Solana’s SOL neared $100 early Friday as ongoing hype for the blockchain’s speedy transactions, cheap fees and a lottery of meme coin issuances extended into its third week.

Metrics show Solana has possibly been the strongest draw among on-chain traders, with trading volumes and network fees crossing those of Ethereum – which is usually the highest – on a seven-day rolling basis.

Value locked on Solana applications grew in tandem, rising to $1.3 billion worth of tokens from the $400 million mark in November to reach levels previously seen in July 2022.

These factors have apparently helped extend year-to-date gains for SOL to over 830%, with most growth in the past two months alone. The buying pressure has sustained even amid significant selling pressure from the bankruptcy estate of crypto exchange FTX, which held billions of dollars worth of SOL. The token was trading around $94 during the European morning, according to CoinDesk Indices data.

Dog-themed bonk (BONK) apparently revived attention with a more than 1,000% jump in late November. That inspired a flurry of meme coins, such as dogwifhat (WIF), which yielded some early retail buyers with gains of over 10,000% in a short period.

WIF added another 35% to market capitalization in the past 24 hours alone, showing no signs of stoppage amid significant hype in crypto circles on X.

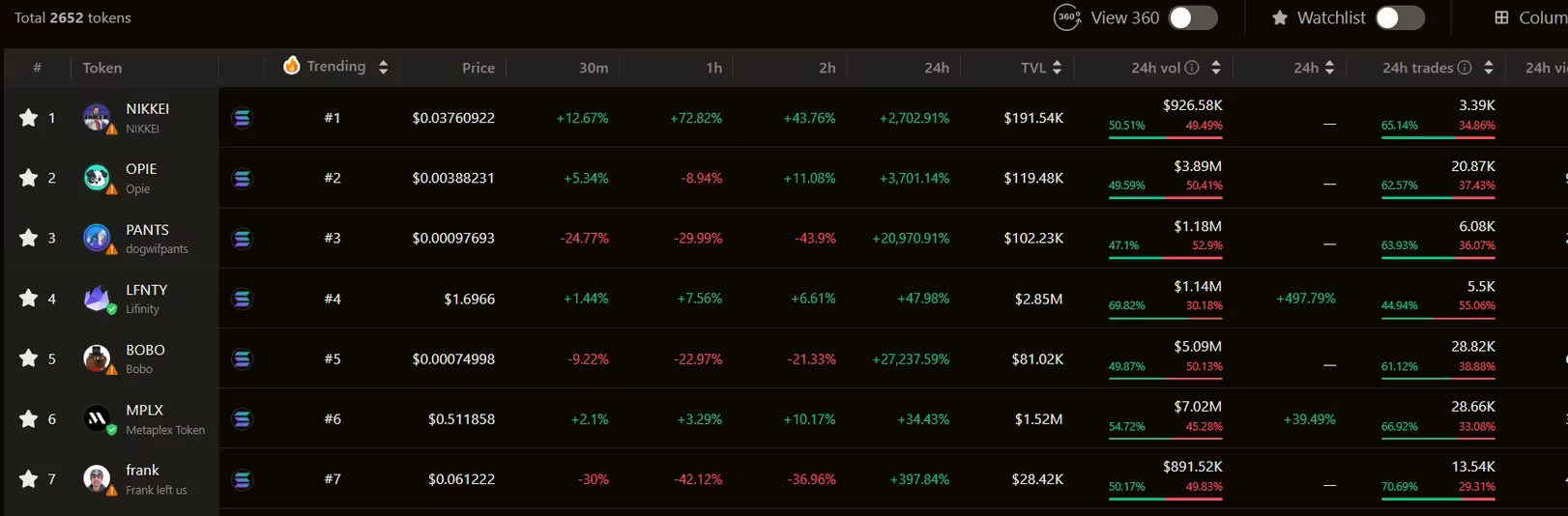

Data shows thousands of meme coins have since been issued by opportunistic developers. Most of these run up from a very low market capitalization to a few million.

Solana-based meme coins issued in the past 24 hours. (Birdeye)

Meanwhile, some analysts expect SOL’s outperformance to continue in the weeks ahead, pointing to the possible interest from retail investors as a driver of token growth.

“Solana is recovering more steadily than most major competitors and shows more interest in it in the community, which promises to keep its performance above the market in the coming months,”

“Google searches on Solana have soared 250% in the past two months,” shared Alex Kuptsikevich, FxPro senior market analyst, in a Friday note to CoinDesk. “User interest has coincided with the explosive growth of the asset and rising prices of related meme coins.”

“The Solana blockchain continues to grow strongly with the background of new protocols and related airdrops,” Kuptsikevich added, referring to the BONK, ACS and JTO airdrops to Solana users in the past weeks.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

Tether expands reach with Juventus acquisition and new Bitcoin-native public company launch

Tether announced on Thursday that it had acquired additional shares in Juventus Football Club, bringing its total stake to over 10.12% and representing 6.18% of voting rights. Tether, Bitfinex, SoftBank & Jack Mallers also launch Twenty-One, the first Bitcoin-native public company.

Ethereum Price Forecast: Accumulation addresses grab 1.11 million ETH as bullish momentum rises

Ethereum (ETH) saw a 1% decline on Friday as sellers dominated exchange activity in the past 24 hours. Despite the recent selling, increased inflows into accumulation addresses and declining net taker volume show a gradual return of bullish momentum.

Stacks price eyes $1 amid growing interest in Bitcoin layer-2 protocols' DeFi ecosystems

Stacks (STX) price rises, hitting a new weekly high at $0.90 during the Asian session on Friday. The Bitcoin layer-2 protocol shows bullish resilience, trading at $0.88 at the time of writing, reflecting growing institutional interest in the decentralized finance (DeFi) ecosystem.

Bitcoin's surge to $94,000 shows a mix of macro optimism and shifting investor sentiment: Glassnode

Bitcoin (BTC) traded above $93,000 on Thursday as rumors of US-China tariff easing stirred a rebound in price, sending the percentage of supply in profit at current price levels to 87.3%, 5% above 82.7% recorded in March, according to Glassnode data.

Bitcoin Weekly Forecast: BTC holds steady, Fed warns of tariffs’ impact, as Gold hits new highs

Bitcoin price consolidates above $84,000 on Friday, a short-term support that has gained significance this week. The world's largest cryptocurrency by market capitalization continued to weather storms caused by US President Donald Trump's incessant trade war with China after pausing reciprocal tariffs for 90 days on April 9 for other countries.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.