- Solana price faces sixth consecutive day of lower closes.

- Late bear traders may get burned if they are short at $150.

- Final daily Ichimoku support is coming up.

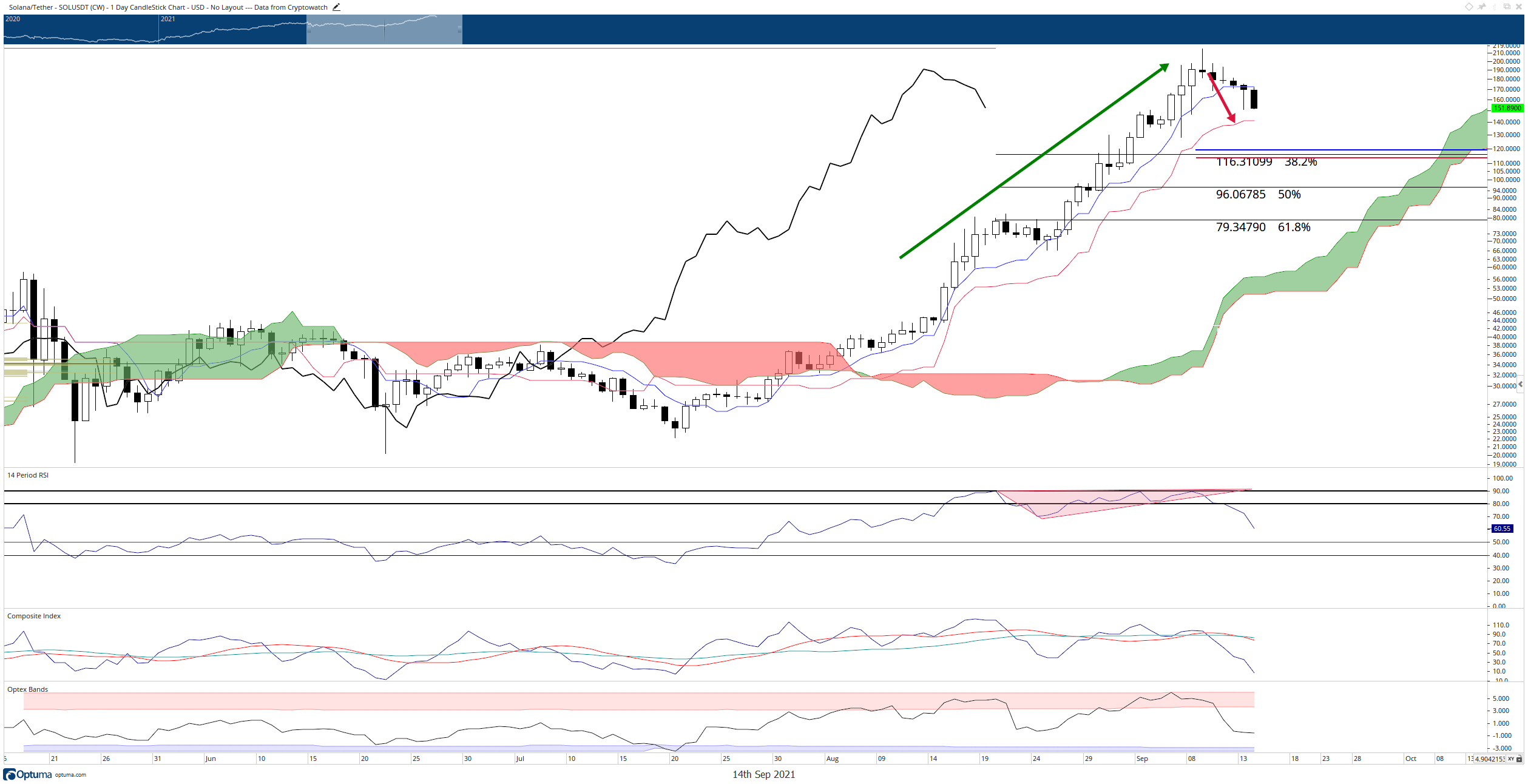

Solana price has moved lower by as much as -30% over the past six trading days. As the pullback from new all-time highs continues, Solana is entering into established median pullback ranges in cryptocurrencies. As a result, shorts attempting to enter the market near the $150 may find themselves on the losing side of a runaway market.

Solana price closes in on the final daily Ichimoku support level

Solana price is getting close to the final support level in the Ichimoku system: the Kijun-Sen. The Kijun-Sen is currently at $141.25 and is in a position to trap any late short-sellers who decide to short if Solana fails to hold $150. The Kijun-Sen is the primary 'day trader' indicator in the Ichimoku system. It represents medium-term movement and is easily thought of as a dynamic 50% Fibonacci retracement level. Support and resistance are often found against the Kijun-Sen. It is for that reason any new short positions may be under threat. A factor contributing to the Kijun-Sen holing as support is the extreme low in the Composite Index - it is approaching historical support levels.

SOL/USDT Daily Chart

Bulls should not be overly confident, though. The Relative Strenght Index has yet to hit the first oversold condition in a bull market (50) and given the current Solana price action, a move below the Kijun-Sen may be necessary. The weekly Tenkan-Sen and Kijun-Sen fall share a price range between $115 and $120. Solana will likely need to push beyond the daily Kijun-Sen for the Relative Strenght Index to test 50 or 40. A move to the $115 - $120 value area will put the Optex Bands into an oversold condition, helping to confirm a bottom.

Any daily close above $175 will invalidate any further bearish momentum.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.