Solana meme coin SILLY price eyes nearly 40% gain after key bullish developments

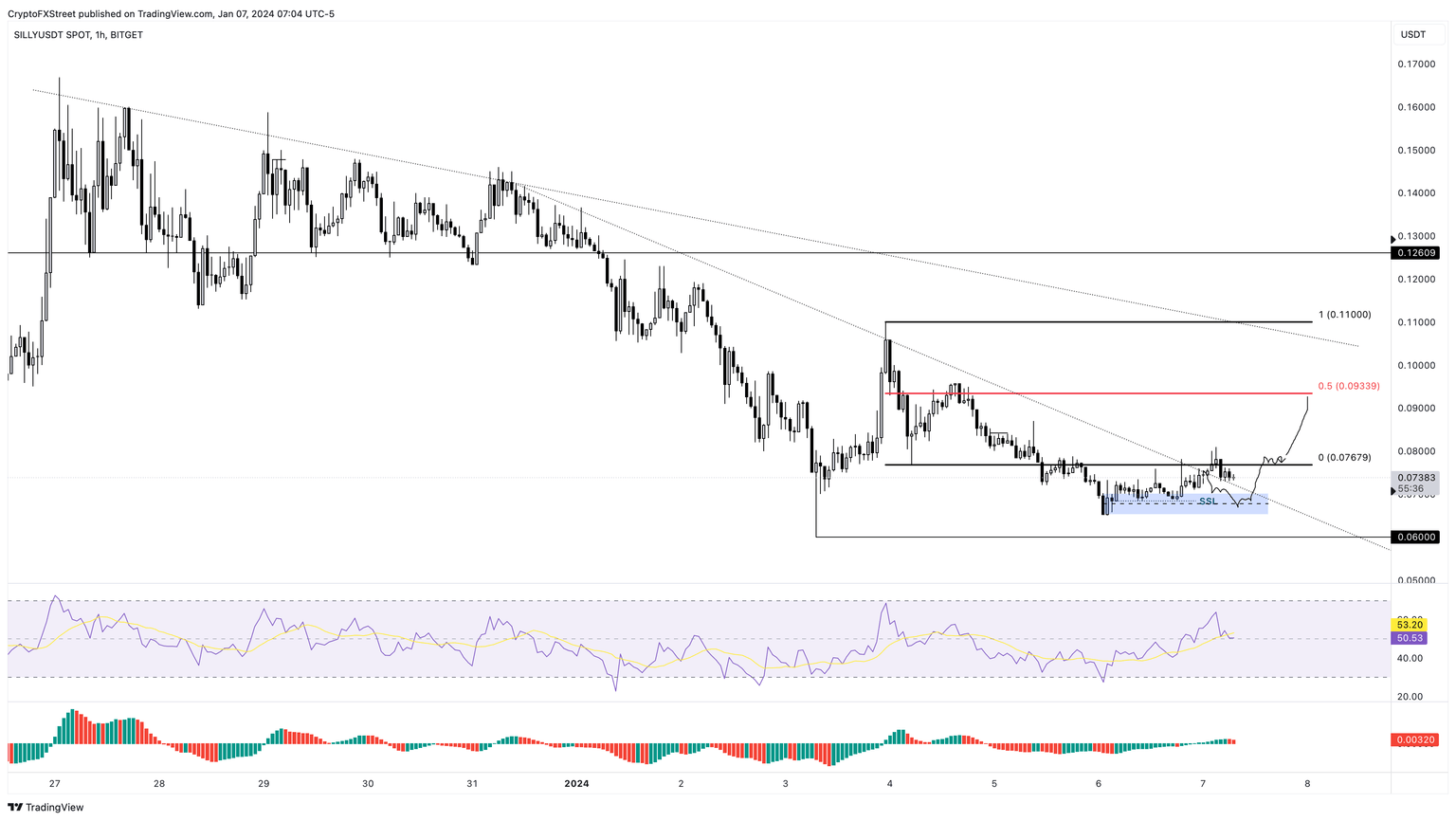

- Silly Dragon price is attempting to recover inside the $0.0676 to $0.11 range.

- A successful flip of the range low into the support floor could propel the altcoin to the range’s midpoint at $0.0933.

- SILLY could also sweep of the range high at $0.11 in a highly bullish case.

- A flip of the $0.0653 level into a resistance barrier will invalidate the optimistic outlook.

Silly Dragon (SILLY) price is close to producing a breakout that could kickstart a trend reversal and a double-digit recovery rally. The Solana-based meme coin could provide handsome gains to patient investors.

Also read: This ‘SILLY’ Solana meme coin is making records after Bonk, rallying by 160% in a week

SILLY price likely to trigger a breakout

SILLY price has been on a downtrend since December 27, 2023, shedding roughly 64% of its market value. But the recent move has created a range, extending from $0.0676 to $0.11, which indicates that a bottom could be near.

After producing a swing low at $0.0653 on January 6, SILLY price has produced a higher low and higher high, indicating a shift in market structure. This move is the second sign that sidelined buyers are starting to bid.

If SILLY price reclaims the range low at $0.0676, it will be indicative of a trend reversal and a potential bounce. In such a case, investors can bet on a mean reversion play that propels the Solana-based meme coin Silly Dragon to retest $0.0933. This move would constitute a nearly 40% gain from the current level of $0.0736.

A sustained momentum here, coupled with new capital entering the ecosystem, could see SILLY price retest the range high at $0.11.

Also read: Avalanche-based meme coins rally by 200% as the Foundation announces its plan to accumulate them

SILLY/USDT 1-hour chart

On the other hand, if SILLY price gets rejected from the range low of $0.0676, it could fall back to the $0.0653 to $0.0702 demand zone. If this support zone is flipped into a resistance zone, it will invalidate the bullish thesis.

If the selling momentum persists, SILLY price could crash 8% and revisit the next key level of $0.060.

Also read: Solana nears $100 as meme coin frenzy continues to drive rally

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.