Solana price breaches multi-month bullish pattern, forecasts $40 SOL

- Solana price has successfully breached the neckline of an inverse head-and-shoulders, kick-starting an uptrend.

- This technical formation forecasts a 70% move to $37.21 for SOL, but depending on the momentum, it could retest the $38.92 hurdle.

- Invalidation of the optimistic outlook will occur on the flip of the $18.66 support level.

Solana price successfully breached a multi-month pattern on April 11 – and has not looked back since. With Bitcoin also exhibiting a bullish outlook, SOL holders are in for a treat.

Also read: This Solana price consolidation foreshadows 70% bullish breakout

Solana price and its explosive start

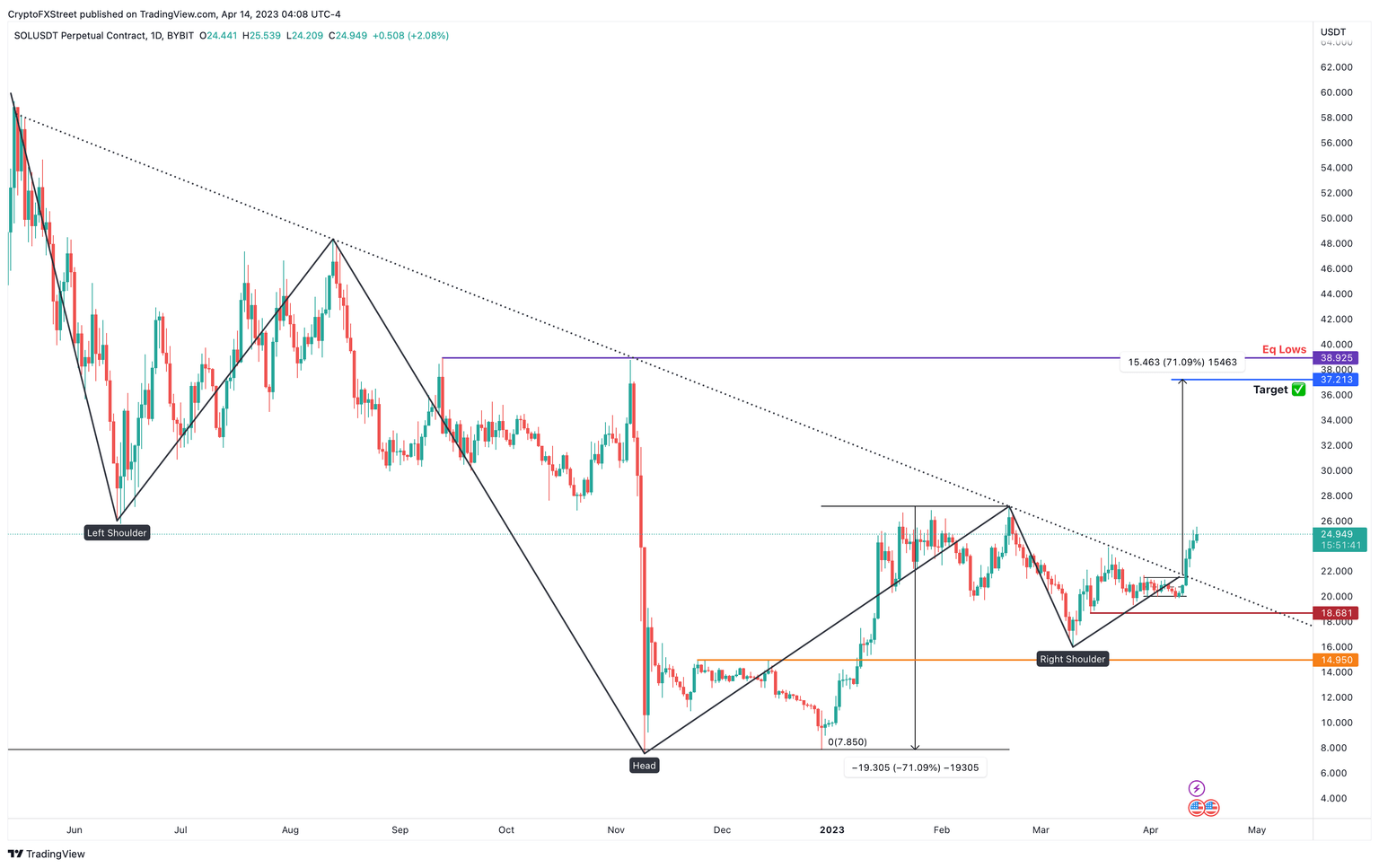

Solana price action between May 15, 2022, and April 11, 2023, set up a bottom reversal pattern known as an inverse head-and-shoulders. This technical formation contains three distinctive swing lows. The central trough is named the head and is lower than the other two troughs, which are referred to as shoulders. Hence the namesake inverse head-and-shoulders. In this case, a declining trendline connects the peaks of these swing lows, known as a neckline and serves as a confirmation level.

On April 11, Solana price produced a daily candlestick close above this neckline, confirming a breakout. The inverse head-and-shoulder technical formation forecasts a 71.09% upswing to $37.21, obtained by adding the distance between the right shoulder’s peak and the head’s lowest point.

If the bullish momentum holds up after reaching the theoretical target at $37.21, SOL could extend higher and tag the $38.92 blockade.

SOL/USDT 3-day chart

While the optimism around Solana price is warranted, investors need to pay close attention to Bitcoin pierce, which has set up an elaborate bearish divergence. A sudden collapse in BTC could ruin the altcoin party for SOL.

An invalidation of Solana price’s bullish outlook would happen on a breakdown of the $18.66 support level which will skew the odds in the bears’ favor. Such a move could see Solana price slide down to the $14.95 barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.