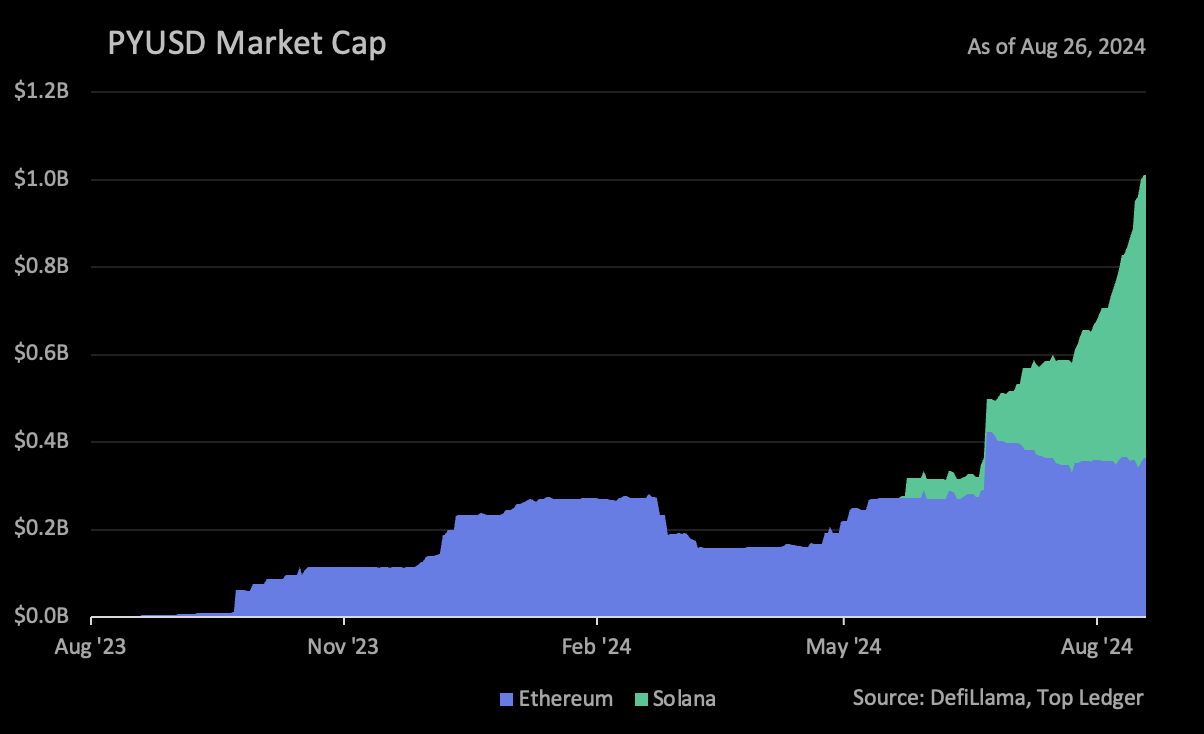

- PayPal stablecoin PYUSD reaches a $1 billion market capitalization after expanding to Solana from Ethereum in May .

- Solana-based PYUSD has a market share of 64% against Ethereum’s 36%.

