Solana price breaches key weekly resistance, SOL gains are likely sustainable

- Solana price rallied past the weekly resistance at $76, eyeing the $80 target for the altcoin.

- SOL price gains are likely sustainable as the asset’s on-chain metrics support a bullish outlook.

- Solana yielded nearly 27% weekly gains for SOL holders.

Solana accompanied other altcoins as they rallied alongside Bitcoin and yielded double-digit weekly gains for holders. SOL holders gained 27% in the past week as the asset rallied past its weekly resistance.

Also read: Cardano, Solana and Algorand see one of the highest social dominance days in 2023

Solana TVL hits highest level in 2023

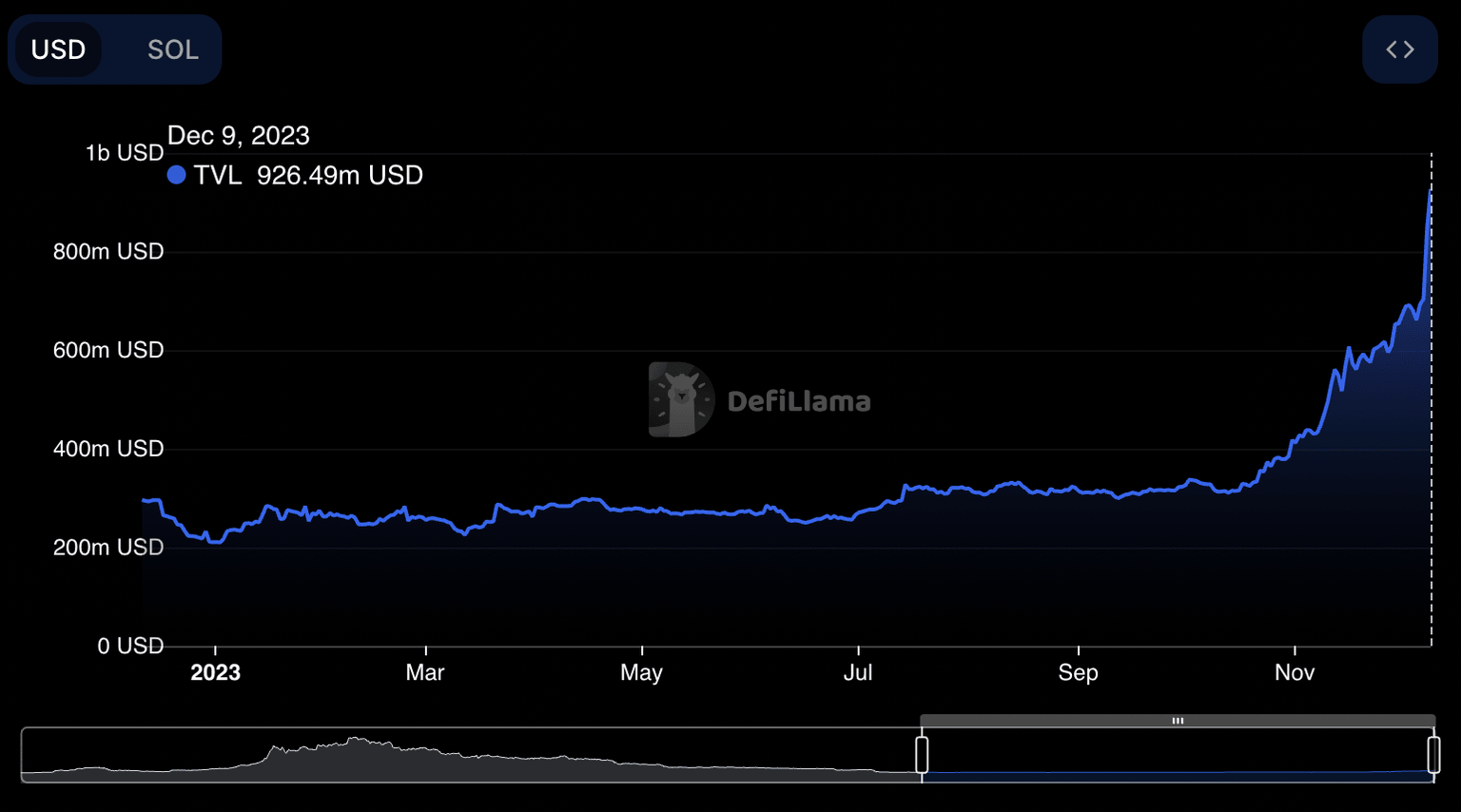

The Total Value Locked (TVL) in the Solana blockchain hit its highest level in 2023. According to data from crypto intelligence tracker DeFiLlama, $926.49 million in assets are locked in the Solana blockchain. This is the highest level of TVL seen since the beginning of 2023.

