- Solana price doubled since mid-December, and hits a high of $24 close to the level where investors first dubbed the token “Sam coin.”

- Experts argued that Ethereum competitor Solana is entangled with bankrupt crypto exchange FTX.

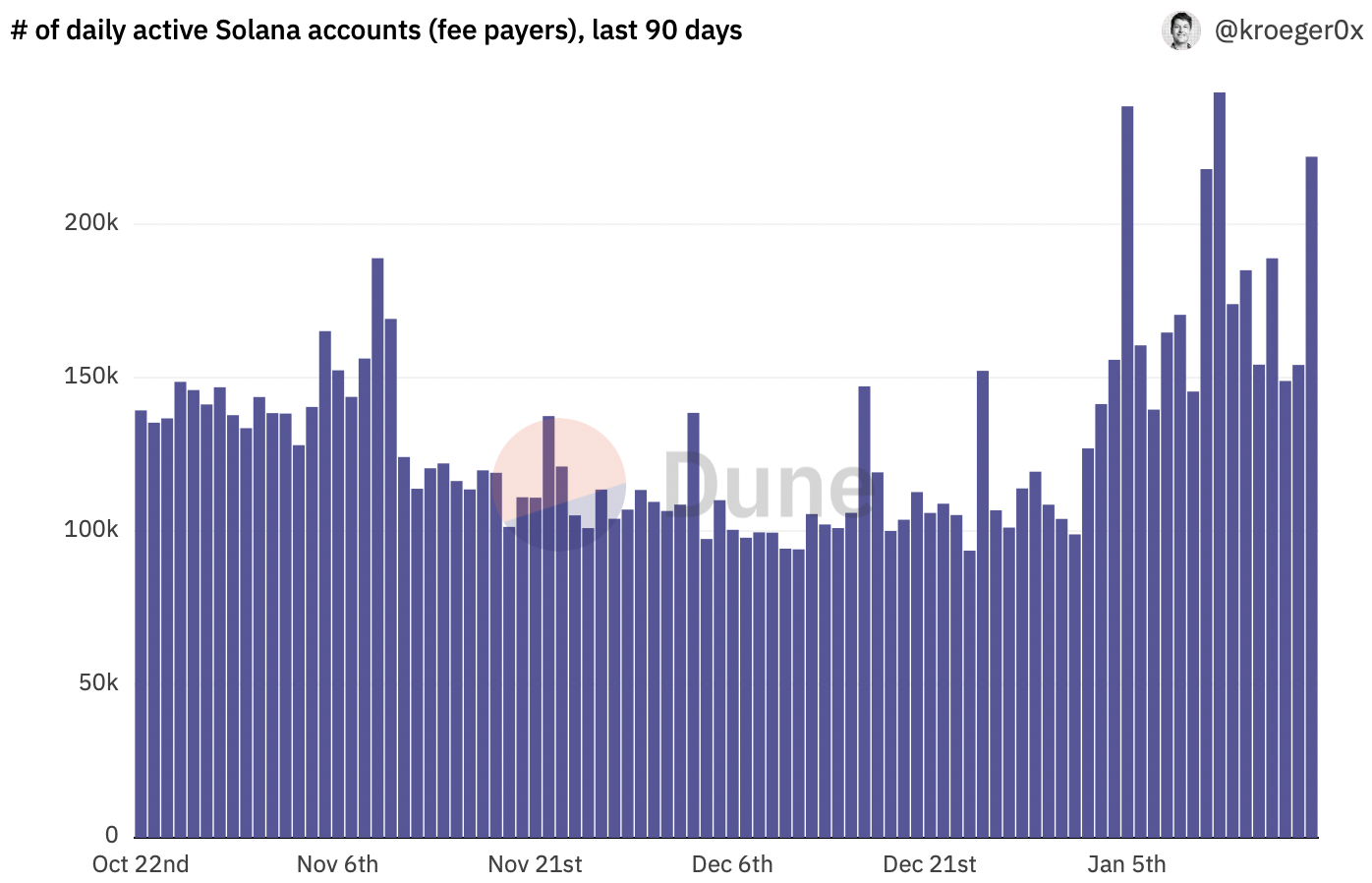

- The number of daily active SOL accounts has climbed above pre-FTX exchange collapse levels, alongside a surge in transaction count.

Solana, an Ethereum alternative blockchain, has witnessed a spike in the daily active SOL accounts and transactions on its network. The altcoin is working on dissociating itself from the FTX exchange collapse and “Sam coin” narrative.

SOL price has doubled since mid-December and hit a weekly-high of $24 earlier this week. The altcoin has nearly wiped out all losses from the FTX exchange collapse and SOL price is climbing steadily to pre-FTX levels.

Also read: Here’s how Ethereum whales predict massive gains in meme coin Shiba Inu

Solana is on track to beat Ethereum competitors in the race to wipe out FTX-induced price drop

Solana, a public blockchain platform and an Ethereum alternative was labeled “Sam coin” on crypto Twitter, post the FTX-exchange collapse because Samuel Bankman-Fried, the co-founder and former CEO of FTX, was a proponent of the altcoin.

