- Solana network’s on-chain activity falls despite a rise in the number of new addresses on the blockchain.

- The Ethereum-killer gears up to compete with rival blockchains with its update release for mainnet beta validators.

- Solana price decreased nearly 8% over the past week.

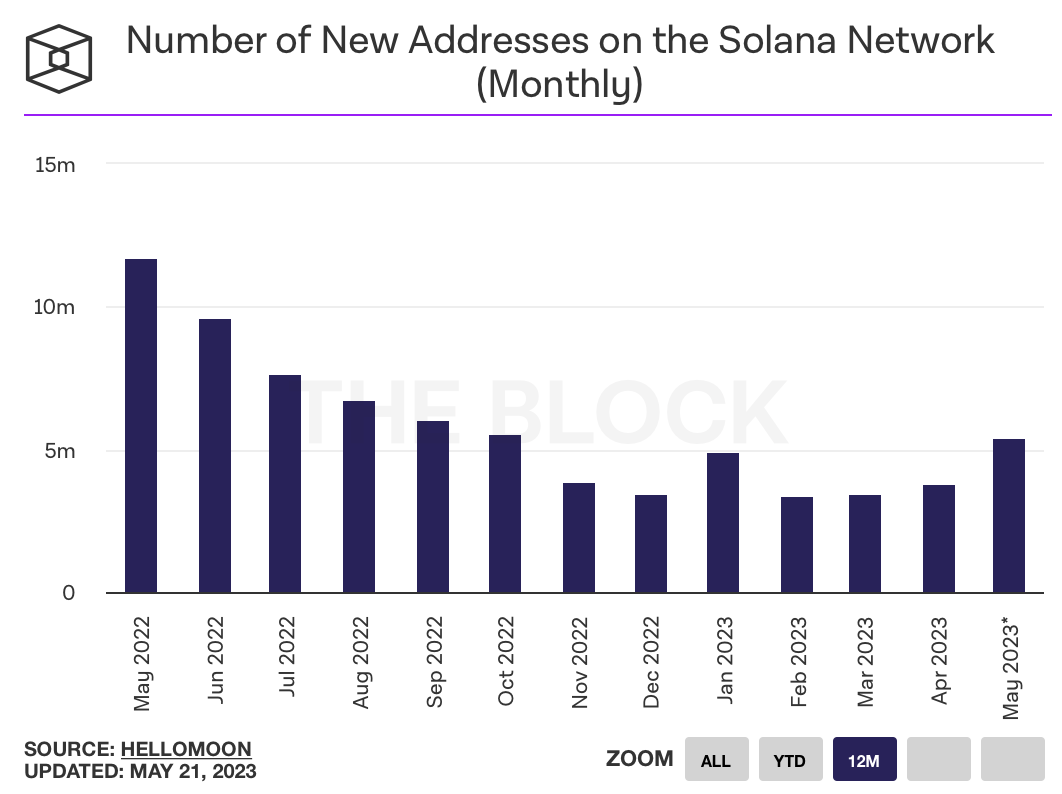

Solana (SOL), one of the largest smart contract competitors of the Ethereum network, witnessed a significant increase in the number of new addresses added in the month of May. The blockchain’s on-chain activity in terms of value moved lower and active addresses declined, despite the rise in overall number of new addresses joining the SOL network.

Also read: Solana captures new users as Bitcoin and Ethereum struggle

Solana new user address growth fails to fuel recovery in price

Solana blockchain added a large number of new user addresses in May 2023. Based on data from The Block, the number of new addresses added on a monthly basis is much higher than February, March and April of this year.

Number of new addresses added to the Solana network

The number of new addresses is a key metric in assessing the adoption of SOL among crypto market participants as it represents interest and utility of the asset for users. Combined with the significant rise in new addresses on a monthly basis, this month Solana positioned itself as a competitor to Ethereum and Cardano.

The on-chain activity and adoption of SOL failed to fuel a bullish thesis for the asset among users and the altcoin’s price declined nearly 8% since May 15.

To tackle the key issues facing the Solana blockchain, like outages and challenges faced by validators, developers shared an update for mainnet beta validators.

