SOL becomes institutional investors' choice over Ethereum as Solana price sustains above $50

- Solana price is down by 14.65% since the intra-day high of $63.98.

- Solana has found its audience in the institutional investors who have poured over $1 billion into the crypto market in just a few months.

- The rally has also resulted in the Grayscale Solana Trust (GSOL) rallying by nearly 378% since the beginning of October.

Solana price has been one of the biggest attention grabber over the past couple of days owing to its unexpected 25% rally in a single day right before the weekend. While a specific reason cannot be deduced for the rise, the potential lies in the fact that SOL is now becoming one of the most preferred institutional assets.

Solana sees institutional interest

Solana is already one of the biggest cryptocurrencies in terms of gains, and the institutions seem to be observing this keenly, too. Consequently, cryptocurrency has become the most in-demand asset when it comes to institutional investors, surpassing even Ethereum.

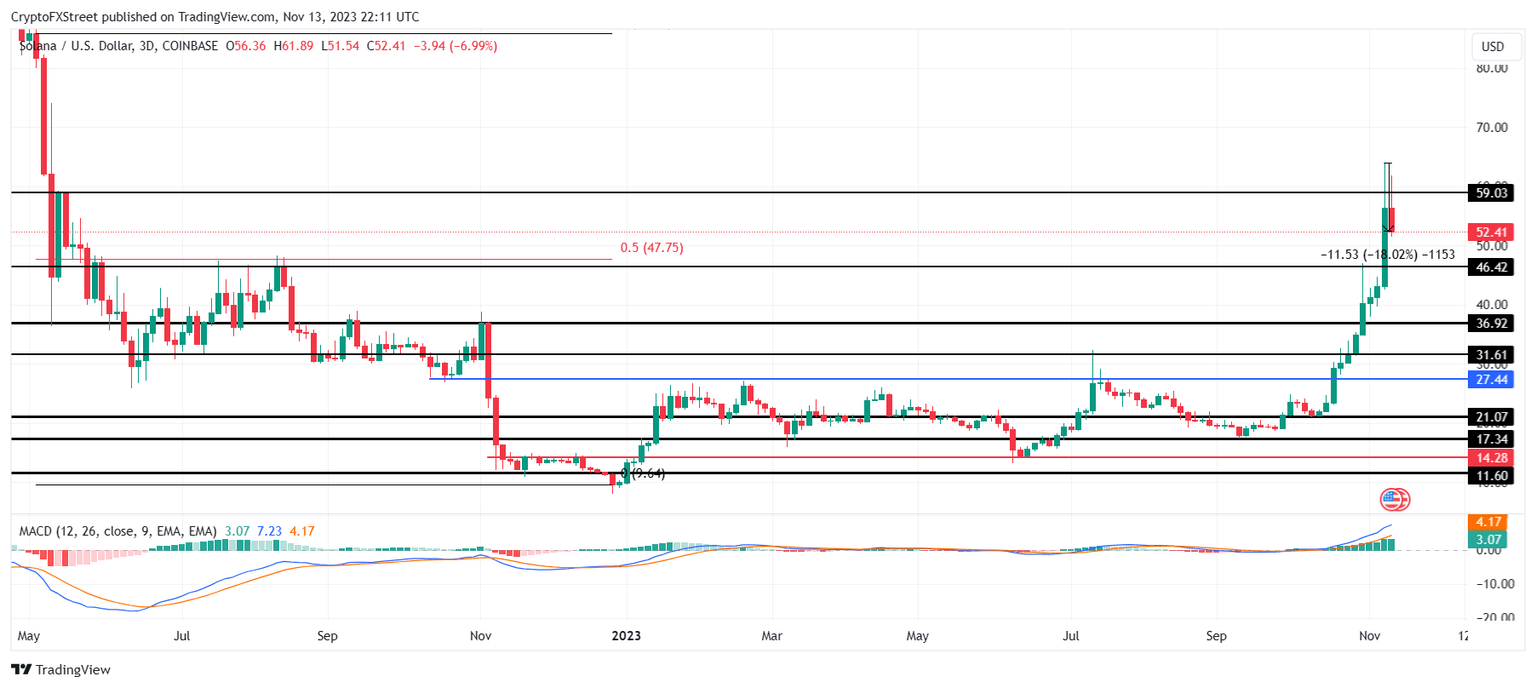

The CoinShares weekly institutional investors’ report highlights that for the week ending November 10, SOL observed inflows worth $12.4 million, which added to the monthly inflows of $23.1 million, bringing the year-to-date inflows to $121 million.

