Solana captures new users as Bitcoin and Ethereum struggle

- Bitcoin and Ethereum have declined 7% and 12% over the past thirty days, plagued by high transaction fees.

- The Solana network has captured users from Bitcoin, Ethereum and other competitors.

- SOL price is attempting to recover from its April decline below the $25 level.

Solana (SOL), a decentralized scalable blockchain platform, witnessed a spike in the number of active and new addresses in May. SOL has recently captured large volumes of new users as prices of Bitcoin and Ethereum struggled to recover from their recent declines.

Also read: Chainlink whales begin accumulation as LINK enters opportunity zone

Solana adds large volumes of wallet addresses to its network

Solana, one of the largest competitors of the Ethereum network, has registered an increase in the number of new wallet addresses in its network. This is a significant development, since the metric represents the inflow of capital to Solana and implies that the asset captured new users.

Based on data from TheBlock, the number of new addresses on the Solana network has more than doubled in May so far from a 7-day moving average of 136.61K on May 1 to 298.31K on May 16.

Number of new addresses on the Solana network

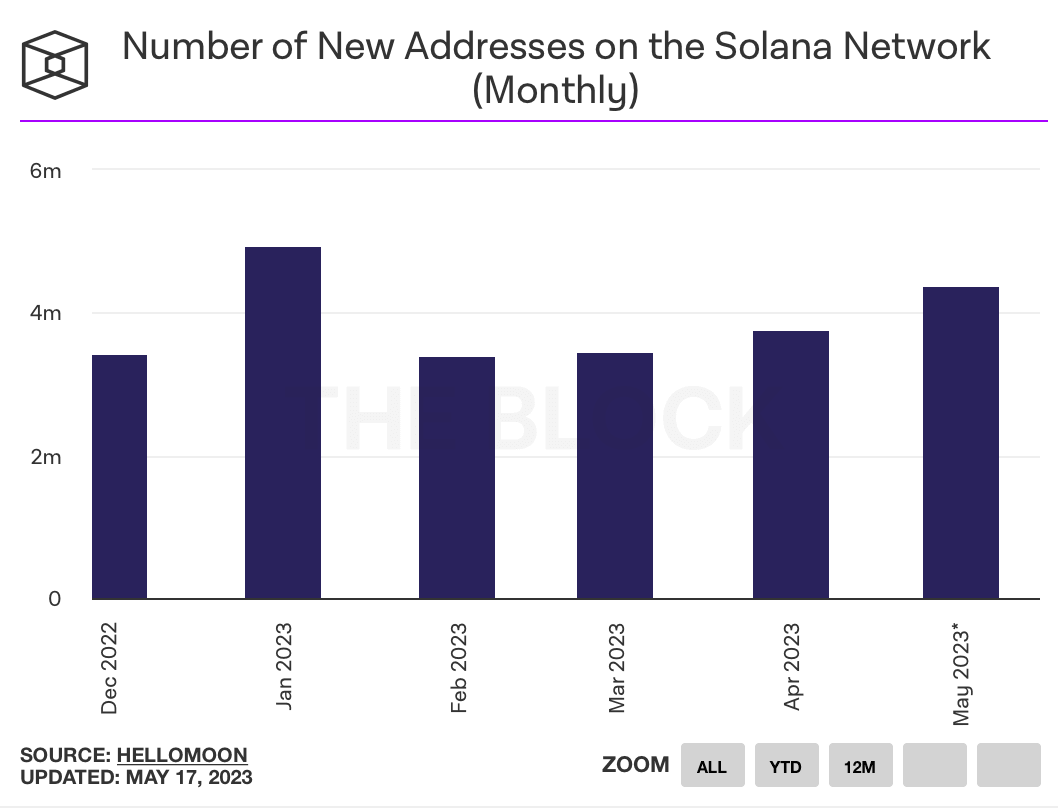

To put this development into perspective, let’s look at the number of new addresses on a monthly basis. Until May 17, the number of new addresses already exceeds that of February, March and April. This implies that the Solana blockchain has consistently captured more users in the month of May, as competitors like Ethereum recently struggled with high transaction fees and outages.

Number of new addresses on the Solana network (monthly)

How Solana’s rising on-chain activity can fuel a price recovery

In May so far, Bitcoin and Ethereum prices have struggled to recoup their losses and support lines are being tested nearly on a daily basis. Solana price fell 8.6% this month so far, while Bitcoin and Ethereum prices declined 2.3% and 7%, respectively. Still, a spike in new addresses can be considered as a bullish sign for SOL.

