Solana finds $545M lifeline as PayPal officially adopts Chainlink and SOL for payments

- Solana price rebounded 6% on Friday, outperforming BTC, ETC and XRP.

- SOL recovery defies bearish pressure from upcoming token unlocks and FTX's imminent payout.

- Global peer-to-peer payment giant PayPal officially announced crypto services to include Chainlink and Solana tokens.

- Solana bulls established short-term dominance on Friday, mounting $545 million in long leverage positions against $328 million in shorts.

Solana price rallied 6% on Friday, drive by multiple catalysts—including PayPal integration, strong U.S. jobs data, and China retaliatory tariffs on US imports.

Solana forms local bottom at $120 as PayPal officially adopts Chainlink and SOL for payments

Solana price surged 6% on Friday, outperforming major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and XRP.

This sharp recovery comes amid concerns surrounding upcoming token unlocks and the potential market impact of FTX's imminent payout.

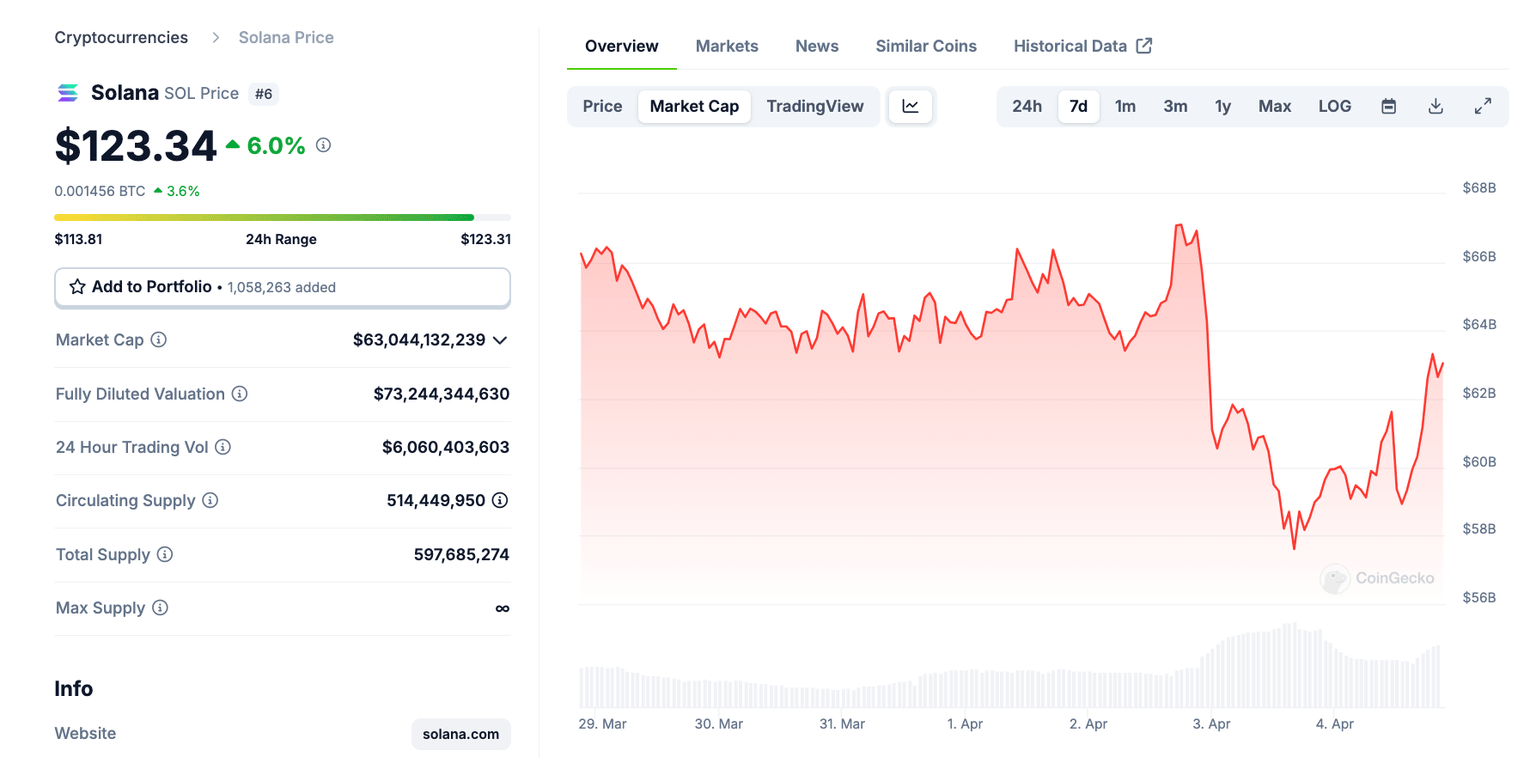

Solana price action, April 4 | Source: Coingecko

However, the broader market sentiment received a boost after PayPal, a global peer-to-peer payment giant, officially announced support for Chainlink (LINK) and Solana (SOL).

