SOL open interest rises nearly $50 million in three days as Solana price revisits pre-FTX collapse highs

- Solana price has forayed above $40.80, levels last tested in August 2022, three months before FTX imploded.

- The surge comes with rising open interest, up $46 million since October 30.

- It comes amid the ongoing Solana Breakpoint conference, with discussions of bringing off-chain assets on-chain via SOL network.

Solana (SOL) price is trading with a bullish bias, indicating a solid uptrend in the daily timeframe and outperforming the broader market. It comes on the back of the ongoing Solana Breakpoint conference in Amsterdam, Netherlands, provoking or exciting the hands of perpetual traders.

Also Read: Solana Breakpoint conference could be saving grace for RNDR holders as Render price eyes 6% fall

SOL open interest nears $500 million

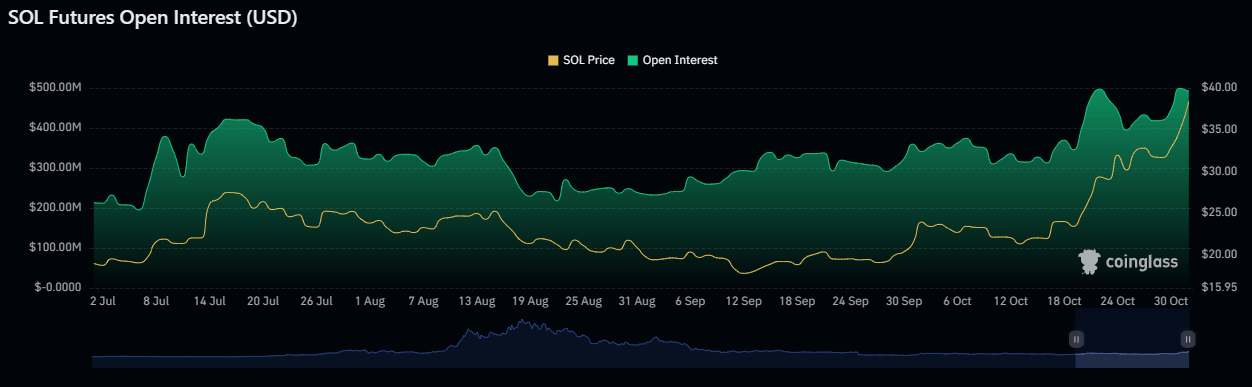

Amid the ongoing Solana Breakpoint conference, SOL open interest has risen by almost $50 million, with the sum of open long and short positions for the purported “Ethereum killer” rising from $445.77 million to $492.05 million between October 30 and November 1.

SOL Open Interest

Binance, Bybit and OKX exchanges are leading with the most orders, recording $267.08 million, $175.24 million and $79.05 million, respectively. The now controversial Bitget exchange is in position five with $40.55 million after BingX exchange’s $73.59 million. The same order applies to trading volume, with Binance leading with $3.33 billion.

SOL exchange statistics

The conference started on October 30, bringing together a massive guest list ranging from executives from different ecosystems, developers and creators for panel discussions. Among the key themes that have stood out are plans to “bring off-chain assets on-chain with Solana.” Specifically, the founders across the Solana ecosystem discussed on-chain capital markets for real world assets such as whiskey, real estate, credit and more.

The future of payments is on-chain, according to the event organizers, and Solana is looking to show the world how it is done, providing the different ecosystems in attendance with an avenue and stage to showcase their innovations.

Solana price outlook

Solana (SOL) price remains bullish after confirming the breach of a solid order block, the November 5, 2022, supply zone, which extends from $33.64 to $37.07, by breaking past its midline at $35.26.

Momentum remains strong despite SOL being massively overbought, indicated by the Relative Strength Index (RSI) at 84. Nevertheless, with this momentum indicator still northbound, Solana price could make it to the range high of $41.84. In a highly bullish case, the gains could stretch to tag $48.00, 15% above current levels, with the Solana Breakpoint conference continuing for the next two days.

SOL/USDT 1-day chart

Conversely, a rejection from the $41.84 range high, possibly triggered by profit taking, could send Solana price south. A break below the $35.26 level would probably be the right time to sell, as losing this support floor could see the cryptocurrency spiral back into the consolidation phase between $30.10 and $16.48 going south.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.