The altcoin’s price plummeted in the weeks leading up to FTX’s bankruptcy and SOL struggled to recoup its losses. Since mid-December SOL price yielded nearly 100% gains and hit a weekly high of $24. This is close to the pre-FTX exchange collapse price for the Ethereum-killer altcoin.

Solana’s price rally has been mirrored by on-chain metrics on the SOL blockchain. The number of transactions on the SOL blockchain and daily active SOL accounts has climbed above levels seen in November 2022, marking an important milestone in Solana’s journey.

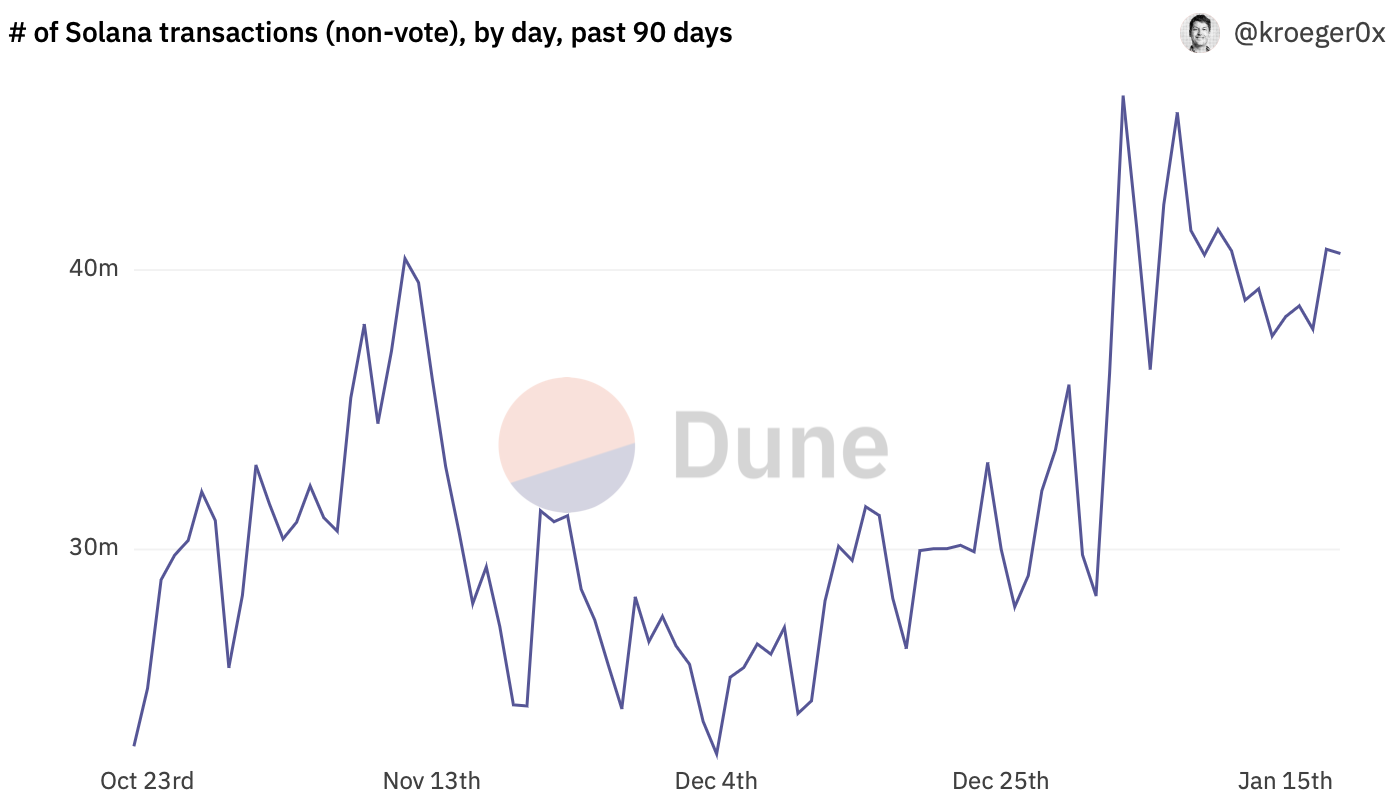

Based on data from crypto analytics platform Dune, the number of Solana transactions per day is 40.59 million (as of January 19), nearly twice that of pre-FTX exchange collapse in November.

Number of Solana transactions by day (As of Jan 19)

As seen in the chart below, the number of daily active Solana accounts has nearly doubled since November.

Number of daily active Solana accounts

Critics of the Solana network have called out the Ethereum-killer for being too centralized and venture capital-controlled. Riyad Carey, a research analyst at crypto data firm Kaiko believes that with FTX and Alameda Research out of the picture, Solana protocol is free from baggage and is ready to become more community-centric. Carey believes Solana has the potential to be a top three or five chain by total value locked in 2023.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.