Following the official announcement on Friday, SOL price has increased from the weekly timeframe low of $112 to reclaim the $123 level at press time.

Solana Price Forecast: $130 resistance poses major risks

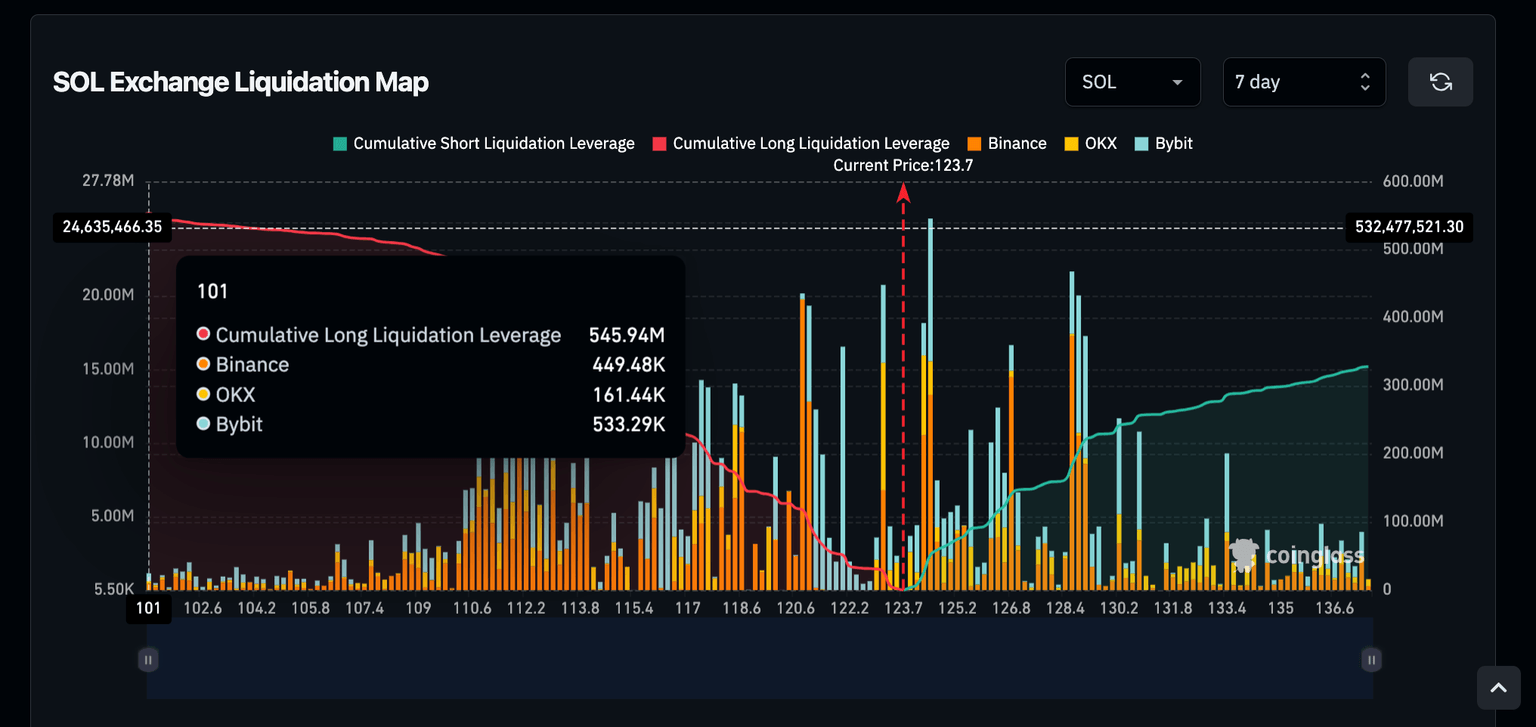

Validating the bullish Solana price forecast narrative, the Coinglass liquidation map chart below shows that Solana bull traders have deployed over $545 million in leverage over the last seven days.

Notably, the long positions currently outpace the $328 million total active short leverage by nearly 40%.

Solana Exchange Liquidation Map | Source: Coinglass

This means that after initial fears surrounding FTX payouts on tokens, hosted on the Solana network, SOL speculative traders are betting big on the potential that global demand for alternative assets after China tariffs tanked US stocks markets could drive SOL price further upwards in the coming trading sessions.

Trading around $123, at press time, Solana price appears poised for a continuation of the current 6% rebound on Friday.

However, looking closer at the Coinglass liquidation map chart shows a towering cluster of $221 million of the total active short leverage around the $129 mark.

Effectively, bull traders must now watch out for potential pull-back triggers as SOL price approaches the $130 level.

A breakout from that key resistance cluster could trigger a short-squeeze liquidation, potentially fuelling another leg-up towards $150.

On the downside, the $110 level, with $348 million active long leverage, remains the key support level that bears must breach to invalidate the current bullish momentum.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.