- November is poised to be an active and engaging month for altcoins, presenting investors with good opportunities for trading.

- The market has been highly reactive to conferences and events recently, with coming ones likely to offer similarly positive catalysts.

- Solana, Arbitrum, Ripple and Axie Infinity are among the ecosystems with events this month.

The cryptocurrency market has a lot to look forward to in November, which has been touted as the best-performing month in terms of returns, particularly for Bitcoin (BTC). Besides the Ripple Swell event set to begin on November 8, other ecosystems also have activities on the calendar that could drive some volatility in the market.

November altcoin setups to watch

While the XRP community has its eyes peeled on Ripple Swell 2023, several other ecosystems have conferences and events planned and spread out across the month. These could serve as positive catalysts, considering how the market has been highly reactive to such gatherings of late.

After the Solana Breakpoint conference in Amsterdam last week featuring creators and developers, Ripple is following with a meeting for leading industry innovators. For SOL, the purported Ethereum killer soldiers on despite FTX exchange still sending tokens to exchanges. This could either mean that the market shows a “bearish overhang” thesis is invalidated or that buying pressure is enough to outweigh the supply.

SOL/USDT 1-day chart, XRP/USDT 1-day chart

The Yield Guild Games (YGG) ecosystem will also be hosting a summit stretching fromNovember 17 to 25. The altcoin is already showing solid momentum, despite the conference being two weeks out, thereby giving traders room for trading here.

YGG/USDT 1-day chart

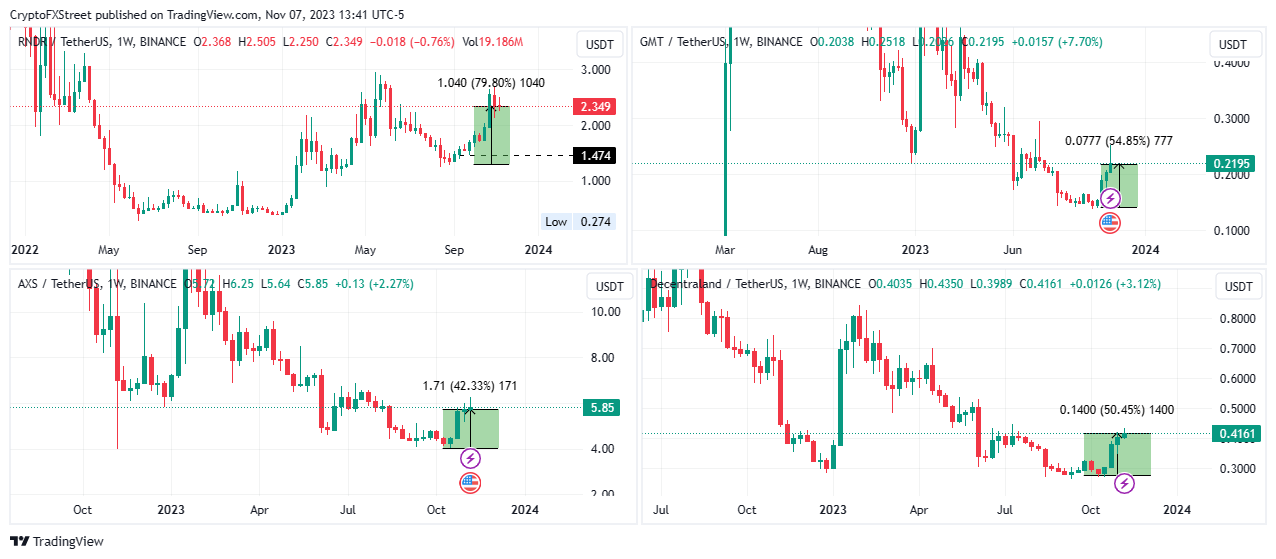

In the gaming space, the STEPN (GMT) and Axie Infinity (AXS) ecosystems are also poised for volatility with the sector leaders performing the strongest. Historically, once gaming gets going, it runs aggressively, and as some of the big names in the crypto space continue talking about gaming, this space could provide good trading opportunities for forward-looking investors.

RNDR/USDT 1-week chart, GMT/USDT 1-week chart, AXS/USDT 1-week chart, MANA/USDT 1-week chart

Meanwhile, the Arbitrum (ARB) network has been busy, with the ARB eco incentives due for launch next week. The Arbitrum staking proposal was also passed on November 7, with the EIP still oncoming as a fundamental narrative. Notably, traders have already started booking profits on their ARB positions, while broader fundamental metrics continue to recover. Besides ARB, ecosystem altcoins including but not limited to GMX (GMX) and Pendle (PENDLE) could provide interesting trades as well owing to the fact that they are direct beneficiaries of the ecosystem fund.

ARB/USDT 1-day chart, PENDLE/USDT 1-day chart, GMX/USDT 1-day chart

For the AI space, Fetch.ai (FET) and SingularityNET (AGIX) come to mind, with the OpenAI conference kicking off on Tuesday. While FET and AGIX have little to do with OpenAI, they rallied before the conference, as overflows from related tokens such as Worldcoin (WLD) benefit the space as a trend.

FET/USDT 1-day chart, AGIX/USDT 1-day chart, WLD/USDT 1-day chart

As these ecosystems grind toward their respective events, traders may have them on their watchlists with news from the conferences likely to influence traders. The “buy the rumor, sell the news” narrative could also play out. Caution should be taken when shorting in these environments, and generally during bull markets, unless news is released and there is movement in price, traders could then look for opportunities to leverage the “sell the news” event.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.