Solana blockchain activity remains high despite FTX exchange’s Chapter 11 proceedings

- Solana blockchain continues to see high activity despite an estimated 50 million SOL tokens locked in bankrupt crypto exchange FTX.

- A research report by Citigroup Inc reveals a sharp reduction in the circulating supply of Solana, while active addresses and daily NFT volume remain high.

- SOL price eyes $20 target after yielding nearly 25% gains over the past week.

Solana blockchain activity remains high despite concerns surrounding 50 million SOL held by bankrupt crypto exchange FTX. Active wallet addresses on the Solana network have increased, alongside a climb in the daily NFT trade volume.

Solana network’s active addresses and activity remains high against all odds

Solana, an Ethereum-alternative, has recently earned the title “Sam coin” after Samuel Bankman-Fried (SBF), the founder of the bankrupt cryptocurrency exchange, FTX. SBF was an active proponent of Solana ecosystem’s native token SOL. Following FTX exchange’s collapse and bankruptcy Solana was hit by a massive reduction in daily active addresses and NFT trade volume.

SOL price nosedived from $37 to $13 within a five day period between November 5 and 10, 2022. While the Ethereum-killer is struggling to wipe its losses from the FTX collapse, SOL’s price has climbed to $17 and the token’s metrics like daily active addresses and NFT trade volume have completed their recovery. Both metrics have returned to levels last seen before the collapse of SBF’s crypto exchange platform, according to Citigroup Inc’s recent report.

The fact an estimated 50 million SOL tokens are locked on the bankrupt crypto exchange that is currently going through its Chapter 11 proceedings, has curbed the circulating supply of SOL tokens acting as a further pump to price. The total supply of SOL tokens is currently 538.38 million of which 9.2% is locked on Bankman-Fried’s bankrupt exchange.

The rise of key metrics back to pre-FTX levels is being interpreted as a comfort among users on the Solana blockchain.

Solana price eyes $20 target

@CryptoGodJohn, a cryptocurrency analyst and trader told his 437,200 followers on Twitter that the expert is awaiting a flush of the $20 level in Solana. SOL price has yielded nearly 73% gains over the last two weeks, since the beginning of 2023. The altcoin has rallied despite sideways price action in Bitcoin and Ethereum in the first week of January 2023.

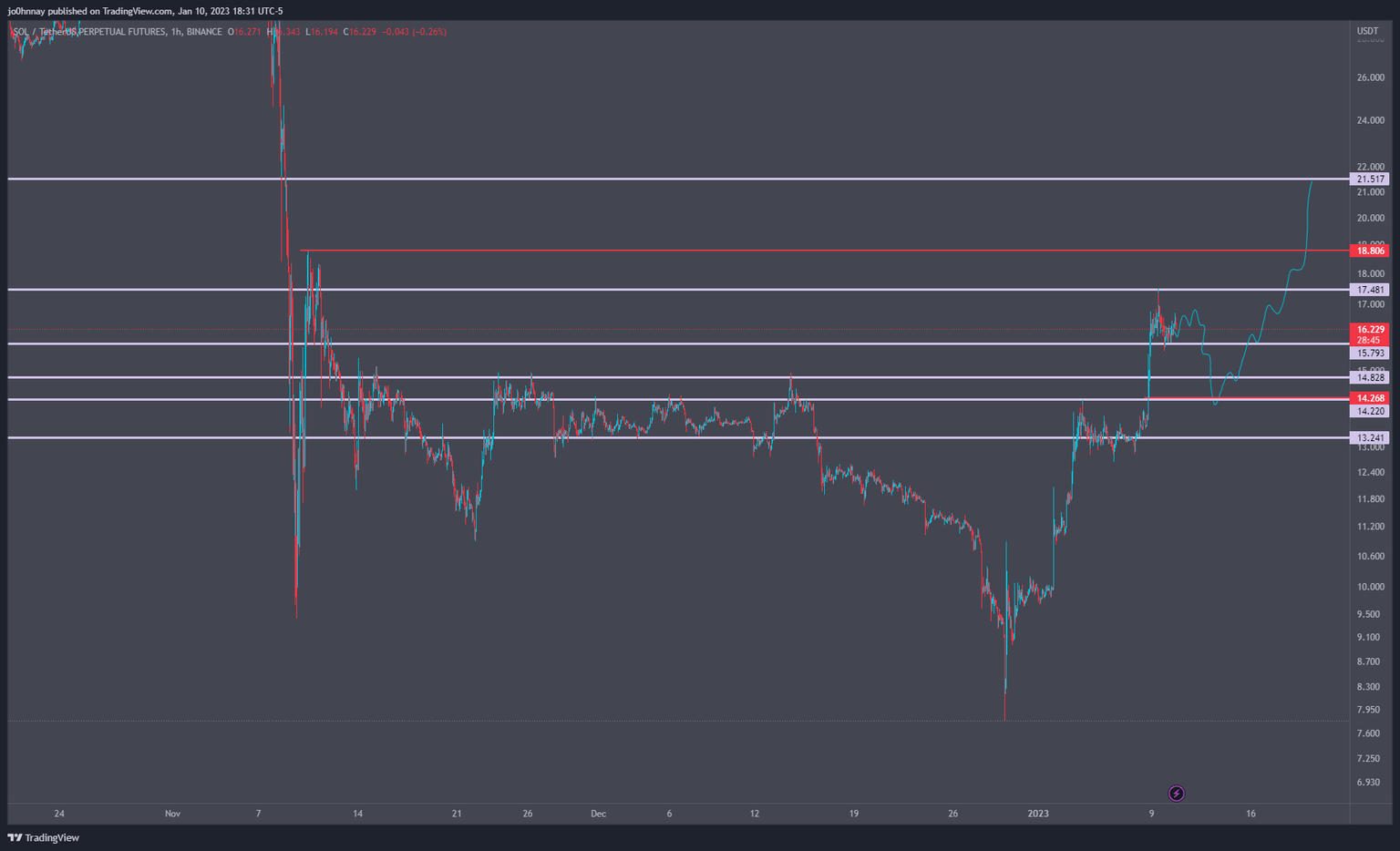

SOL/USDT Perpetual Futures Contracts

Johnny identified three key levels in the Solana price chart above, at $17.48, $18.80, and the target of $21.51. Yet. the expert believes SOL could first plunge to $14.26 and collect liquidity before the next leg up.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.