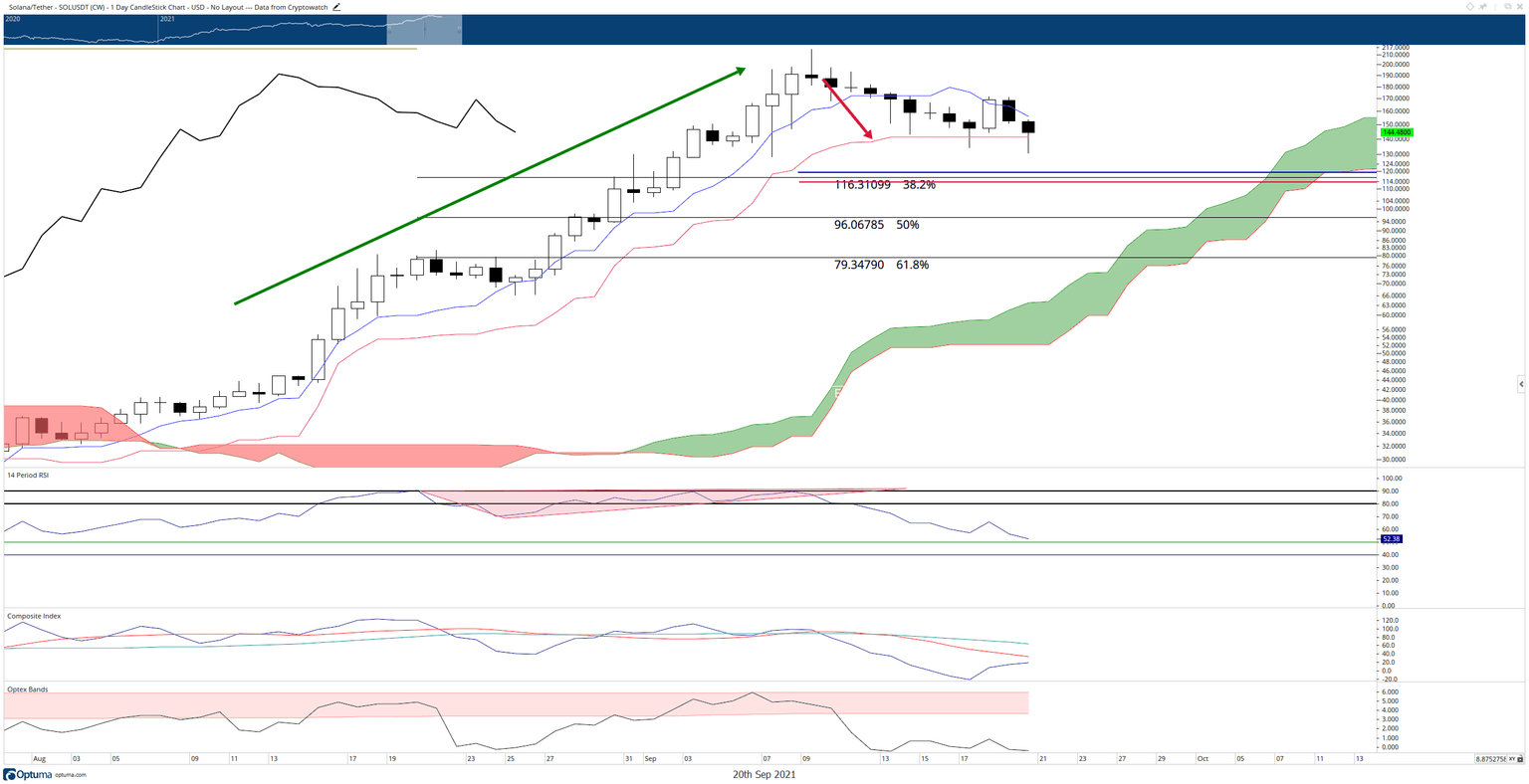

Solana bulls panic selling could push SOL price sub -$100

- Solana price makes new fourteen-day lows.

- Bulls are likely trapped between $150 and $171.

- Failure to hold support at $140 would signal a drop towards $115.

Solana price has been on one wild ride since Friday. Major whipsaws in price action have generated uncertainty on both sides of the market. However, with a +14% move higher on Friday followed by a -23% move on Saturday and Sunday, bears remain in control.

Solana price must hold $140 as support, -20% move lower ahead

Solana price has undoubtedly generated some mood swings for bulls and bears recently. Bulls, in particular, had a moment of panic when bears pushed Solana below the $140 level and Kijun-Sen to $130 – but then felt relief as price returned higher to say above $140.

Bears will need to return Solana price below the Kijun-Sen at $140 to maintain selling pressure. However, the Volume Profile remains extremely thin between $130 and $115, so any return to $130 will likely generate a fast move to the target area.

However, bulls should not be disheartened. The current moves have all the signs and opportunities of creating a spectacular bear trap. If bears cannot push Solana price below the Kijun-Sen, then bulls will need to capitalize on that failure by pushing Solana at least the highs of last Friday near $171.

SOL/USDT Daily Ichimoku Chart

Solana bulls and bears should expect to see some back and forth between the Tenkan-Sen at $156 and the Kijun-Sen at $140. Bulls should look for the Relative Strength Index to hold 50 as support for confirmation that an uptrend is near. Bears will want to see if the same Relative Strength Index level fails and instead moves towards 40. Bulls and bears should be aware that Solana price action is very sensitive to the current risk-off sentiment in all financial markets.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.