Rise in TVL is indicative of higher adoption and utility of Solana among traders in the crypto market. It boosts the security of the Solana network.

Solana TVL hits highest point in 2023 Source: DeFiLlama

Bullish on-chain metrics support SOL gains

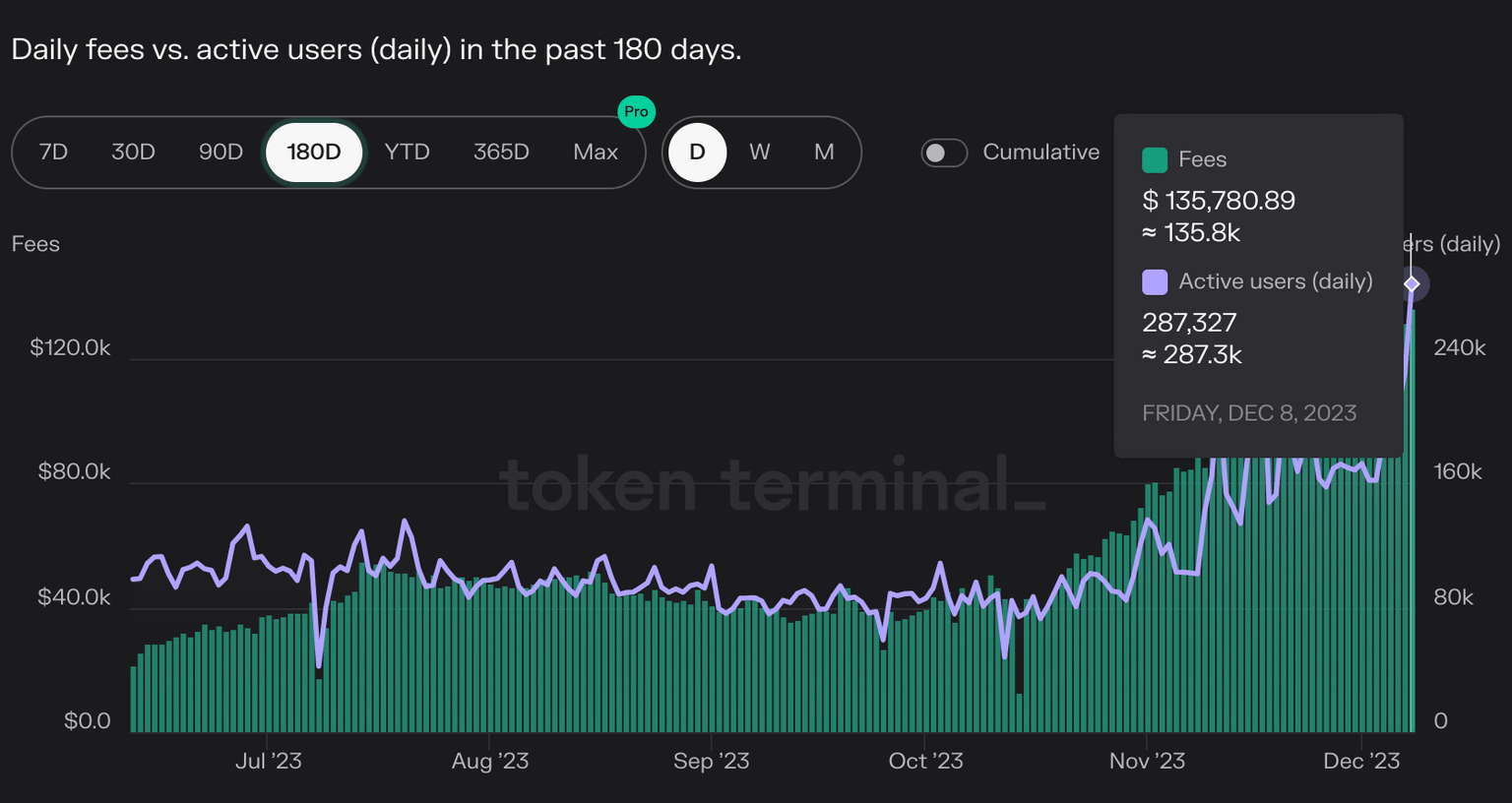

The count of Daily Active Users (DAU) in the Solana blockchain has hit its highest level in six months, according to Token Terminal. Solana DAU now climbed to 287,327 on December 9.

Daily active users in the past six months Source: Token Terminal

Solana price rallied past the weekly resistance at $76. The altcoin is trading at $76.40 on Binance after printing 2.15% daily gains. SOL holders noted 28% weekly gains on Binance.

The social dominance of the altcoin is on the rise as market participants rotate capital among top cryptocurrencies. Social dominance, as seen on Santiment, climbed to a level previously seen on November 2, 2023. This supports a bullish thesis for SOL price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.