‘Smart money’ wallets are unloading APE, filling up on aSTETH, Nansen data suggests

Prolific and active cryptocurrency traders have been unloading Yuga Labs’ ApeCoin and filling up on Aave’s aSTETH, according to data from blockchain analytics firm Nansen.

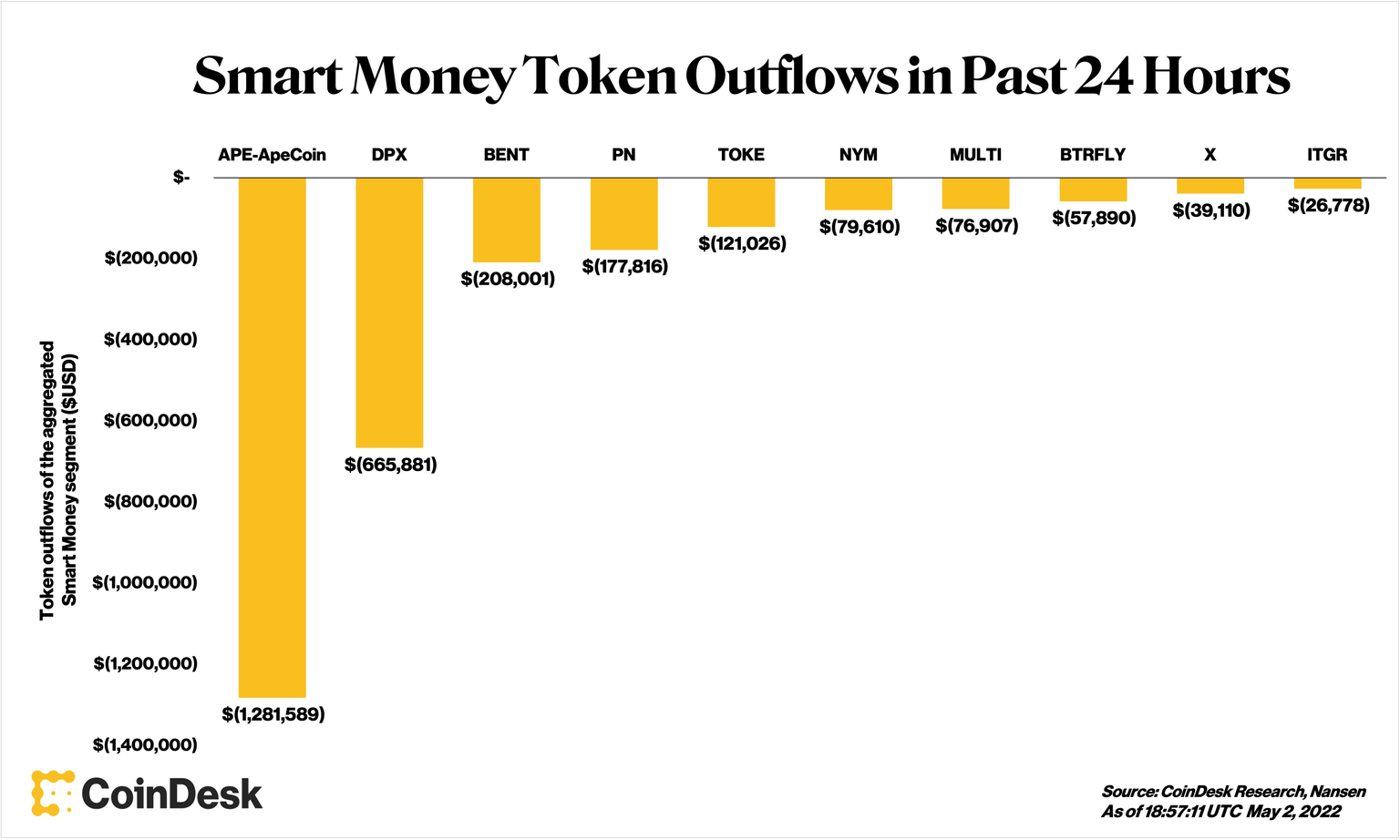

Over the last 24 hours, $1.28 million worth of APE has flowed out of wallets that Nansen has categorized as belonging to “smart money,” more than any other token tracked by the firm.

Nansen considers a wallet to be “smart money” if it meets at least one of several tests, including:

-

It is known to belong to an investment fund

-

It has made at least $100,00 by providing liquidity to the decentralized finance (DeFi) protocols, SushiSwap and Uniswap, excluding so-called impermanent loss

-

It has made multiple profitable trades on a decentralized exchange (DEX) in a single transaction, through mechanisms such as “flash loans”

Typically, outflows are a harbinger of a decrease in asset prices. APE prices dropped as much as 16.8% over the past 24 hours following the public debut of the “Otherside” metaverse project, Yuga Labs’ biggest non-fungible token (NFT) product launch.

Smart Money token outflows in past 24 hours (Nansen) (Sage D. Young)

Best known for creating the Bored Apes Yacht Club (BAYC) NFT collection, Yuga Labs launched ApeCoin, an ERC-20 governance and utility token used for the ApeCoin decentralized autonomous organization (DAO). People who wanted to participate in the “Otherside” metaverse project would have to purchase an NFT with APE if they didn’t have a Bored Ape or Mutant. Each “Otherdeed” NFT, representing a title to virtual land in the “Otherside” metaverse, was on sale at a flat price of 305 APE.