Mainnet Beta Validators: Please upgrade to https://t.co/M9PjgQS0Kp

— Solana Status (@SolanaStatus) May 22, 2023

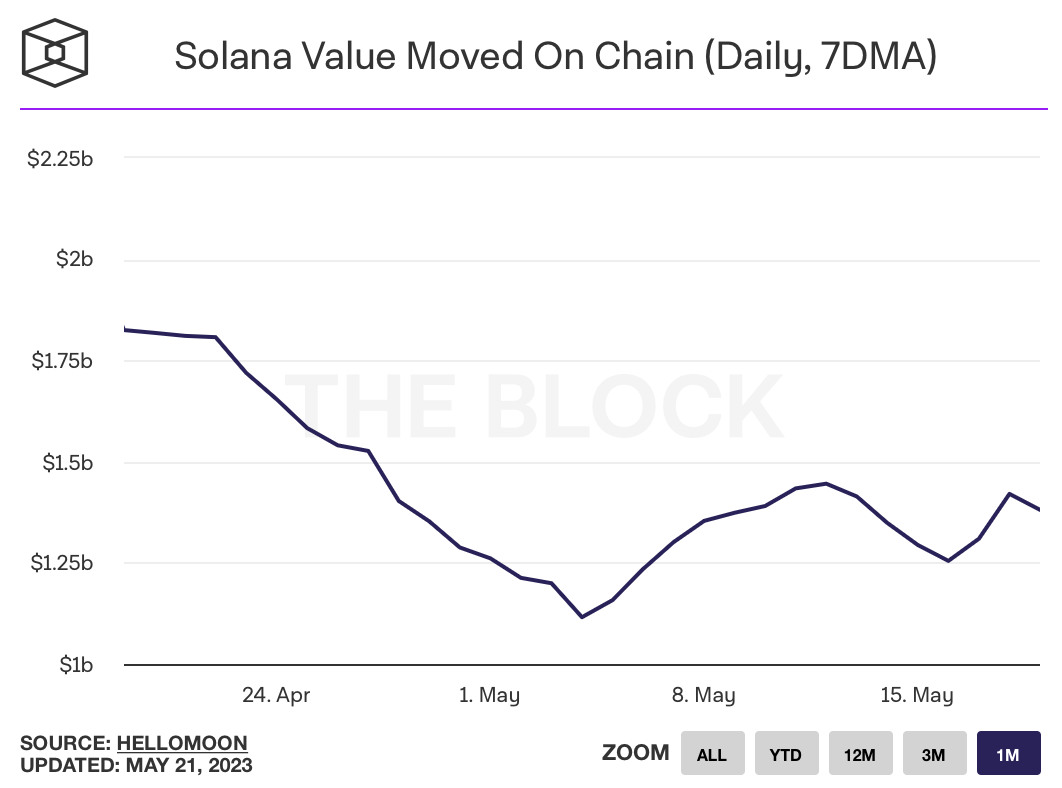

Solana blockchain’s value moved and active addresses fail to catch up

Value moved on-chain is the transaction volume or measure of economic throughput of Solana’s blockchain. The below chart from The Block demonstrates that the seven-day moving average of value moved on-chain has decreased for Solana.

Solana value moved on-chain 7-day moving average

Transaction volume declined from $1.82 billion (7-day Moving Average) to $1.38 billion between April and May 19.

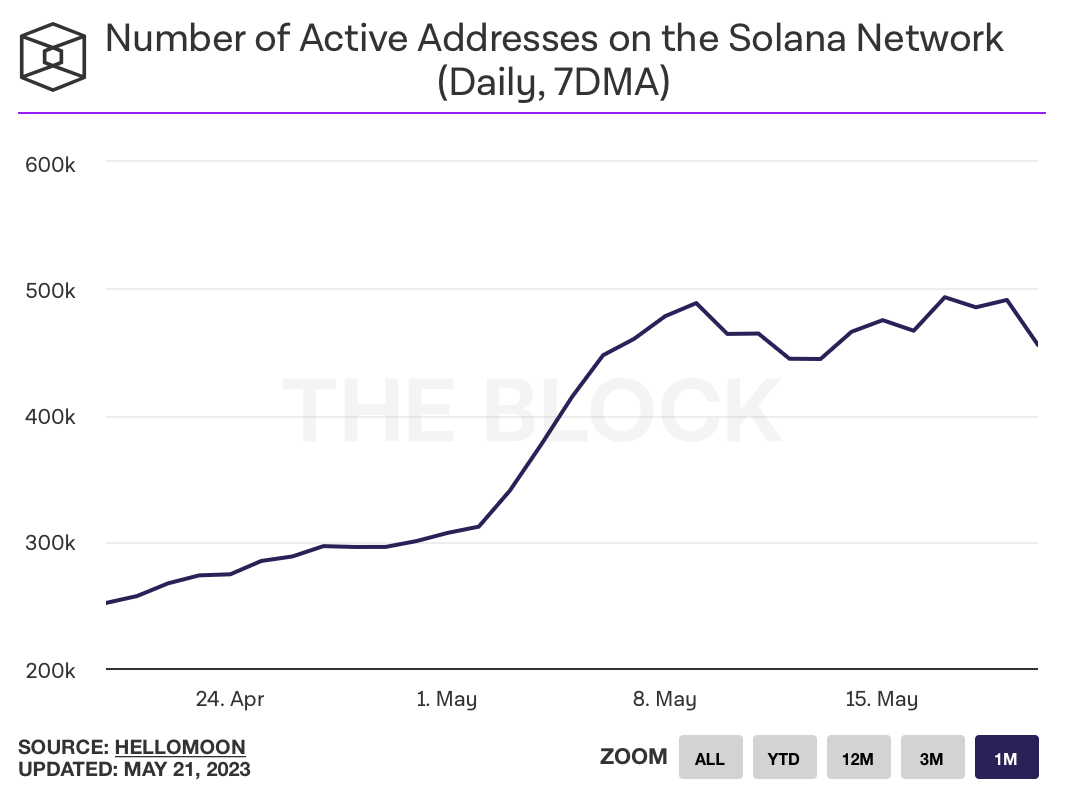

The 7-day moving average of active addresses on the SOL blockchain followed a similar trend, nosediving from its peak of 490.95K on May 19 to 455.37K on May 21.

Number of active addresses on SOL 7-day moving average

Solana blockchain’s native token SOL failed to recover from its April 2023 decline from $23.71 to $19.46 on Monday. SOL is struggling to begin its recovery, while Ethereum and Cardano prices were largely unchanged over the past week. It remains to be seen whether the mainnet beta validator upgrade fuels a recovery in Solana price.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.