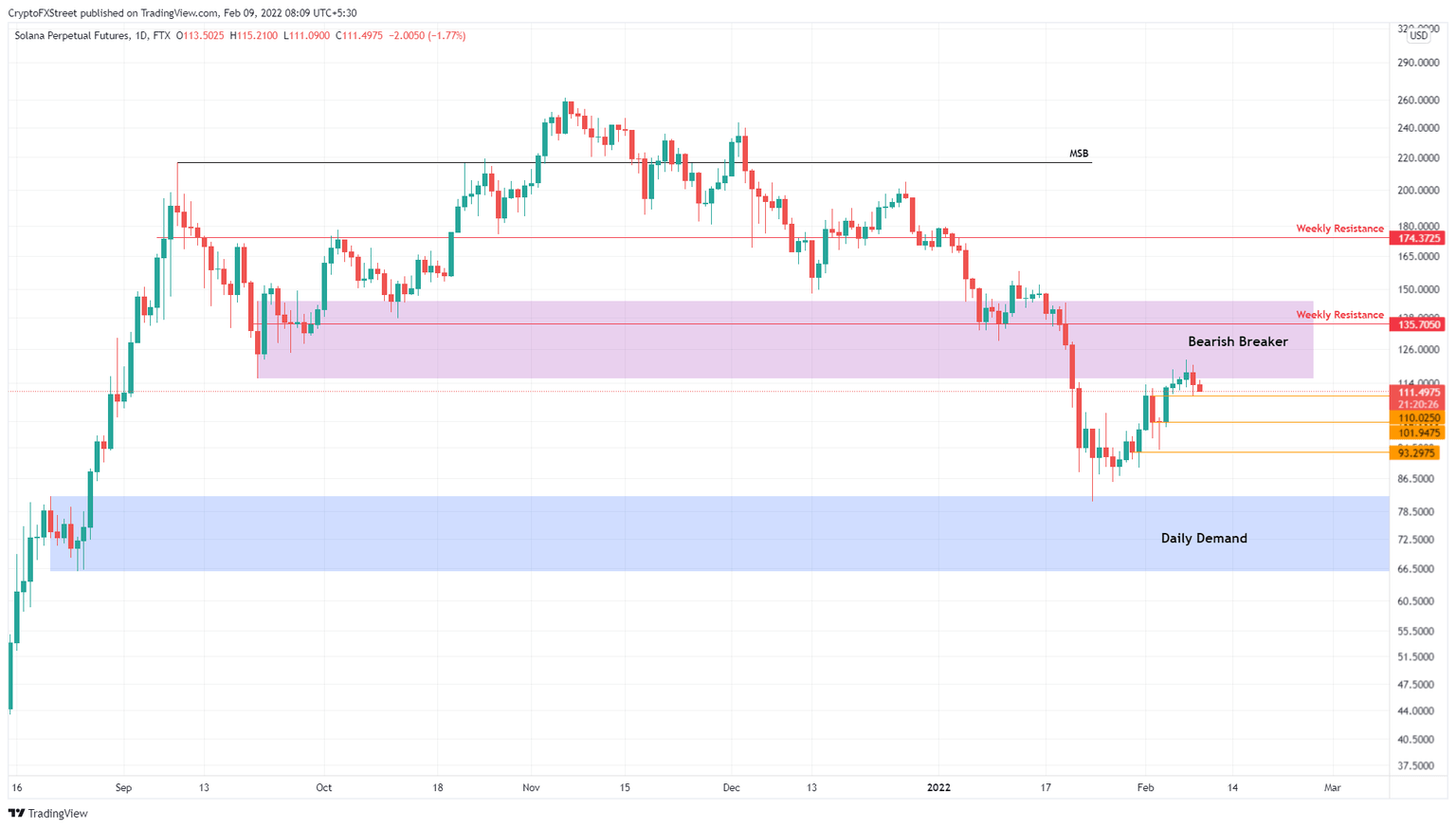

- Solana price retraced 11% after encountering the bearish breaker, extending from $115.51 to $144.70.

- The resulting retracement found support at $110.03, hinting at a reversal rally.

- A breakdown of the $93.30 barrier will invalidate the bullish thesis for SOL.

Solana price saw a slow reversal of the overall downtrend after retesting a crucial support level. Nonetheless, the uptrend was impressive but was stopped due to a stiff resistance barrier, leading to a pullback. SOL bulls seem to have made a comeback and suggest that a new uptrend seems likely.

Solana price to restart its ascent

Solana price retraced roughly 11% after tagging the $115.51 to $144.70 bearish breaker for the second time. This downswing found support at the $110.03 barrier and is currently establishing a directional bias.

A resurgence of buyers will likely result in a bounce off the said foothold leading to an uptrend into the breaker. This time around, investors can expect Solana price to pierce through and retest the weekly resistance barrier at $135.71.

In total, this run-up would constitute a 23% ascent from $110.03 and is likely where the upside for Solana price is capped. A move beyond this barrier will require additional buying pressure or a retracement that resets the bullish momentum.

SOL/USDT 1-day chart

While the $110.03 support level seems to be holding the downswing steady, a breakdown could lead to a retest of the $101.95 barrier. This down move will give the bulls another chance at a comeback. Failure to pull a 180 will likely suggest a weakness among buyers.

If Solana price produces a daily candlestick close below $93.30, it will invalidate the bullish thesis and open the possibility of creating a lower low. In this situation, SOL could gain by revisiting the daily demand zone, extending from $65.91 to $81.90.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.