Solana (SOL $14) has lost 60% of its market value in a week due to its exposure to the now-defunct crypto exchange FTX, which could continue to haunt the "Ethereum killer" well into the future.

FTX/Alameda exposure hurting Solana price

FTX and its sister-firm Alameda Research is liable to have control over 50 million SOL, according to Solana's statement released on Nov. 10.

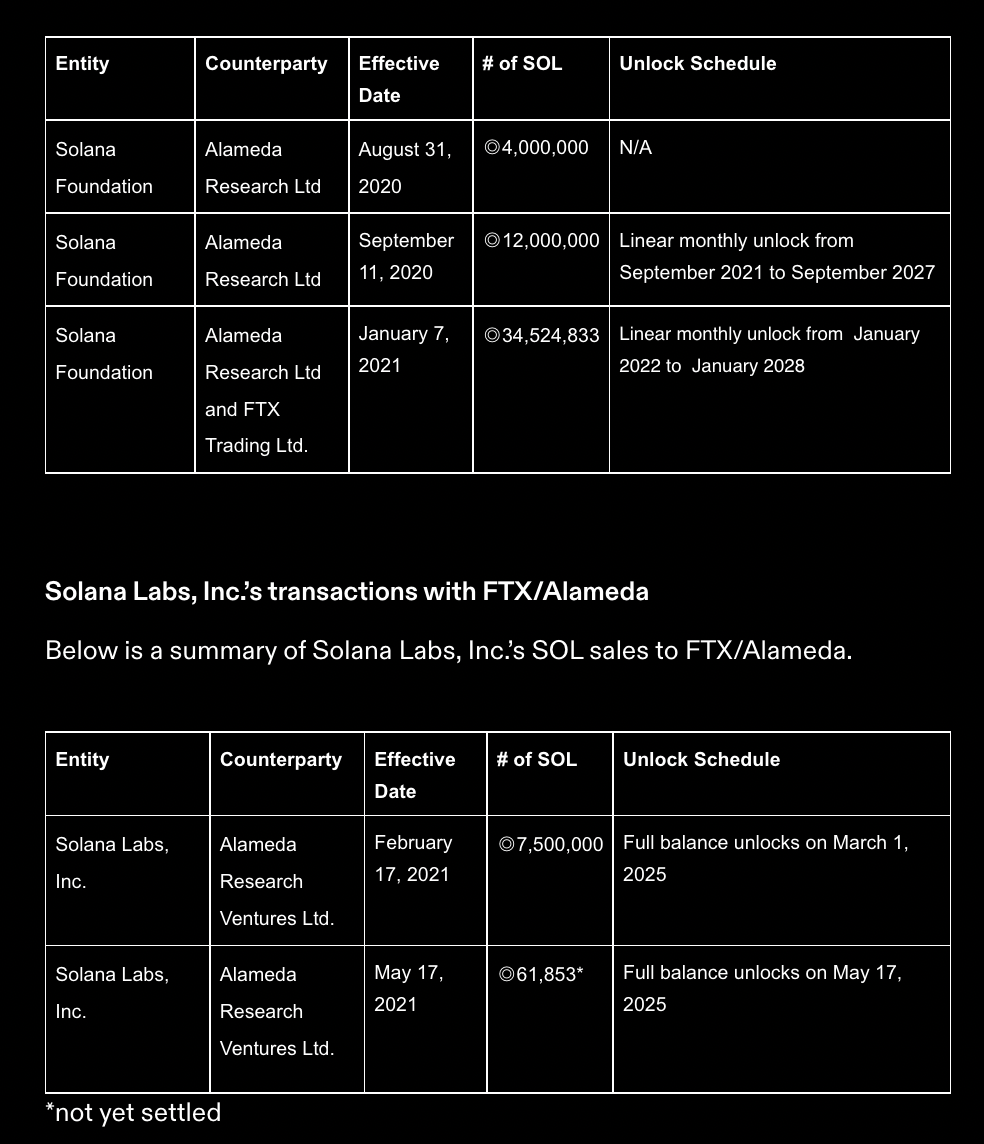

The FTX entities received 4 million SOL from the Solana Foundation on Aug. 31, 2020. They also started receiving a portion of 12 million SOL from Sep. 11, 2020, and nearly 34.52 million SOL from Jan. 7, 2021, through a "linear monthly unlock" mechanism.

Summary of SOL sales to FTX/Alameda Research. Source: Solana Labs

Furthermore, the FTX entities started receiving portions of a 7.5 million SOL reserve from Solana Labs on Feb. 17, 2021. Notably, a transaction worth 62,000 SOL between the same entities stands unsettled.

Most SOL tokens promised to FTX/Alameda are vested, meaning the firm does not yet have them in custody but is liable to receive them through the linear monthly unlock mechanism. The last of these unlocks will occur by January 2028.

That leaves the market with interpretations about what might happen to the SOL tokens once they are unlocked, given FTX's bankruptcy filing that's likely to put a freeze on all remaining funds.

Also, the firm reportedly has $9 billion in liabilities versus a $1 billion balance sheet, which could prompt its trustees to liquidate its SOL holdings to repay debtors.

To avoid such a scenario, Solana could make technical changes to its token economy, reducing FTX's impact. One recent governance proposal submitted on Nov. 13 presented a few options that could be on the table, including:

-

The errant allocation is burned.

-

Increase the lock to 10 years on the errant allocation.

-

Airdrop all SOL token holders' additional SOL, except for the party holding the errant allocation.

-

A combination of the above.

SOL price relief bounce?

From a technical perspective, Solana shows signs of bullish divergence between its price and relative strength index (RSI).

A bullish divergence materializes when an asset's price forms lower lows but its momentum indicator form a higher low. Traditional analysts see it as a buy signal, which may result in a short-term SOL price recovery on its daily chart.

SOL/USD daily price chart featuring bullish divergence. Source: TradingView

SOL/USD could rise toward $18, its range resistance level, in the event of a short-term recovery. In other words, a 20% rebound.

But on longer-timeframe charts, SOL could see further decline toward $2.50, or an 80%-plus drop, in 2023, based on a giant head-and-shoulders setup shown below.

SOL/USD weekly price chart featuring head-and-shoulder breakdown setup. Source: TradingView

Interestingly, the token's downside target falls in its most voluminous range, per its Volume Profile Visible Range, or VPVR, indicator.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: BTC misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

$18 billion in Bitcoin and Ethereum options expire today: Market braces for big moves

A record-breaking $18 billion in Bitcoin and Ethereum options expire today, sparking anticipation of sharp market moves and potential volatility.

Crypto.com launches US trust company for digital asset custody

Crypto.com launches a US trust company to offer digital asset custody services, marking a major step in its North American expansion strategy.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.