Solana buyers are drying up while sellers push SOL price to $90

- Solana price volume continues to decrease as buyers and sellers wait for a clear direction.

- Solana is trading between two strong resistance and support levels.

- Until price action displays something different than the status quo, the short-term direction remains down.

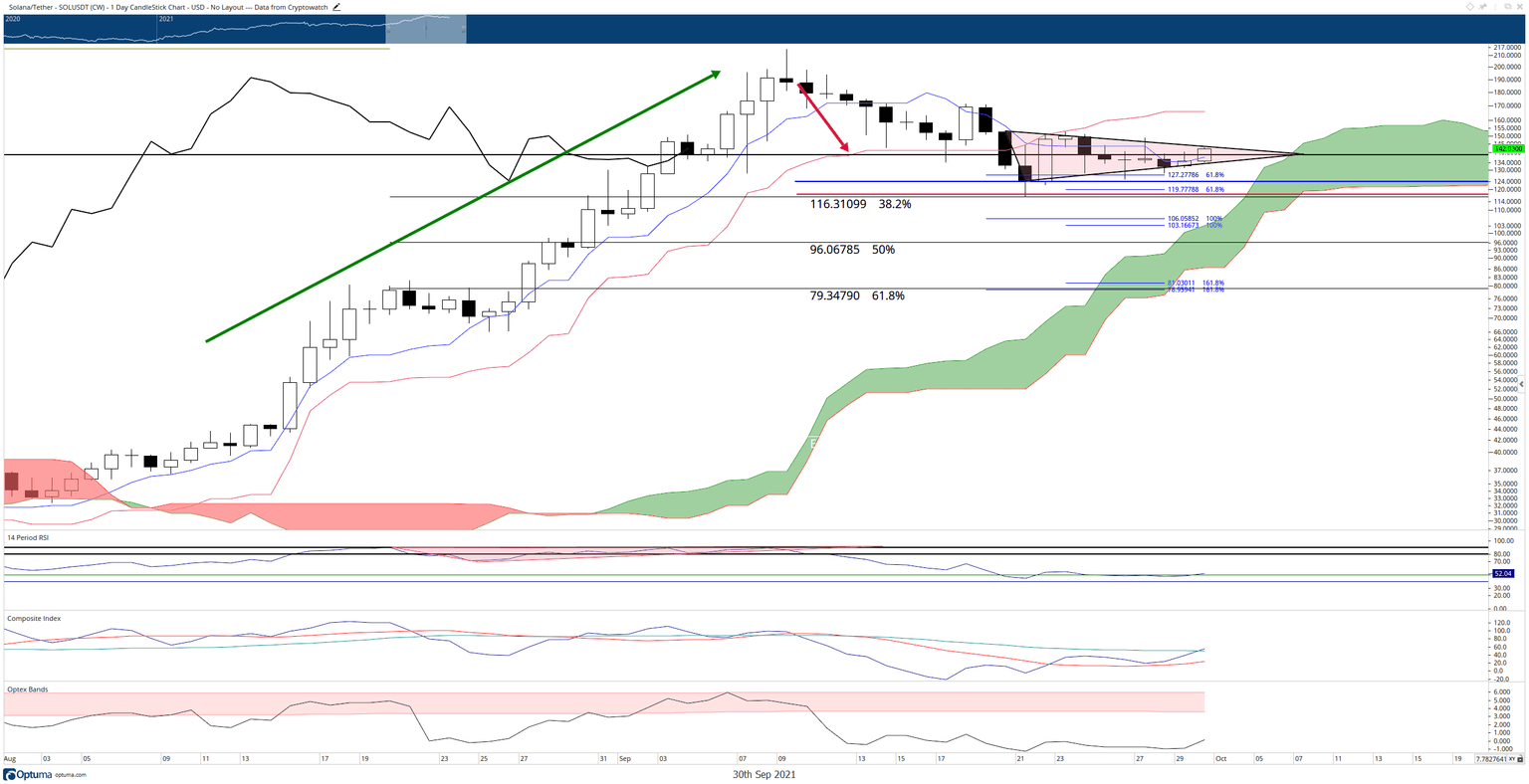

Solana price – like many cryptocurrencies today – sits at a make-or-break level. Above the current candlestick, the black horizontal line is the Point-Of-Control for the last high volume node between $139 and $75. Solana must remain above that level, or it risks returning to sub-$100 levels.

Solana price requires buyer conviction; else, short sellers will continue towards $90

Solana price continues to trade in a constricted but overall bearish condition. Bulls face consistent rejection against the Tenkan-Sen, a level that has acted as resistance now for over two weeks. Many attempts to trade above the Tenkan-Sen have been successful, but any convincing close above eludes buyers.

Near term-support for Solana is significant. Value areas between $115 and $125 are the weekly Tenkan-Sen, weekly Kijun-Sen, 38.2 Fibonacci retracement, and 61.8% Fibonacci extension levels. So it is no wonder why bears are having a difficult time pushing Solana price lower. However, risk-off sentiment remains a growing concern and will outweigh any structural, technical price support.

SOL/USDT Daily ichimoku Chart

While Solona price sets up for a strong sell-off, bears should be aware of the conditions that could quickly invalidate any downside movement. First, buyers will need to push Solana to a close above the daily Kijun-Sen at $168, but that still puts the Chikou Span in a touchy spot. October 9th is when the Chikou Span could close at $168 and be above the candlesticks to confirm a new bullish expansion phase.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.