Solana-based Cypher developer confesses to gambling away $300K of user funds

Pseudonymous Cypher Protocol developer Hoak has confessed to stealing nearly $300,000 worth of user funds and gambling them away.

The core developer of the Solana-based cross-margin decentralized exchange (DEX) admitted his wrongdoing in a public statement shared in a May 14 X post:

To address the elephant in the room, the allegations are true, I took the funds and gambled them away. I didn’t run away with it, nor did anyone else.

Hoak’s confession follows a post on May 13 by the pseudonymous core contributor Cobra revealing the absence of funds.

The post went unnoticed until an unknown Discord group member shed light on experiencing fund withdrawal issues. According to Cobra:

Hoak has stolen funds from the cypher redemption contract. This happened over months via 36 withdraws… Deployer wallet (ETR8…) withdraws funds from Cypher’s redemption contract. Then conducts swaps and sends SOL, USDC, and USDT to an intermediary wallet (7sKM…). This intermediary wallet then sends funds to Binance.

A total of $317,000 in Solana’s (SOL $144), Tether (USDT $1.00 ) and USD Coin (USDC $1.00) was sent by the address associated with Hoak to the Binance exchange, according to on-chain data compiled by Cobra.

Summary of stolen funds. Source: Cobra

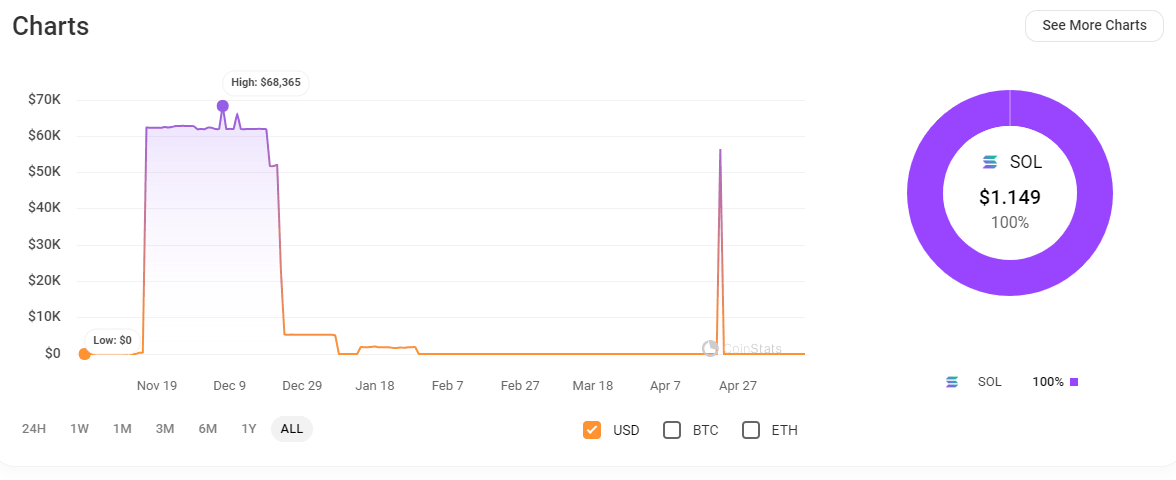

At its peak, Hoak’s wallet held a total of $68,365 worth of digital assets on Dec. 7, 2023, before the funds were sent to Binance. The wallet held over $56,000 worth of digital assets on April 22 before over 99% of the assets were transferred in the next two days, CoinStats data shows.

Wallet “7sKM” related to Hoak. Source: CoinStats

The insider’s actions dealt Cypher Protocol another significant blow, which has been trying to stage a comeback. In August 2023, the DEX was hacked, resulting in the loss of over $1 million worth of digital assets.

Is gambling addiction a growing issue in the crypto space?

While Hoak said that he expects no understanding for his actions, he blamed his rampant gambling addiction for the thefts:

I am also in no way, shape, or form attempting to victimise myself, but this is the culmination of what snowballed into a crippling gambling addiction and probably multiple other psychological factors that went by unchecked for too long.

Cryptocurrency skeptics have often criticized the industry for being driven by casino-like behavior. United States Securities and Exchange Commission Chair Gary Gensler has famously compared the crypto ecosystem to “casinos in the Wild West,” with stablecoins functioning as the “poker chips.”

According to a 2023 YouGov survey of over 4,200 adults in the United Kingdom, people gambling at “harmful levels” were nearly five times more likely to own cryptocurrencies than the general population, making them more likely to be negatively impacted by crypto trading.

Crypto Survey 2023. Source: GamCare/YouGov

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.