Solana price approaches launching pad that could propel SOL by 40%

- Solana price rejection at the bearish breaker resulted in a 27% crash.

- Investors can expect SOL to bounce off the $65.91 to $81.99 demand zone and rally 41%.

- A daily candlestick close below $65.91 will invalidate the bullish thesis.

Solana price faced a solid rejection on February 7 as it pierced a crucial resistance area, leading to a massive correction. The resulting move breached multiple support levels and is currently approaching a stable demand zone, signaling a potential for reversal.

Solana price gathers steam

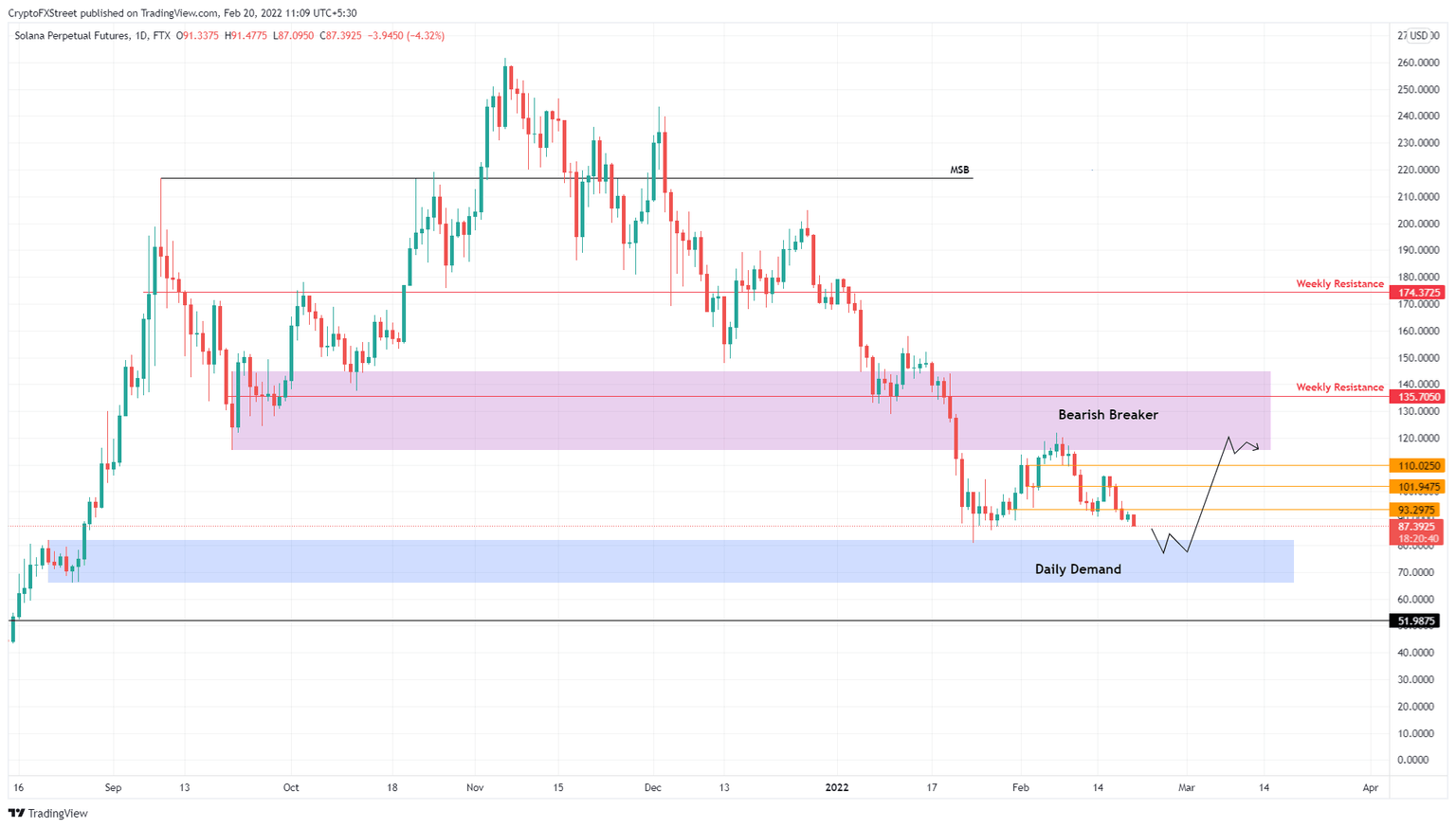

Solana price is currently approaching the $65.91 to $81.99 demand zone after getting rejected at the daily breaker on February 7. The breaker, extending from $115.51 to $144.70, was a pivotal point that led to a 27% correction.

Going forward, investors can expect Solana price to drop another 7% to tag the aforementioned demand zone. Doing so will be the key to triggering a bounce that pushes SOL on an uptrend. This bullish move will likely slice through the $93.29, $101.94 and $110.02 resistance barriers and attempt to slice through the breaker.

From a conservative standpoint, an upswing from $81.99 to $115.51 would represent a 41% ascent. However, if bid orders continue to pile up, SOL could make a run for the weekly resistance barrier at $135.71, indicating a 65% gain.

SOL/USDT 4-hour chart

As bullish as Solana price looks, an increase in selling pressure that pushes it produces a daily candlestick close below $65.91 will create a lower low and skew the odds in the bears’ favor, invalidating the bullish thesis.

In a highly bearish case, this move could be a precursor to SOL revisiting the $51.98 support level, signaling a 22% crash.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.