Solana continues to fall as bears take over and push SOL to $75

- Solana price continues to face extensive weakness and selling pressure.

- SOL may be unable to hold the $80 value area.

- Extreme bearish price action could trigger a capitulation move.

Solana price faces some of the most intense selling pressure and bearish sentiment in over a year. Unknowns regarding Russian aggression into Ukraine have caused significant volatility across all financial markets.

Solana price hits new five-month lows as SOL seek evidence of support

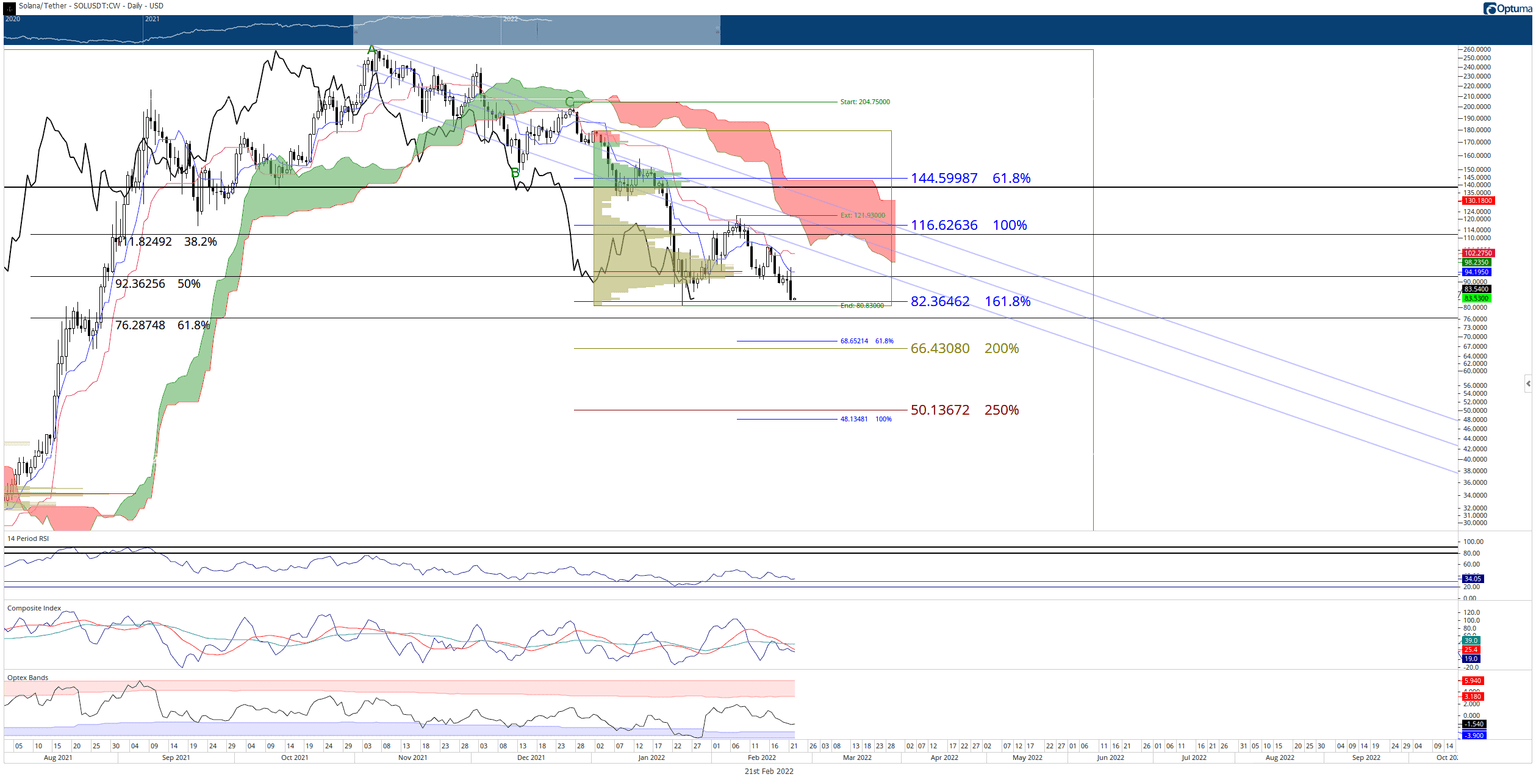

Solana price completed the lowest daily close in five months, exceeding the lows found in late August 2021. Selling pressure and the daily close for Monday terminated right on top of the 161.8% Fibonacci retracement at $82.25.

From the perspective of the Volume Profile, the 2022 Volume Profile is at its yearly lows, indicating price discovery and a wide-open range to continue south. However, the extended 2021 Volume Profile shows that a high volume node occurs a the psychologically important $75 price level. This is likely where bears will push Solana price down.

Historically, when risk-on markets are faced with these kinds of geopolitical events, the initial reaction is volatile, violent, and bearish. Stocks, some commodities, futures, and cryptocurrencies are all in the same bearish boat. But when uncertainty goes away and a status quo develops, the return to equilibrium and initial values is often swift and immediate.

SOL/USDT Daily Ichimoku Kinko Hyo Chart

Solana price doesn’t have that far to go from a bullish perspective to begin a new journey higher. The first goal that bulls must accomplish is a daily close above the nearest resistance cluster in the $93 value area where the 50% Fibonacci retracement and daily Tenkan-Sen currently reside.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.