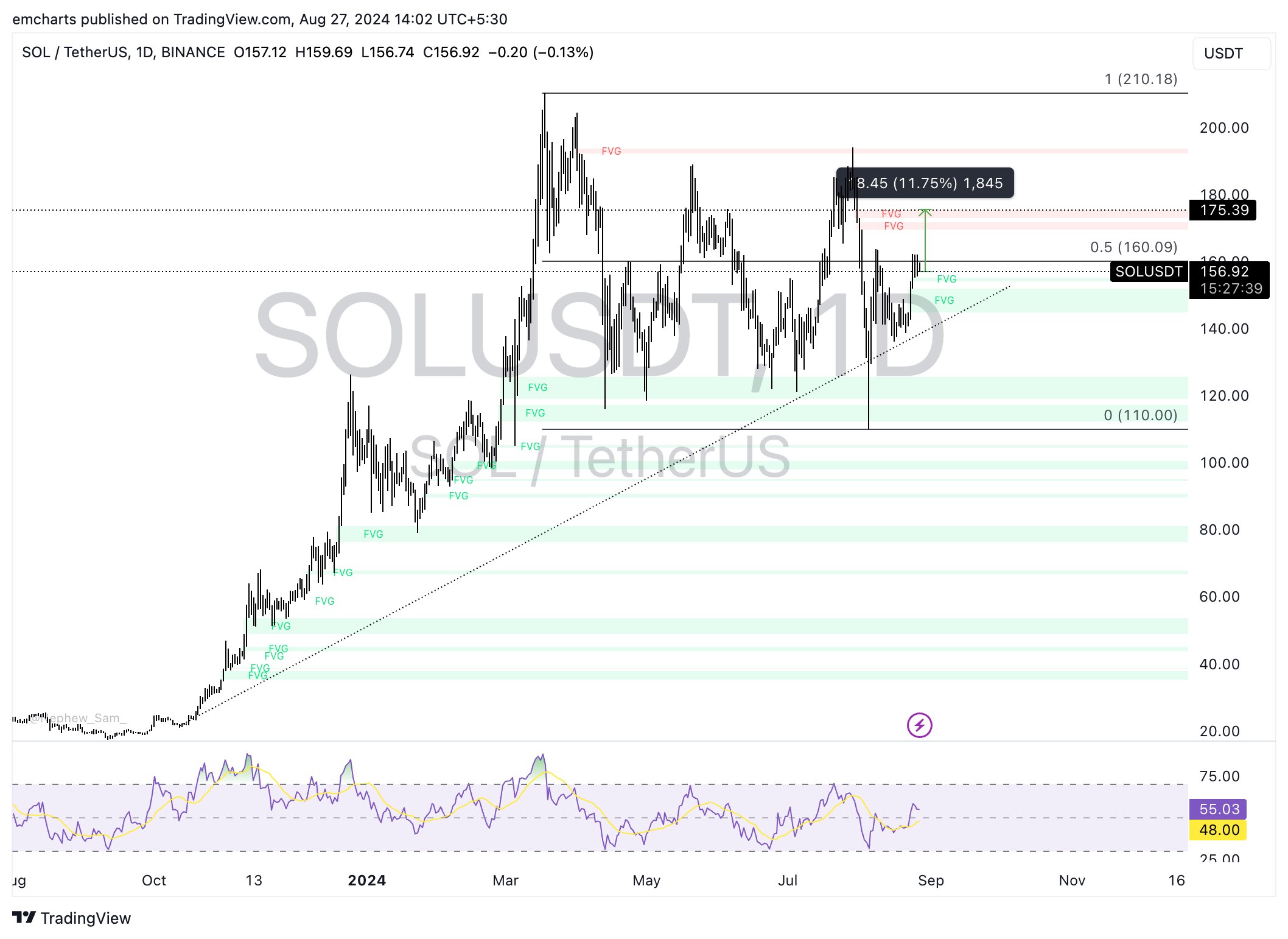

- Solana hovers around $160 on Tuesday, nearly unchanged on the day.

Solana-based PayPal stablecoin (PYUSD) has exceeded the $1 billion threshold in market capitalization, supporting the Solana network’s on-chain activity and demand. Solana’s native token SOL price hasn’t moved following the news and it is trading broadly unchanged on Tuesday at around $160.

Demand for Solana-based PYUSD drives stablecoin to $1 billion

PayPal launched its stablecoin on Ethereum in August 2023 and expanded PYUSD to the Solana chain in May 2024. PYUSD is backed by liquid assets and redeemable 1:1 with US Dollars. Solana announced in an official tweet on Monday that PYUSD market capitalization surged to $1 billion. The SOL network accounts for 64% of the stablecoin’s market share.

PYUSD Market Cap

PYUSD crossing the $1 billion market cap is a key milestone for traders since stablecoin represents fiat on/off-ramp for traders. Retail demand is represented by stablecoin market share on the Solana chain.