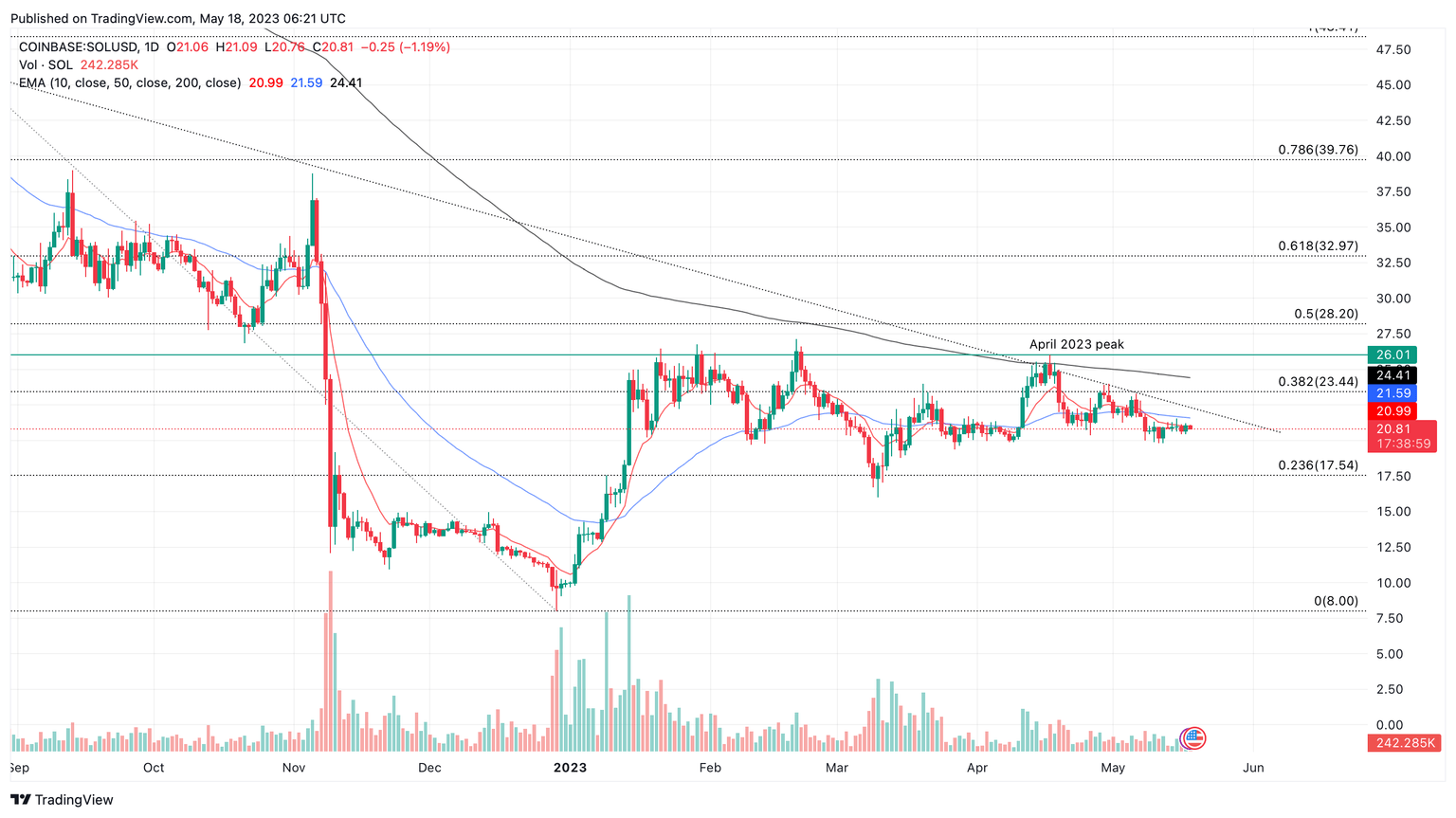

Mid and lower market capitalization altcoins are also struggling due to their correlation with Bitcoin and broader market conditions. SOL price is currently attempting a recovery from its most recent pullback on April 18, when price nosedived below $25.

Solana price is in a downward trend that started in August 2022. The Ethereum-killer altcoin is testing resistance at its 10-day Exponential Moving Average (EMA) at $20.99 and trading below the 50-day and 200-day EMAs at $21.59 and $24.41.

In its recovery, SOL price could face immediate resistance around 38.2% Fibonacci level at $23.44.

SOL/USD one-day price chart

A decline below the 23.6% Fibonacci level at $17.54 could invalidate the bullish thesis for Solana.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.