Solana could make double-digit gains for three reasons

- Solana stablecoin supply increased 156% year-on-year to $3.76 billion, per Dune Analytics data.

- Increasing DeFi opportunities and liquidity protocols, as well as the expansion of Ethereum-based projects to Solana are the key market movers.

- Solana dominates the crypto ecosystem when looking at the share of new tokens appearing on decentralized exchanges.

- SOL trades at $142 on Monday, eyes 12% rally to $160 target.

Smart contract blockchain Solana (SOL), a key competitor for Ethereum,has noted a 150% increase in its stablecoin supply, largely driven by increasing DeFi opportunities, liquidity and lending protocols and expansion of projects from Ethereum ecosystem to Solana.

The total value of assets locked (TVL) in the Solana blockchain exceeds $4.82 billion, according to DeFiLlama data, more than tripling since the beginning of the year. The increasing usage of the Solana ecosystem puts its native token SOL in a good position for an upcoming rally towards the $160 target.

Three catalysts for Solana price rally

Data from Dune Analytics and 21Shares shows that Solana’s stablecoin supply stands at $3.76 billion as of August 12. The metric is representative of the DeFi opportunities within the SOL ecosystem for users.

Stablecoins that hold fiat as a collateral are typically considered the onramp and offramp channels for crypto traders. Therefore a rising stablecoin supply on exchanges is indicative of capital inflow from traders, buying stablecoins in exchange of fiat. On a year-on-year basis, Solana’s stablecoin supply has increased 156%.

Nearly $5 billion in TVL

Per DeFiLlama data, the value of crypto assets locked in Solana is inching closer to $5 billion. As of August 19, TVL stands at $4.82 billion, seen in the chart below. TVL noted 3X gains since the beginning of 2024.

Solana TVL

More opportunities in DeFi, through lending protocols

Projects like Sanctum, Jito and Kamino have offered users in the Solana ecosystem more opportunities to earn through the capital deployed on SOL. Kamino protocol offers lending opportunities to users and enabled PayPal’s stablecoin PYUSD to garner $300 million in market capitalization within three months of its debut in Solana .

The project has faced challenges when scaling on Ethereum, despite offering PYUSD on the Ether chain for nearly 10 months.

Sanctum is a Solana blockchain network that provides developers with an infrastructure to build creative crypto staking applications and gained popularity for its liquid token staking. Jito is a Maximum Extractable Value (MEV) bot, a tool designed to draw maximum value from Solana transactions. MEV is profit that can be obtained by reordering or censoring transactions on a blockchain.

These projects have attracted users to the Solana ecosystem through their offerings.

PYUSD market capitalization

Dominant share of new tokens on DEXes

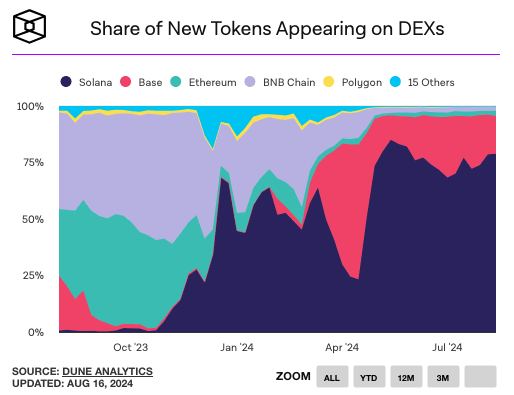

Dune Analytics data shows that Solana dominates the number of new tokens being added to decentralized exchanges (DEXes), followed by Base, Ethereum, BNB Chain, Polygon and other blockchains in the ecosystem.

Solana’s dominance can be attributed to the relevance of meme coins and their listing on DEXes like Raydium.

Share of new tokens on DEXes

Solana gears for 12% gains

Solana is in a multi-month upward trend that started in October 2023. More recently, the trend has been broadly sideways, with the Ethereum-competitor making a comeback above $140 after sweeping liquidity at the August 5 low of $110. The Relative Strength Index (RSI) momentum indicator reads 43.54 on the daily chart, under the neutral level.

SOL could extend gains by 12.33% and rally to $160.09, its 50% Fibonacci retracement level of the decline from its March 18 top of $210.18 to its August 5 low of $110. Solana faces resistance at the Fair Value Gap (FVG) between $150.79 and $152.54.

SOL/USDT daily chart

Looking down, Solana finds support at $121, a level that has broadly held prices for three months, followed by the August 5 low of $110.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.