Solana leapfrogs Ethereum on DEX volume

-

Solana-based decentralized exchanges have been busier than their Ethereum counterparts over the past seven days.

-

The meme coin frenzy seems to have catalyzed higher volumes on Solana.

-

Solana also boasts of higher capital efficiency than Ethereum and other chains, according to one research firm.

Solana has replaced Ethereum as the No. 1 smart-contract blockchain by trading volume.

Trading volume in Solana-based decentralized exchanges (DEX) has increased 67% to $21.3 billion in seven days, data tracked by DeFiLlama show. Volume in Ethereum-based decentralized exchanges rose 3% to $19.4 billion over the same period. There are 17 DEXes on Solana. Orca, the largest, accounts for 88% of the total volume. On Ethereum, Uniswap leads the pack of 46 DEXes.

The so-called flippening seems to have been catalyzed by speculative fervor in Solana-based meme coins dogwifwhat, bonk, book of meme, and slerf.

At press time, the top trending tokens for the past 24 hours on the DEX Screener were from Solana. Such has been the speculative frenzy that 2,300 meme coins came into existence in a single hour on March 13 and the supply of stablecoins on Solana hit a multiyear high of $2.80 billion.

In the last 1 hour, 2,500 Solana memecoins were created.

— Ram Ahluwalia CFA, Lumida (@ramahluwalia) March 13, 2024

According to Reflexivity Research, the surge in Solana's volume began in fourth-quarter 2023 as a result of the proliferation of points programs and airdrops like the Solana DEX Jupiter.

Solana also boasts a higher capital efficiency than Ethereum and other smart-contract blockchains. In other words, the blockchain can support higher trading volumes with a lower dollar value of assets locked in its DeFi ecosystem.

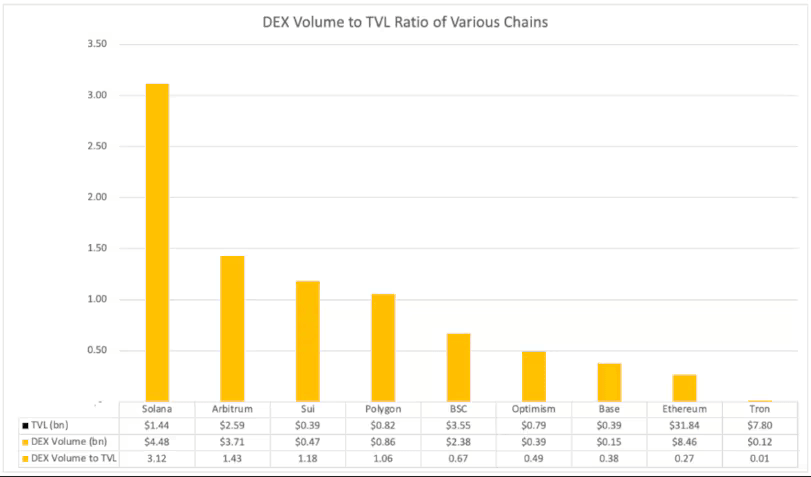

"The DEX volume-to-total value locked (TVL) ratio, has recently highlighted Solana's notable performance over Ethereum. This ratio, one measure of capital efficiency, suggests that Solana has recently begun to significantly outpace Ethereum, suggesting a higher level of operational efficiency within its ecosystem," Reflexivity Research said in a recent report commissioned by Solana Foundation.

The DEX volume to TVL ratio measures capital efficiency. (Reflexivity Research, 21Shares) (Reflexivity Research, 21Shares)

Solana's SOL token has jumped 68% to $170 this year, while ether has rallied 40% to $3,214 and the CoinDesk 20 Index, a measure of the broader crypto market, added 33%, CoinDesk data show.The SOL/ETH ratio hit a record high of 0.059 on Monday and was hovering near 0.053 at press time, according to data tracked by TradingView.

Ethereum remains the world's biggest smart-contract blockchain in terms of the total value locked in the DeFi ecosystem. At press time, the TVL in Ethereum stood at $46.44 billion versus $3.6 billion in Solana.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.