Ethereum and others, on the other hand, are far below SOL when it comes to year-to-date flows, although Ethereum is making slight progress this past month, as noted by the $62 million inflows since November began.

Solana institutional investment

This will prove to be highly helpful for SOL in noting a boost in its value but also push the price and value of the Grayscale Solana Trust, also known as GSOL. The Grayscale investment product, following the rally in Solana price, has exploded, with the investment vehicle trading at a premium of 378% since the beginning of October.

GSOL 3-day chart

While investment product value is not considered to be an accurate measure of demand, it does highlight the rate of improvement.

Solana price reverses after rally

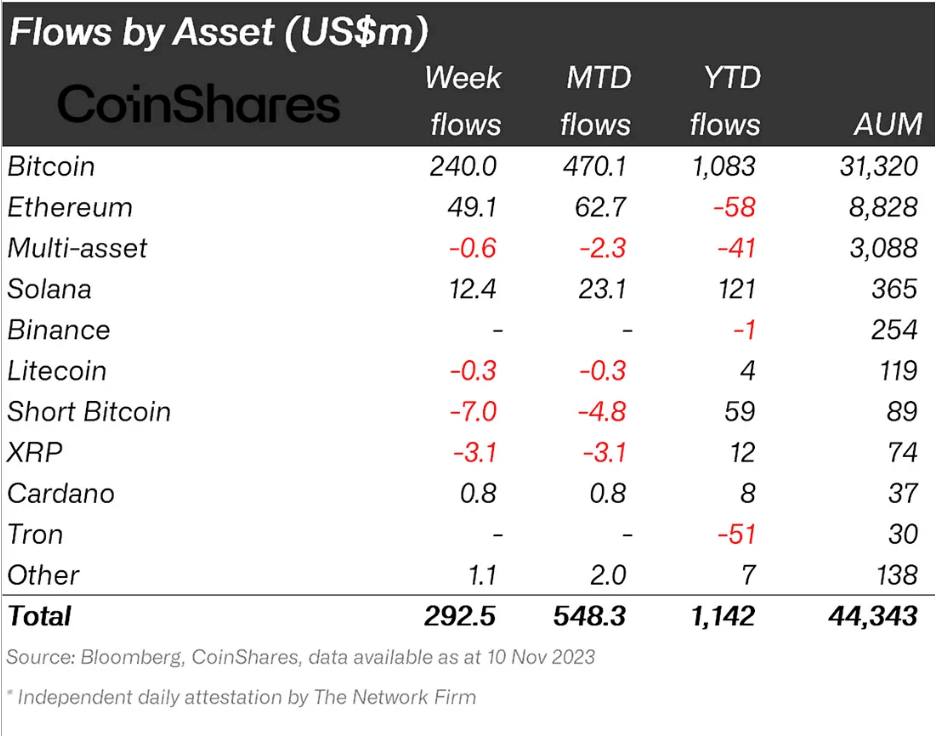

Solana price trading at $52.41 has noted a near 7% decline on the 3-day chart, with SOL noting an 18.02% decline from the intra-day trading highs of the token. The most likely outcome right now for the altcoin is slow declines followed by a reversal in the cryptocurrency’s price.

SOL could see a gradual decline over the next couple of days, bringing the altcoin to test the support line at $46.42. While the drawdown may not be significant, losing this support would prove to be harmful as it would extend the 24-hour losses towards the $40 level.

Although no clear signals of a price reversal are visible, the consistent rally has overheated the market, which would need some cooldown. This might result in further decline.

SOL/USD 3-day chart

However, if Solana price bounces off the $46.42 support line and climbs back to breach the $59.03 resistance level, it would invalidate the bearish thesis and send SOL towards tagging the new highs beyond $60.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

-638355143961323918.png&w=1536&q=95)