- Solana price pops back above the monthly R1 resistance level.

- SOL price ready to make new all-time highs soon.

- The overbought RSI is overshadowing the positive sentiment in Solana.

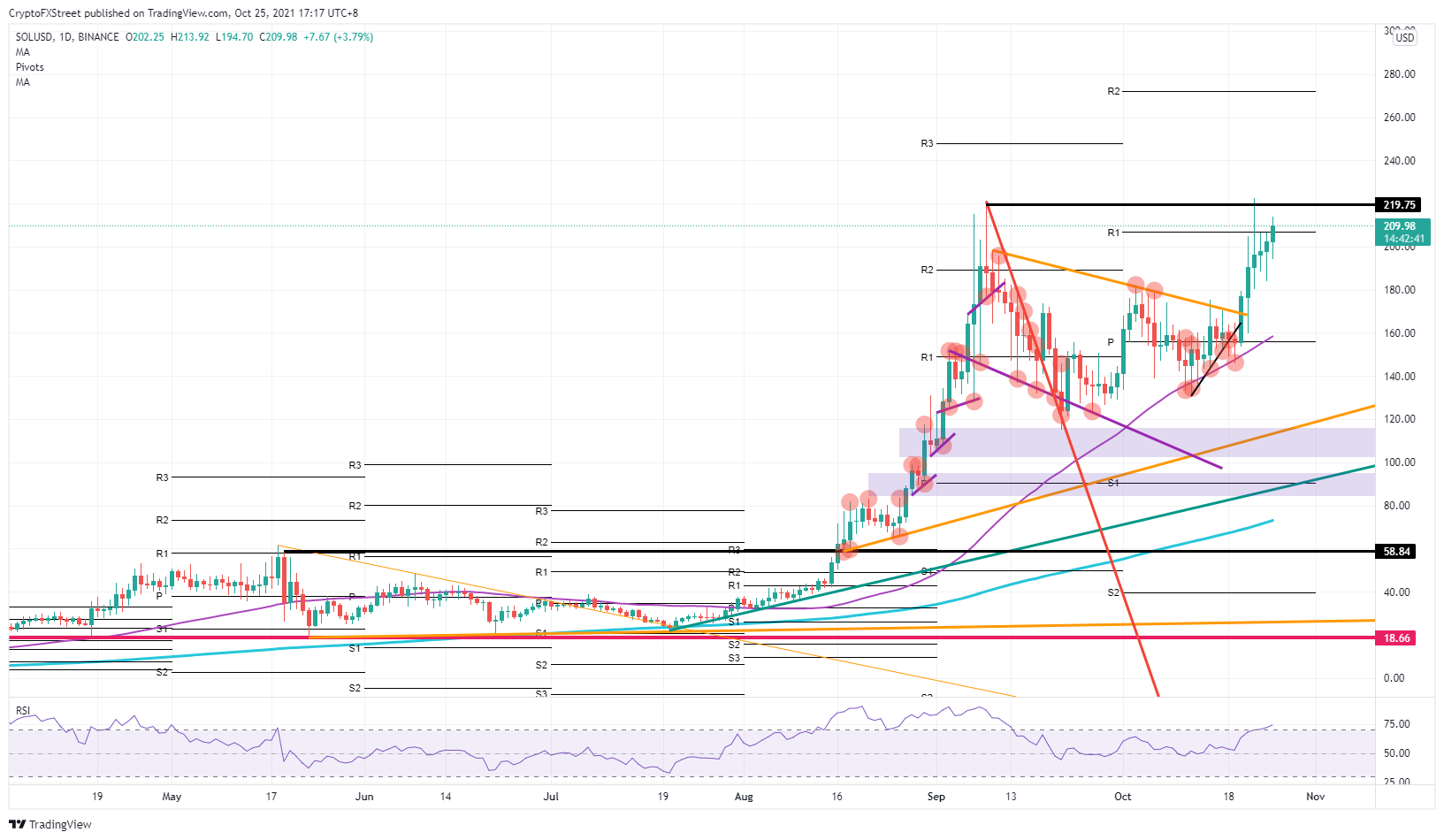

Solana (SOL) price has been on a tear after posting its sixth consecutive daily bullish candle. With the pop back above the monthly R1, expect new all-time highs to be reached soon as favorable tailwinds are nowhere near to fade anytime soon. The Relative Strength Index (RSI) is introducing a note of caution when it comes to SOL making further highs.

Solana price targets 33% gains

Solana price has popped back above the monthly R1 at $206.91. With that pop, new buyers were attracted, and the price in SOL is now getting lifted towards $219.75 to make new all-time highs. The RSI has entered into overbought territory, which could put a limit on further extended profits. Some cautiousness is advised, although SOL does have a history of trading wide into overbought territory in the RSI, as already shown around mid-September, where another bull run occurred.

SOL price will probably push towards $240 for an intermediary pivot point and then up to the monthly R2 resistance level at $272.10. Once there, expect the uptrend to halt and take a breather as profit-taking will occur, and the RSI will need to cool down as it will have gone too far into the overbought area. Thus resulting in a bit of a correction back towards $240.

SOL/USD daily chart

Should the positive spillover effect from Bitcoin or global markets start to fade, still expect SOL price to hit new all-time highs but then to start to fade relatively quickly. Bears will start to match and oversell the profit-taking from bulls, and the price will start to break back below $180. Another leg lower would see $160, with the monthly pivot and the 55-day Simple Moving Average (SMA) as support.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.