- Solana price breaks below the 200-day SMA but looks ready to be picked up by bulls.

- SOL’s RSI sees bullish knee-jerk reaction as bears book gains.

- As markets try to hold on to the week’s gains, expect tailwinds to lift sentiment, attracting more to the rally.

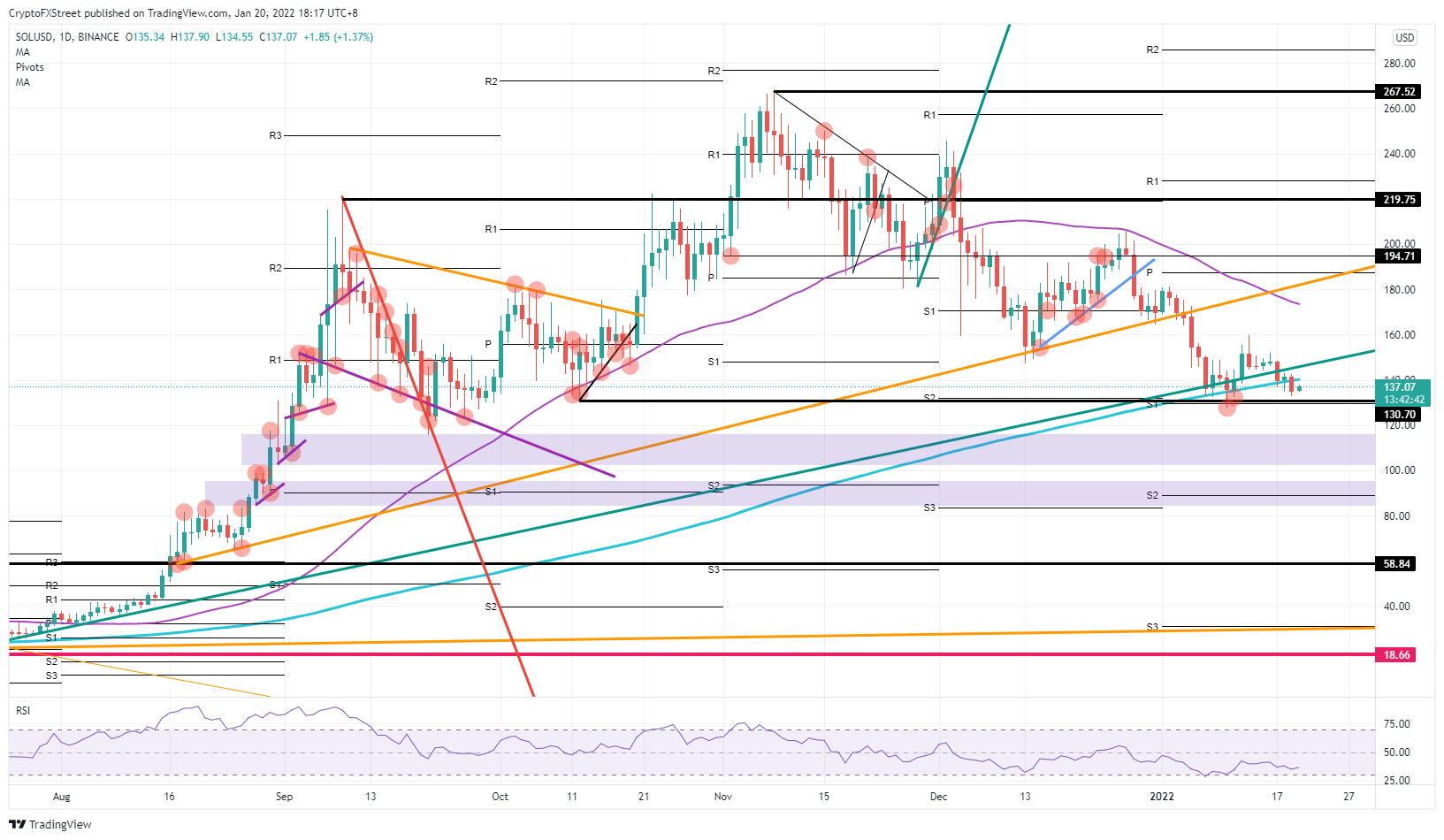

Solana (SOL) price action has been fading towards $131 after being rejected at $160, with bulls unable to make new highs. The recent break of the 200-day Simple Moving Average (SMA) looks to have been picked up by investors. A window of entry exists below the 200-day SMA, the double support at $130.70 with the low of October, and the monthly S1 support pivot, which all are seen falling in line with each other. This area creates a perfect entry point for bulls with stop losses tucked away below the $130.70 level and an upside target at at least $200 medium-term.

Solana bulls gear up for $200 medium-term price target

Solana price made a slight dead cat bounce at $130.70 last week after being rejected at $160. With the break below the green ascending trend line and the 200-day SMA, a window of opportunity is now offering itself, with the double barrier as support at $130.70. That bulls and investors are stepping on the SOL-train shows itself in the Relative Strength Index (RSI) with a bit of nudge to the upside, away from the oversold barrier.

This way, SOL investors are prepositioning for an uptrend as global markets are trying to shake off the negative sentiment from this week. Expect a return above the green ascending trend line if investors sit on their hands and do not fold preemptively. That would signal to sidelined bulls to engage as momentum is there for another uptick towards $160. Beyond that, they ought to cover ground towards $195 where SOL could break out of the downtrend entirely and add the 55-day SMA and the monthly pivot as supporting elements to their bullish arsenal.

SOL/USD daily chart

The risk to the downside for SOL is from bulls waiting too long for an entry and wanting to buy too close to the $130.70 level. That could stem a break and make investors hesitant of entering, giving bears a free ticket to push price-action towards $120. With that, bulls and investors would want to wait for the next best entry, which is only at $58.84, miles away, and the S2 at $89 as a more intermediate anchor for an entry.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.