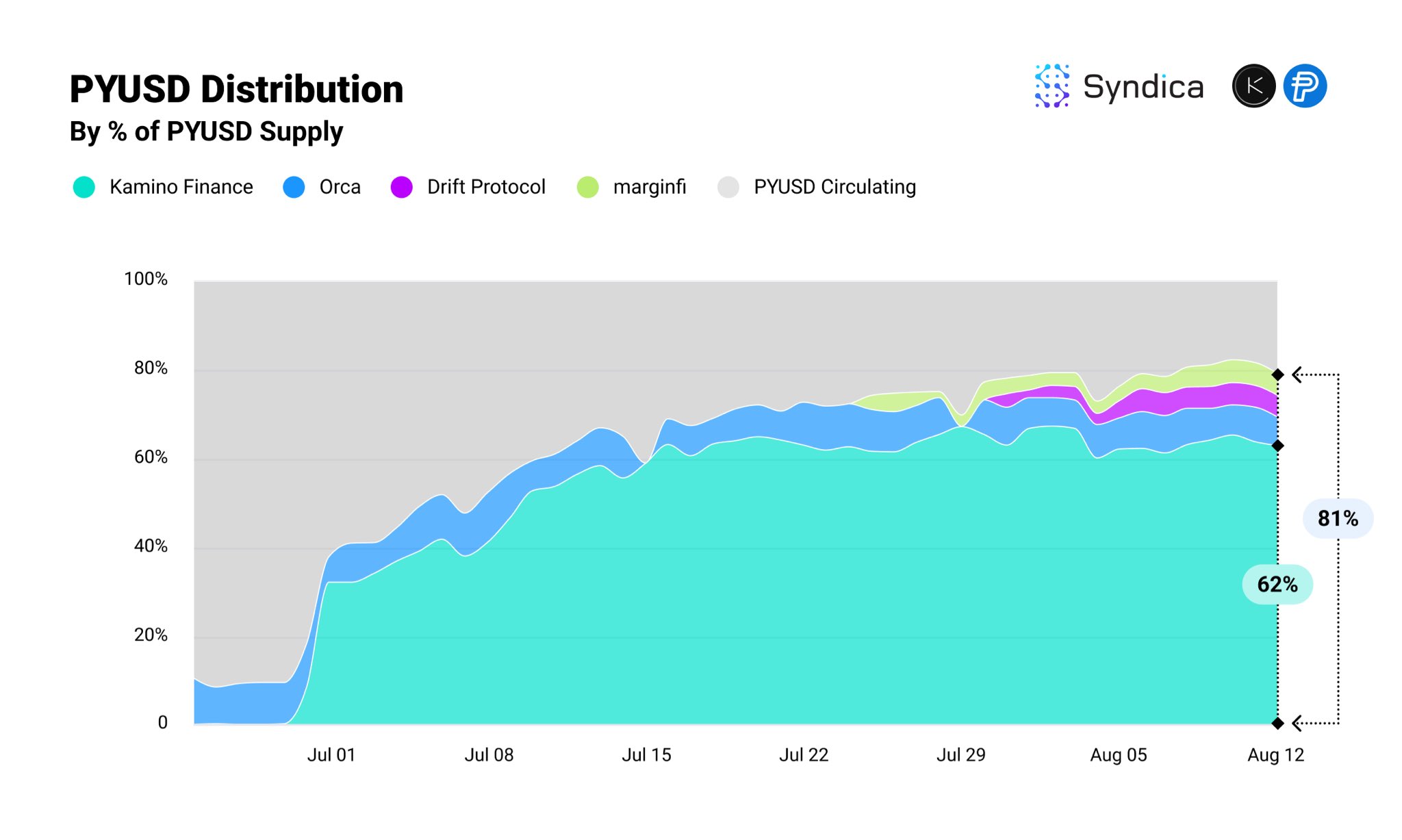

Solana network is the primary chain for PYUSD with token incentives that boost the asset’s adoption in DeFi protocols like Kamino Finance and Syndica.io.

PYUSD distribution per Artemis data

Data from crypto intelligence tracker Artemis shows that PYUSD supply moves within the Solana network at a fraction of Ether’s cost. The median transaction fee for peer-to-peer PYUSD transfers is a tenth of a cent on Solana.

Solana could be poised for double-digit gains

Solana is in a long-term upward trend, hovering close to $160. SOL trades at $156.92 at the time of writing, and the altcoin could extend its gains by 11.75% to $175.39, a key resistance level for Solana as it aligns with the upper boundary of the Fair Value Gap (FVG) between $172.91 and $175.39.

Before reaching the FVG, SOL faces resistance at $160.09, the 50% Fibonacci retracement of the decline from its March 18 top of $210.18 to the August 5 low of $110.

The momentum indicators Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) support the bullish thesis for SOL. RSI reads 55.48, signaling strength in SOL’s price trend. MACD shows green histogram bars above the neutral line, this implies the underlying positive momentum in Solana’s price trend, on the daily timeframe.

SOL/USDT daily chart

In the event of a correction in the altcoin’s price, Solana could find support in the Fair Value Gap (FVG) extending between $154.08 and $155.25.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.