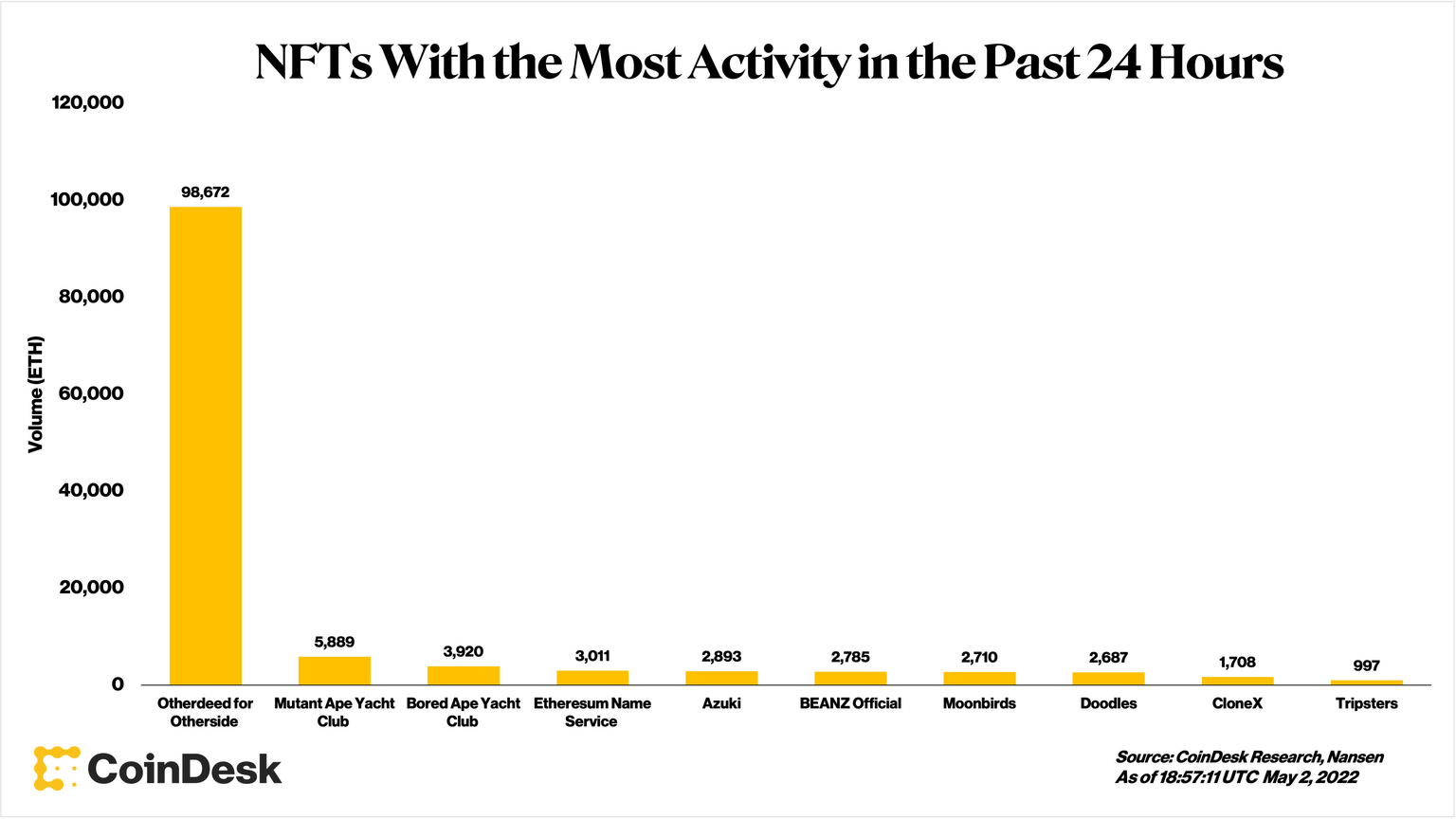

Not surprisingly, among NFTs, the most actively traded collection in the last 24 hours has been Otherdeed for Otherside.

NFTs with the most activity in the past 24 hours (Nansen) (Sage D. Young)

With just under 100,000 ETH in volume and generating roughly $285 million for Yuga Labs, Otherdeed for Otherside congested the Ethereum blockchain, costing traders more than $176 million in fees alone.

Yuga Labs tweeted, “This has been the largest NFT mint in history by several multiples, and yet the gas used during the mint shows that demand far exceeded anyone’s wildest expectations.”

In light of creating some of the highest gas fees in Ethereum’s history, Yuga Labs publicly apologized on Twitter for “turning off the lights on Ethereum for a while.”

Over the same 24-hour period, roughly $0.8 million worth of aSTETH has flowed into smart money wallets, the biggest inflow among tokens tracked by Nansen. Inflows are considered a bullish signal, but the value of aSTETH maintains the same price level as ether.

Smart Money token inflows in past 24 hours (Nansen) (Sage D. Young)

aSTETH is Aave’s yield-bearing token for stETH, or staked ether, in Lido, the leading liquid staking solution. Even though Curve has the largest pool of stETH, with $4.7 billion in total value locked, Aave is another main destination for stETH, with $3.01 billion total stETH supplied. Smart Money inflows of aSTETH reinforce the popular narrative that staked ETH could be an ideal investment pathway for major institutional investors.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.