SOL Price Forecast: Solana nears all-time high as VanEck, BONK spark $2.9B inflow

- Solana price breached the $248 mark on Monday, marking a 60% gain over the past 14 days.

- Amid positive speculation on VanEck’s SOL ETF, Solana’s largest memecoin, BONK, announced plans to burn 1 trillion tokens within six weeks.

- Solana open interest has crossed $5 billion for the first time, reflecting $2.9 billion in capital inflows since November 4.

Solana (SOL) price reached a new monthly time frame peak of $248 on Monday, November 18, up 60% within the last 14 days. Derivatives market trends signal potential for more upside as bulls set their sights on new all-time high.

Solana nearing new all-time high as memecoin frenzy intensifies

Solana price has been on a steady uptrend in November, fuelled by several bullish catalysts ranging from skyrocketing memecoin demand and Securities & Exchange Commission (SEC) Chair Gary Gensler’s imminent exit.

After Trump officially confirmed Elon Musk’s involvement in the proposed department of government efficiency (D.O.G.E), demand for memecoins surged further.

The news coincided with Binance’s listing of newly-launched Solana memes ACT and PNUT, which saw both assets reach $500 million market caps within 24 hours.

On November 15, BONK capped off the highly volatile week with a major token burn announcement. The landmark burn event will see 1 trillion BONK tokens taken out of circulation before December 25.

These market-moving events have contributed to Solana’s price attempt at breaking new all-time high on Monday.

Solana price action | SOLUSD

The chart above shows that Solana traded as high at $248.52 on Binance on Monday, just 5% shy of its all-time high of $259 recorded in November 2021.

Despite having failed the initial attempt at breaching $250 resistance, recent trends observed in the derivatives markets suggest the rally may not be over yet.

Solana open interest surges by $2.9 billion as traders bet on Trump ETF approval

Amid the memecoin rave, another key catalyst driving Solana's ongoing price rally is growing speculations about a potential Solana spot ETF in 2025.

On November 10, US-based fund manager VanEck officially filed an application for a spot SOL ETF with the SEC.

After months of little progress, Trump’s win has heightened expectations that friendly crypto regulations could improve Solana ETF approval chances.

After Gary Gensler issued a statement hinting at his imminent exit on November 14, the intensity around the positive speculation grew further.

In affirmation of this stance, Solana speculative markets witnessed unusually large capital inflows since Trump’s re-election.

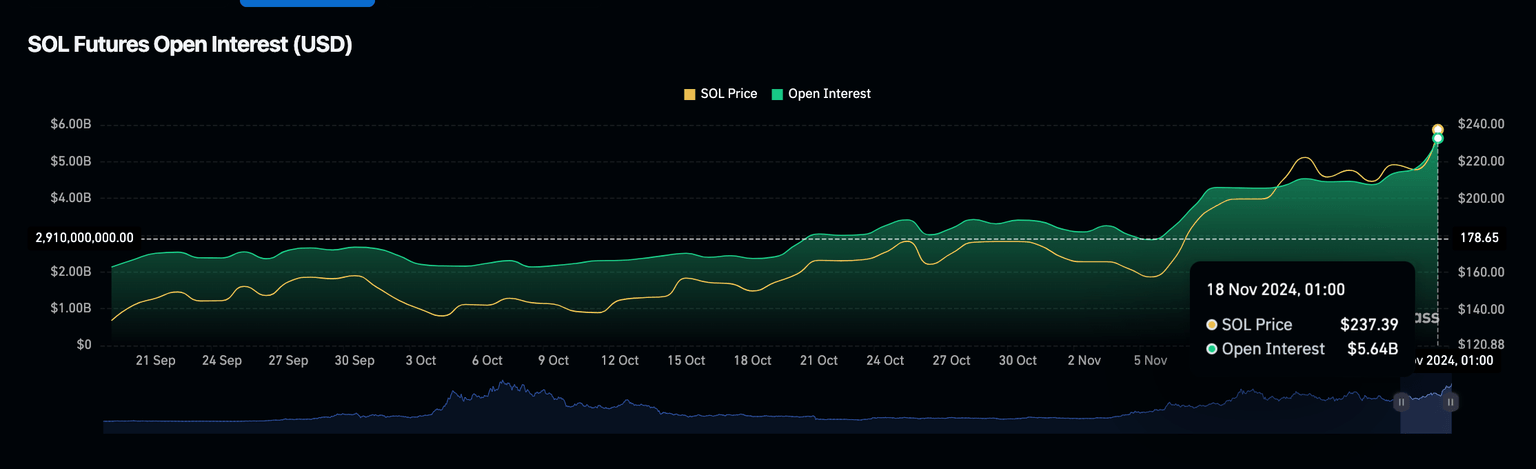

Coinglass’ Open Interest chart below tracks the real-time value of active future contract positions listed for particular assets.

Solana price vs Open Interest | Source: Coinglass

Solana open interest stood at $2.7 billion as of November 4. But amid growing memecoin speculation on Solana ETF approval, the SOL open interest has since increased by $2.88 billion to reach the $5.64 billion mark at press time on November 18.

This increase in Solana open interest is significant for two key reasons. First, while Solana price has increased 60% since November 4, the open interest growth has exceeded 96%.

When open interest rises faster than price, it often indicates an increase in leveraged trading activity as traders position themselves for further price movements.

In Solana's case, the 96% surge in open interest compared to a 60% price rally suggests that market participants are increasingly confident in continued bullish momentum.

Second, Solana's current $5.64 billion open interest level is particularly noteworthy as it dwarfs the $1.95 billion recorded during its previous all-time high price of $259 in 2021.

This indicates significantly greater market participation and larger capital stock in the derivatives market than during prior bullish cycles.

Such a heightened capital base not only supports the bullish momentum, but it also provides a buffer to cushion Solana prices against extreme volatility during market consolidation phases.

Solana Price Forecast: $260 could trigger more upside

Solana's recent rally has been underpinned by a $2.8 billion surge in capital inflows and heightened market liquidity from native memecoin trading.

Over the past 14 days, SOL price has surged by more than 60% and is now nearing new all-time highs.

The Bollinger Bands show that Solana has decisively moved above the upper band, signaling a bullish trend with heightened volatility.

This suggests that buyers are firmly in control.

If Solana closes above the $240 mark, bulls could set sights on the next major resistance at $260, coinciding with Solana's all-time high zone from 2021.

The Parabolic SAR indicator also supports this bullish outlook with the dots consistently below the price candles.

This indicates sustained upward momentum with immediate support levels visible at $210 and $203.94.

If SOL maintains momentum and breaks above $260, it could trigger a psychological rally, opening doors to $300 or higher.

However, a drop below $210 could test the lower Bollinger Band at $196.38, potentially invalidating the bullish outlook.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.